In the blink of an eye, Aphria (APHA) dipped to the lows $3s. The Canadian cannabis company remains the prime investable stock in the sector with the best combination of facilities, revenues and cash on the balance sheet. Despite all the positives, the stock is down nearly 70% from the highs this time last year providing the chance that investors shouldn’t pass up.

Low Inventory

Possibly the best part of the Aphria story was the company not wildly build facilities in 2019. In the process, the company didn’t build up a large inventory before the Canadian cannabis market was fully ready for sales.

The company ended the November quarter with only C$152 million in inventories. Aphria started the fiscal year with just C$92 million in inventory. Of these inventories, nearly C$37 million is related to the distribution business and another C$20 million are unrelated to cannabis. The company even had to purchase inventories in the last quarter due to a lack of production.

The prime reason for the low inventories in comparison to the expected sales was the completion of their Aphria Diamond facility didn’t occur until the end of 2019. The new facility has cultivation capacity of 140,000 kg and brings their total production capacity up to 255,000 kg.

Aphria only sold 7,062 kg of cannabis in the quarter ending November. The company will now have the cultivation capacity for 63,750 kg per quarter so how the company manages the expense base with the actual consumer demand will be crucial.

Strong Balance Sheet

The number one factor for success in the cannabis sector could very well be the balance sheet. Aphria ended the last quarter with nearly C$500 million in cash and the company raised another C$100 million during the quarter from a strategic investor back in January when stock prices were far higher.

The company basically has C$600 million in cash while already having a cash flow positive business. Even after cutting guidance for the fiscal year, Aphria has guided the year towards adjusted EBITDA of between C$35 million to C$42 million.

Along with the nice cash balance, Aphria actually has a real business with FY20 revenue targets of C$600 million. The company expects a decent ramp in cannabis sales this year due to the higher cultivation levels along with additional retail stores in Canada and Cannabis 2.0 products.

The stock valuation is now below $1 billion while all these positives are coming together for the company. Other companies with large cash balances either don’t have positive cash flows in Canopy Growth or don’t have material revenues in Cronos Group.

Consensus Verdict

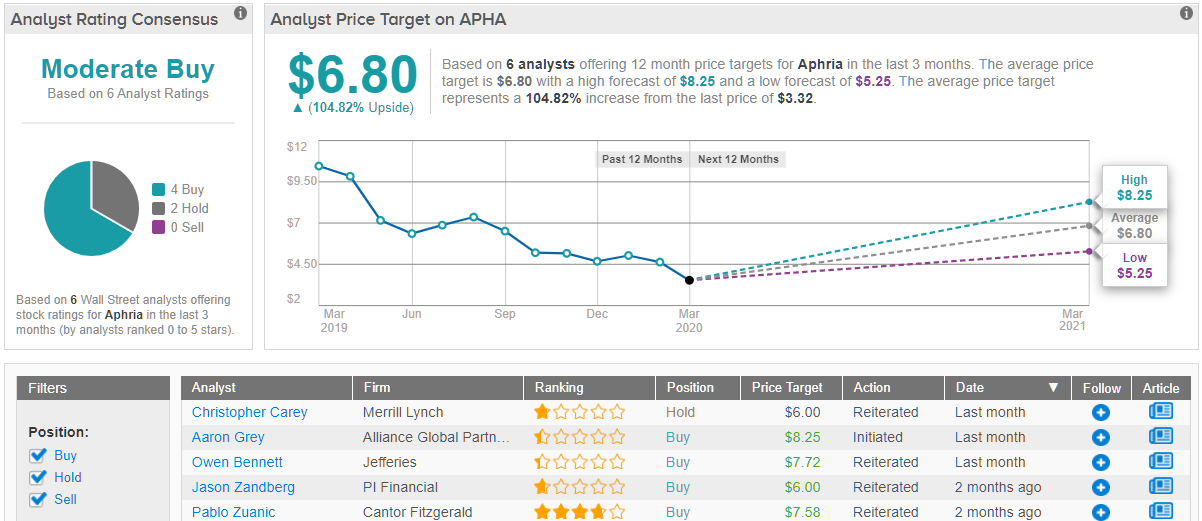

Wall Street is pretty upbeat about the company. TipRanks analysis of 6 analyst ratings shows a consensus Moderate Buy rating, with 4 analysts Buying and 2 recommending Hold. The average price target among these analysts stands at US$6.8, representing nearly 105% increase from current levels. (Discover how the overall price target for Aphria breaks down here)

Takeaway

The key investor takeaway is that Aphria is well positioned to benefit from a Canadian cannabis market primed for positive catalysts in 2020 – new retail stores and Cannabis 2.0 products. The market is throwing away this stock at $3.50 while the company should benefit from reduced competition as other industry players are forced out of business or required to cut operations.

Aphria is the one Canadian stock with a reasonable valuation and a solid balance sheet to buy on this weakness.

To find more good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched platform that unites all of TipRanks’ equity insights.

Disclosure: No position.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.