Hexo (HEXO) stock hasn’t been getting a lot of love from the market or analysts lately, as it has plummeted over 80% from its 52-week high. A couple of analysts have also lowered their outlook on the company, seeing it struggling to gain traction anytime soon.

Even its joint venture with Molson Coors (TAP) hasn’t been enough to turn negative investor sentiment around at this time.

In this article, we’ll look at the major reasons behind the negative outlook and why it’ll take time to know whether or not Hexo will emerge as a turnaround story, or continue to struggle.

Future Canadian cannabis sales not convincing

While the market and Hexo have looked to derivative sales in cannabis as a key catalyst going forward, analysts like Owen Bennett from Jefferies believe Canadian cannabis sales in general are being looked at too optimistically.

Bennett sees derivative sales in the near term possibly being “nonexistent.” While I think that’s overly pessimistic at the macro level, in the case of Hexo it will probably find it challenging to generate any meaningful revenue in the first couple of calendar quarters of 2020.

A major problem is even if HEXO does manage to generate some revenue from derivatives, it will in part cannibalize existing recreational cannabis sales, which means the difference in price between recreation and derivative recreational products will be limited in the early stage of legal sales.

The other key factor is how long it’ll take for the promised opening of new retail outlets in Ontario and Quebec to take hold. It’s not likely to have a lot of impact in the first half of 2020, and if hundreds of stores do open, they’ll do so at a staggered pace, which means it’ll take some time for the full effect of the new stores to have an impact on sales and earnings.

That in term suggests most of the derivative sales will be to existing recreational customers, which will limit the impact on Hexo’s performance. In the future, when alternative ways of consuming cannabis are offered to potential customers, that’s probably when companies like HEXO will get some sustainable growth from derivatives.

Infused beverages

One of the competitive advantages Hexo has over most of its peers is its joint venture with Molson Coors. In the near term the company will release six different infused beverage brands to the market.

Initially it is offering an infused brand called Flow Glow, which is spring water infused with CBD.

A major challenge is infused drinks so far is that companies, such as Canopy Growth, have struggled to identify what the market wants in the U.S. market, and that also was the case with oils. So far nothing significant has been developed on the derivative side of the market to point to it being a positive growth catalyst for Hexo.

Charlotte’s Web has enjoyed some success, but it’s the most identifiable brand in the overall cannabis sector, and has yet to be challenged in a meaningful way with CBD-infused derivatives.

The bottom line is it remains an unknown for Hexo, and can’t be counted on to move the needle anytime soon.

Weak balance sheet

At the end of the last quarter in October 2019, the company had a cash balance of $65.4 million, with overall debt of $55 million. Operating cash flow stood at -$138 million, with dismal free cash flow of -$246 million.

Consequently, Ello Capital projects that Hexo’s current cash balance to allow it to operate for between six and seven months. The company has managed to raise another $100 million since October, and I think should be able to raise more capital when it needs to. How much it will be able to raise is the question at hand.

Since the Canadian market will take some time to rebound, it appears it’s going to need a lot more operating capital in order to keep the doors open.

The company says it plans on reducing operating expenses by 25 percent in fiscal 2020, which if successful, will provide some breathing room for the company.

Consensus Verdict

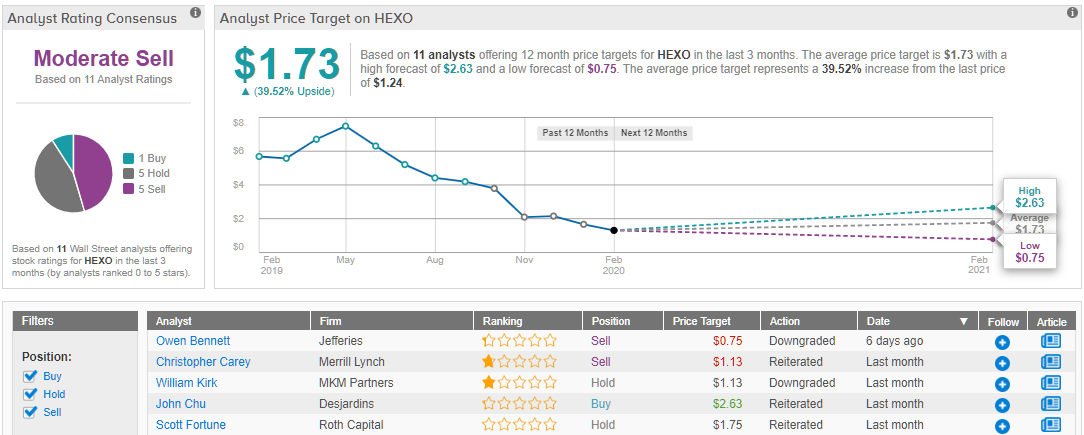

HEXO gets a Moderate Sell rating from the analyst consensus, with 1 “buy,” 5 “hold” and 5 “sell” ratings given in the past 3 months. Shares are priced at $1.24, and the $1.73 average price target suggests an upside of 39.5%. (See HEXO stock analysis at TipRanks)

Conclusion

Taking into account its partnership with Molson Coors, Hexo should be enjoying some strength that its competitors don’t have, but its weak balance sheet, unproven ability to boost sales from derivatives, and the issues associated with the Canadian licensing process which has resulted in far fewer retail outlets than anticipated, Hexo is going to struggle to turn things around in 2020, and probably further out.

Any surprise will be a big plus for the company, such as some of its infused beverage brands outperforming low expectations. Any other derivative sales that surprise to the upside will be a positive catalyst for the company as well.

Even if things improve going forward, it’s going to take time for Hexo to dig itself out of this hole. For that reason I’m bearish on the company for 2020, and will have to wait and see how its derivative sales do in the first half of 2020 before adjusting my outlook for rest of the year, and early 2021.

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.