Aurora Cannabis (ACB) has been on an incredible ride the past few years. From humble beginnings into the second-largest Canadian cultivator by market cap, Aurora has really cemented itself in the cannabis sector as one of the major international players.

With such low barriers of entry, the cannabis sector has seen hundreds of new companies pop up and try to claw away at companies like Aurora. Many of these companies are simply hoping they will get bought up for a pretty penny after everything is said and done.

One major issue with cannabis is that it’s really hard to differentiate a product. This is especially hard when branding and marketing restriction severely hamper the building of brand value. Imagine how hard it was for companies like Nike or McDonalds to build their brand. Now imagine if they were restricted from doing any marketing or branding whatsoever. Many of these companies would cease to exist. But Aurora has really pushed through and created a brand that is now recognizable even with all the restrictions in place. With such a limited ability to differentiate, the only way forward is to differentiate by either price, innovation or by making headlines. And Aurora has been doing a little bit of everything.

In order to differentiate itself, Aurora has been really pushing innovation and efficiency. Its ability to push the boundaries of cultivation technology has really made it an attractive investment. It simply gives it an edge over its competitors and allows its products to be higher quality and less costly to consumers. This is especially true when scaled to Aurora’s international level of production. Economies of scale play an integral part of Aurora’s strategy as well. In addition to being innovative and efficient, Aurora does it at a scale beyond any other. Like a well-oiled engine, Aurora is able to produce and distribute at a low cost and low footprint to any country at scale. This type of ability builds into its value proposition for investors and consumers.

How does a company like Aurora push innovation? Well, it segments itself into every aspect of its value chain. Here are a few: retail distribution, home cultivation wholesale, high value-add product development, genetics research, facility engineering and more. All these things, although costly today, will make generate incredible long-term value. Any developments or new tech they patent will create competitive industry advantages for decades to come. Aurora is betting large on the long-term perspective of their business and it shows.

Some important milestones in their innovation include a $115M investment to acquire the leading cannabis testing, genetics and R&D, Anandia Labs. These types of investments really build Aurora’s foundation as a global cannabis innovation leader. Aurora also took the step of increasing its genetics library with the acquisition of Whistler Medical for about $175 million. These are just a few drops in the bucket to the hundreds of millions it spends in-house developing their own tech.

As the industry develops and adapts, companies able to produce products at a low cost efficiently and effectively will develop better value propositions for investors and consumers. Aurora is one of those companies leading the innovation charge.

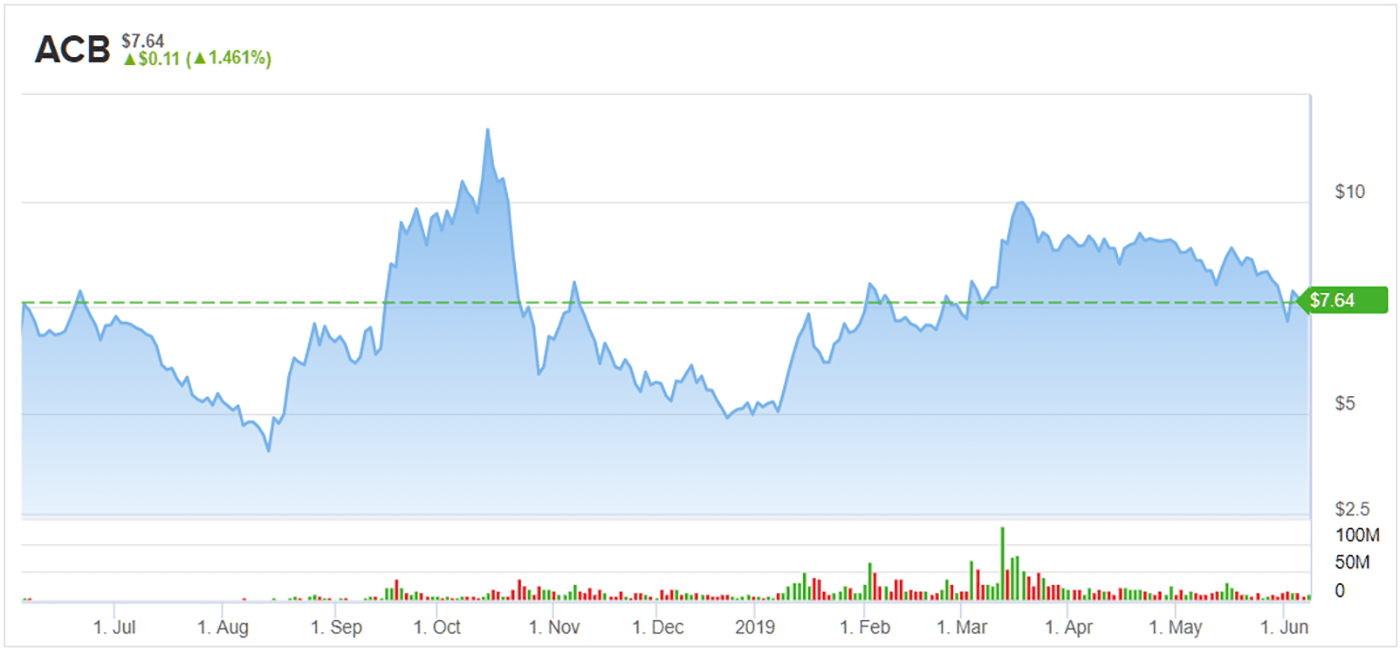

TipRanks’ data shows a bullish camp backing this cannabis titan. The ‘Strong Buy’ stock has amassed 6 ‘buy’ ratings in the last three months, with just one analyst playing it safe with a hold rating. The 12-month average price target stands at $9.27, marking nearly 20% in return potential for the stock.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: The author is Long Aurora stock