As the cannabis sector matures and continues to open up with the edibles launch on the way this year, we just got through another round of earnings. This past quarters earnings were nothing pretty for most companies and we saw a lot of the large-cap companies fall short of analyst estimates — namely Aurora Cannabis (ACB), Canopy Growth (CGC), and Canntrust (CTST). Losses mounted for many cannabis companies focused on expansion, technology, and future market share. Canopy Growth lost over 300 million CA dollars in their last quarter due to higher employee compensation and a paper charge regarding the company’s convertible debt. These losses highlight some of the growing pains that these new companies have to go through in such a fast-changing industry. Prior to earnings season this quarter we saw a massive bull run for the majority of the large-cap cannabis stocks up until about the end of March.

What Changed in March?

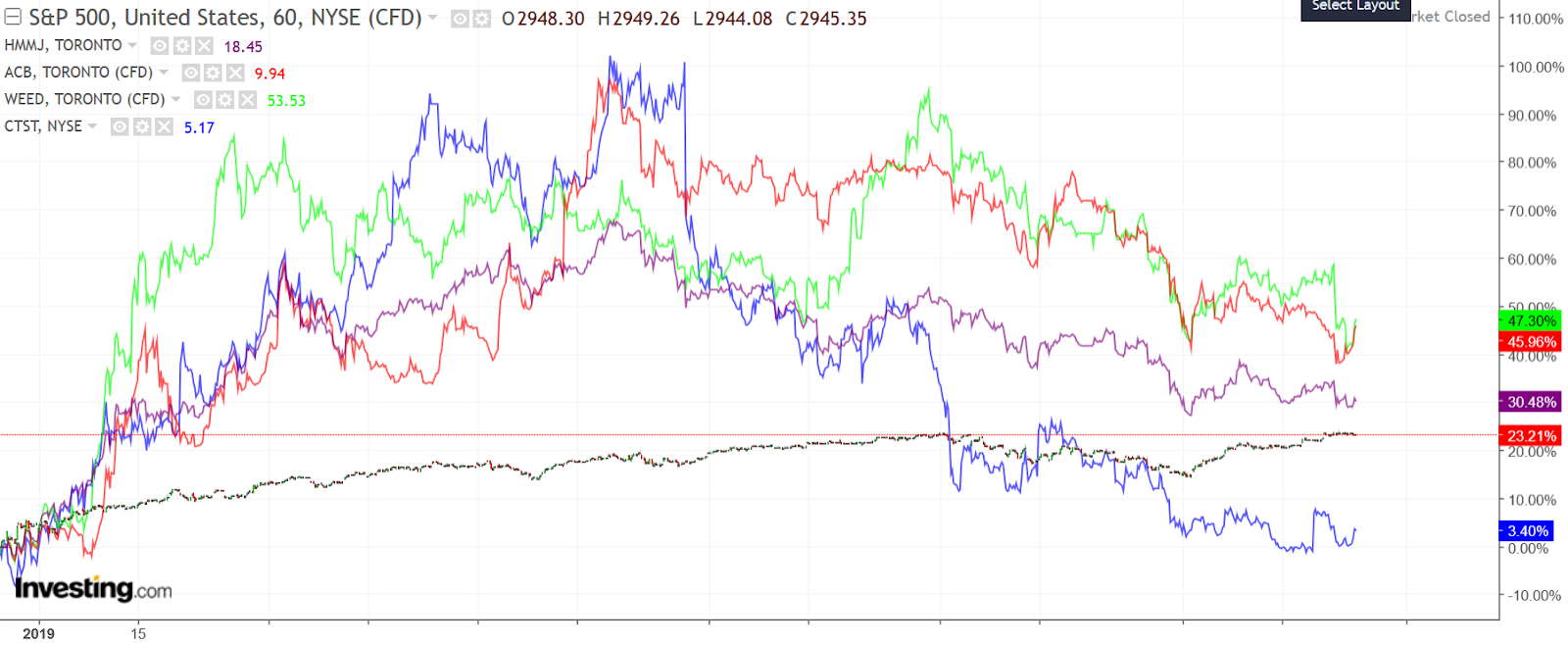

In March we saw most of the large-cap cannabis stock prices peak relative to the broader indexes, using the S&P 500 as an example. In this chart below we compare Aurora Cannabis, Canopy Growth Corporation, Canntrust and HMMJ Horizons Marijuana Life Sciences ETF. Using this ETF is a great way to gauge the large-cap index as a whole. We can see that the cannabis sector peaked in March, hitting its highest point around March 19th.

What I think happened in March was that investors started to take a look at their portfolios. They were noticing that the cannabis sector had outperformed the S&P 500 by over 3x at that point (HMMJ sitting up 60+% meanwhile the S&P had gained roughly 20%). Investors started to shift their money into more defensive names, as they felt that a pullback was imminent after such a strong rally in the markets. This turned out to be true as the cannabis sector declined from March and only accelerated after companies released one disappointing quarter after another. That massive three-month bull run was enticing enough for investors to start selling their cannabis stocks before earnings and if you did so, you were very fortunate. As a long term investor, you need to be able to have a strong stomach for volatility within the cannabis sector, but it still never fails to amuse me how the business cycle works, along with understanding investor psychology.

What Happens Next?

Now that the post-legalization hype has subsided and the markets have already had the opportunity to rally, we are seeing many of our most popular cannabis stocks trading at much lower valuations than just a few short months ago. Just because the stocks are cheap, does not mean that they will magically rise once again without a reason. Personally, I think there are a few things that need to happen for a company to buck the trend, and it starts with proving what they said they were going to do. Many companies made huge promises pre-legalization which drove valuations to historic highs, only to see the stocks crash due to overhype and deteriorating market conditions. Now we need to see strong execution within their business model coupled with a focus on market share and international expansion. As investors, we are always looking years down the road, and the companies that are set up to capitalize on markets outside of Canada will be the most profitable and sustainable companies. For the near term, I want to see companies focusing on the CBD market in the U.S. along with pending federal legalization. Along with this very profitable potential opportunity, I feel that the companies who focus on higher margin products and can dominate the retail and branding aspect of the business will see short-term profitability. For me, it comes down to a two-pronged approach and the company that can perfect this combination will be the most successful in terms of profit along with share price appreciation.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: The author is Long ACB, CTST

Read more on the stocks mentioned: