Tilray (TLRY) stock continues to trend lower, as the company’s market position is slipping in Canada with approximately 8% market share, and production growth priced in. Investors aren’t anticipating as much growth relative to a number of peers due to concerns tied to its production ramp, which is expected to produce less in the way of total production compared to other bigger producers like Aurora Cannabis (ACB) and Canopy Growth (CGC).

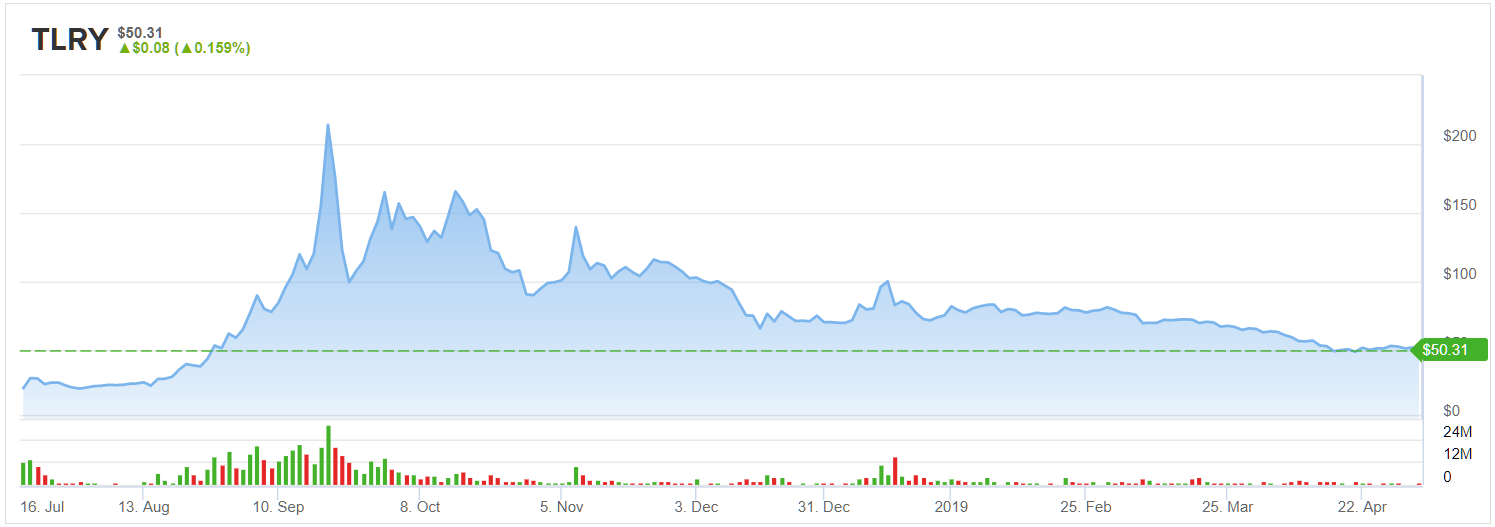

It’s worth noting that the company is now trading at a third of the valuation from it’s all time peak of $150. While the stock is undervalued by its historically over-inflated value, we’re still talking about a company that needs to sustain meaningful growth targets to keep the stock price afloat.

Analysts have been rolling back their estimates as growth might slow due to pricing, or anticipated yields from its pre-existing production. Not to mention, Tilray doesn’t provide production figures tied to its facilities, and instead provides figures on total production by size of facilities, which leads to a wider range of revenue scenarios long-term.

According to Piper Jaffray’s Michael Lavery, “Tilray is less focused on near-term growth (i.e. cultivation capacity) than its competitors, but we continue to believe it looks well positioned for medium to long-term success. We are trimming our 1Q19 revenue estimate by ~$9M to reflect more modest industry sales growth (per Health Canada). We trim our 2020 revenue estimate to $710M and trim our price target from $90 to $84 using our same ~11.0x multiple. We maintain our Overweight rating.” Whereas, Jeffries analyst Owen Bennett anticipates $311.7 million revenue by 2020, which shows that there’s a range of alternative assumptions tied to the production ramp. Keep in mind, Bennett also has a lower price target on Tilray valuing the stock at $61. (To watch the analysts’ track records, click here)

Tilray has recently sparked some hope among investors with the acquisition of Natura Naturals, which added 662k square feet grow capacity. Total reported capacity (from prior quarter) was 1.1M square feet but could expand to 5.5M square feet (assuming they maximize production capacity based on pre-existing licenses). Though, production expansion is the main reason why analysts have varying opinions on Tilray, despite the rapid growth run-rate anticipated over the next couple years.

Furthermore, Tilray is solidly positioned within the liquids segment (though it’s not representative of significant revenues relative to flower). Some partnerships with Beverage makers may have been a little over-hyped as the stock price did price in a lot of anticipated revenue from some of these announcements, which have yet to materialize. There are concerns that Anheuser Busch isn’t putting enough resources and scale behind the partnership to drive any material revenue growth near-term.

Bottom line

Tilray is a bit more of a mixed-bag when compared to other cannabis plays in the space. Though, it’s worth noting that if the revenue ramps towards the higher-end of the assumed range $300m to $700m, it could make investors excited. When Tilray reports earnings on May 14th, the Q1’19 revenue ramp will need to unfold, and announcements tied to production would also need to improve throughout the year to keep shareholders onboard the stock. Otherwise, the stock could be a bit more rangebound until more of the growth materializes.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: The author has no position in Tilray stock.

Read more on TLRY: