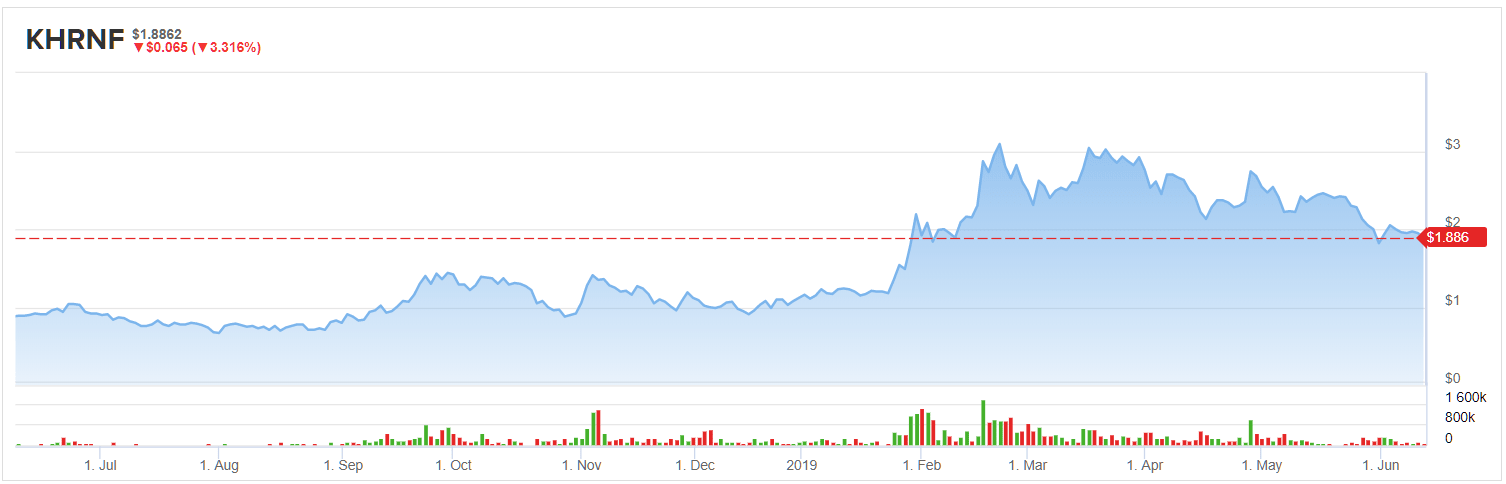

One very interesting company that has been on our watchlist since its tremendous rally at the start of 2019 is Khiron Life Sciences (KHRNF). The stock had a sharp move up from around $1.50 to $4.00 in a very short period of time. The company is rapidly expanding and is focused on capitalizing on the massive Latin American cannabis market. This is a huge market with massive potential and we feel that it’s overlooked by many investors.

There are over 620 million people in Latin America and a recent report from a cannabis industry analysis New Frontier Data stated that the Latin American cannabis market is worth almost $10 billion. Uruguay was the first country in Latin America to legalize adult use cannabis and since then a lot of their neighbors have been considering the same. Legalizing cannabis allows the country an opportunity to capitalize on the market directly and indirectly. Tons of new jobs are created when cannabis is legalized generating more tax dollars from income tax as well as direct tax dollars from cannabis products sold. This has created a massive opportunity for companies looking to jump on this opportunity and Khiron is well on its way.

Khiron is a Canadian integrated cannabis company with its major focus being the Latin American cannabis market. The company is looking to combine the fact that they can grow and cultivate cannabis in Latin America for a fraction of the cost with the technology and leadership of a Canadian run cannabis company to dominate the Latin American market. Khiron currently has 1.9 Million square feet of licensed capacity in Colombia and 3 other countries with a footprint of 5.6 million square feet. Their cost per gram is many times lower than most Canadian companies at $0.35 per from on average. On top of the massive growing operations, the company also has a GMP extraction lab ready to produce all of the high margin products like oils and extracts. Khiron is positioning themselves to capitalize on the medical, recreational use as well as the beauty and wellness segments of the cannabis sector.

Khiron is a very ambitious company, which is probably why its stock had such a tremendous run over the past year with all of its proposed plans. As things unfold and plans turn into actions, we will be watching the company very closely to see how they do in terms of execution. I have seen this scenario so many times in the cannabis sector where a company skyrockets in value based on massive expansion plans only to fall victim to overhype, and then become a tainted company when the bubble bursts dramatically.

All in all, I think the company is targeting a market that very few companies are targeting vs the North American cannabis sector, and that alone presents a unique opportunity. Personally, for myself, I want to own this company in my portfolio because I am a big believer in the global cannabis sector but at the current time, and current state of the market, I will be patient and keep Khiron on the top of my watchlist.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.