The list of cannabis stocks trading near 52-week lows is long and wide including Green Thumb Industries (GTBIF). The difference between most of the stocks in the sector is whether one still trades at unreasonably high levels or a bargain to buy on dips. Green Thumb continues to have a lot to look forward to causing the stock to fall into the later category.

It’s All Relative

Most well-known cannabis stocks either made grand partnerships or large-scale acquisitions to gain scale in the last year, but Green Thumb has mostly grown under the radar. For Q2 ended June 30, the U.S. multi-state operator (MSO) grew revenues 60% sequentially to $44.7 million.

The company actually has the same revenue base as Tilray (TLRY) that had the hot IPO and irrational stock price of $300. Not to mention, the Canadian cannabis company recently bought Manitoba Harvest to add ~40% of the Q2 revenues in the form of hemp food products.

Yet, after all of this, Tilray still has a $2.5 billion market cap in comparison to the current Green Thumb market cap of $1.8 billion. Analysts forecast the company approaching $500 million in 2020 revenues making the stock a much larger bargain than the Canadian counterpart.

Even better, Green Thumb had an adjusted EBITDA profit of $5 million in the quarter. The better profit picture sets the U.S. MSOs apart from the Canadian LPs.

Real Expansion

The company has definitely made some acquisitions, but the difference is that Green Thumb has kept the deals small and under the radar of regulators. In the last few months, the company closed deals for Integral Associates in Las Vegas, MC Brands based in Colorado and Fiorello Pharma providing a license in New York.

Green Thumb has opened 9 retail stores since April 1 in key states of Florida, Ohio and Pennsylvania. The cannabis company only had 20 stores open at the start of 2019 and expects to nearly double the total in 2019 with a goal of reaching up to 40 retail locations by year end.

As with a lot of the U.S. MSOs, Green Thumb has easy and real expansion plans already in progress. The company will triple retail locations by the time it fully opens the stores for the 95 licensed locations.

The expansion possibilities go far beyond existing licenses as new states come online and the company has the ability to pick-up small players in the industry that are easy to integrate and fall below major regulatory reviews.

Takeaway

The key investor takeaway is that the U.S. MSOs continue to offer some of the best values in the cannabis sector. Green Thumb is a prime example of a relatively unknown MSO with a market value of only $1.8 billion despite quarterly revenues of $45 million and adjusted EBITDA profits.

As Congress gets back to work after the summer break, the sector has major catalysts ahead, if the U.S. government can ever approve cannabis at the federal level. The domestic companies would see substantial benefits from access to more capital and listings on major U.S. stock exchanges leading to the stocks rivaling and likely surpassing the market valuations of Canadian peers.

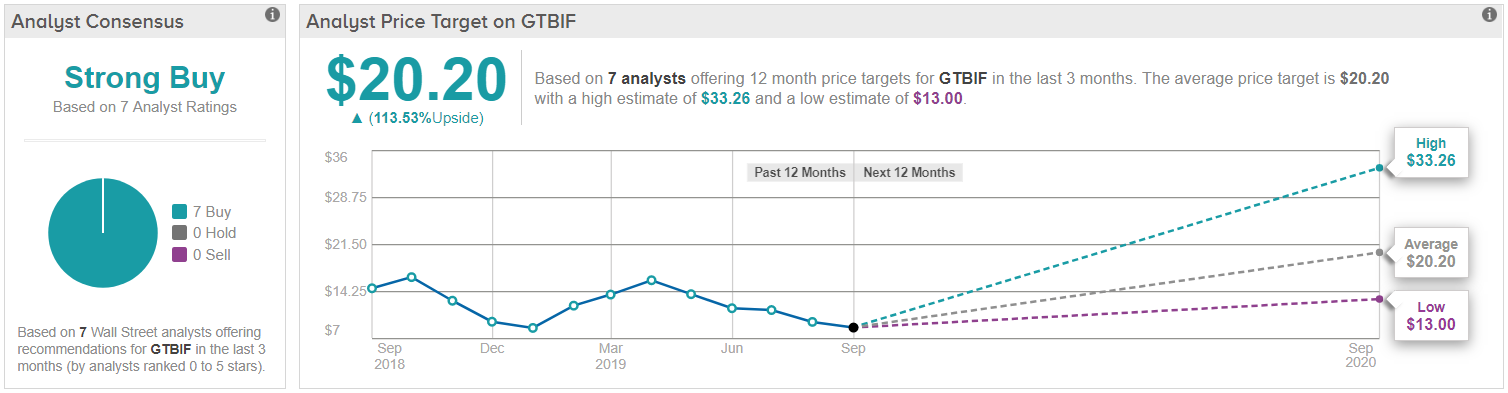

Wall Street’s confidence on the cannabis stock speaks for itself; Green Thumb has received a whopping 7 ‘buy’ ratings in the last three months. Meanwhile, the $20.20 consensus price target suggests a potential upside of of over 100% from the current share price. (See Green Thumb’s price targets and analyst ratings on TipRanks)

Disclosure: No position.