The latest move by Curaleaf (CURLF) sets the U.S. cannabis company as not only a domestic leader, but also a global leader in the cannabis sector. The company will now have a market valuation in the $6 billion range with the revenue base similar to the Canadian players without the massive market valuations. The multi-state operators (MSOs) remain of the best ways to play cannabis growth in 2019.

Big Deal

Curaleaf bought the state-regulated cannabis business from Cura Partners for $949 million. The partners own the Select brand that is a leading West Coast wholesale brand with 2018 revenues of $117 million.

The deal involves Curaleaf issuing 95.6 million at a closing price of C$13.30. The deal includes an additional earn-out of up to $200 million for exceeding 2020 revenue targets in the wholesale extract business and Select-branded retail extract sales.

The Select brand is a market leader in states like California, Oregon and Arizona. When combined with the Acres Cannabis acquisition, Curaleaf will have the top market share in Nevada. Maybe most importantly, the domestic cannabis company will have an oil market share of at least 25% in key states like California and Oregon.

The combined company will have 1,000,000 square feet of cultivation space with 11 cultivation facilities, 44 retail locations in operation and 15 states with THC sales by the end of 2019. Maybe even more importantly going forward is the 1,000+ retail stores and 900+ wholesale dispensary accounts selling products from Curaleaf brands.

Market Leader

The interesting part of the story is that the new Curaleaf had pro-forma 2018 revenues that topped $200 million with nearly $75 million in the December quarter. The amount actually tops the $62 million produced by Canopy Growth (CGC) in the December quarter while the later gets all of the headlines due to the NYSE listing and large investment from Constellation Brands (STZ).

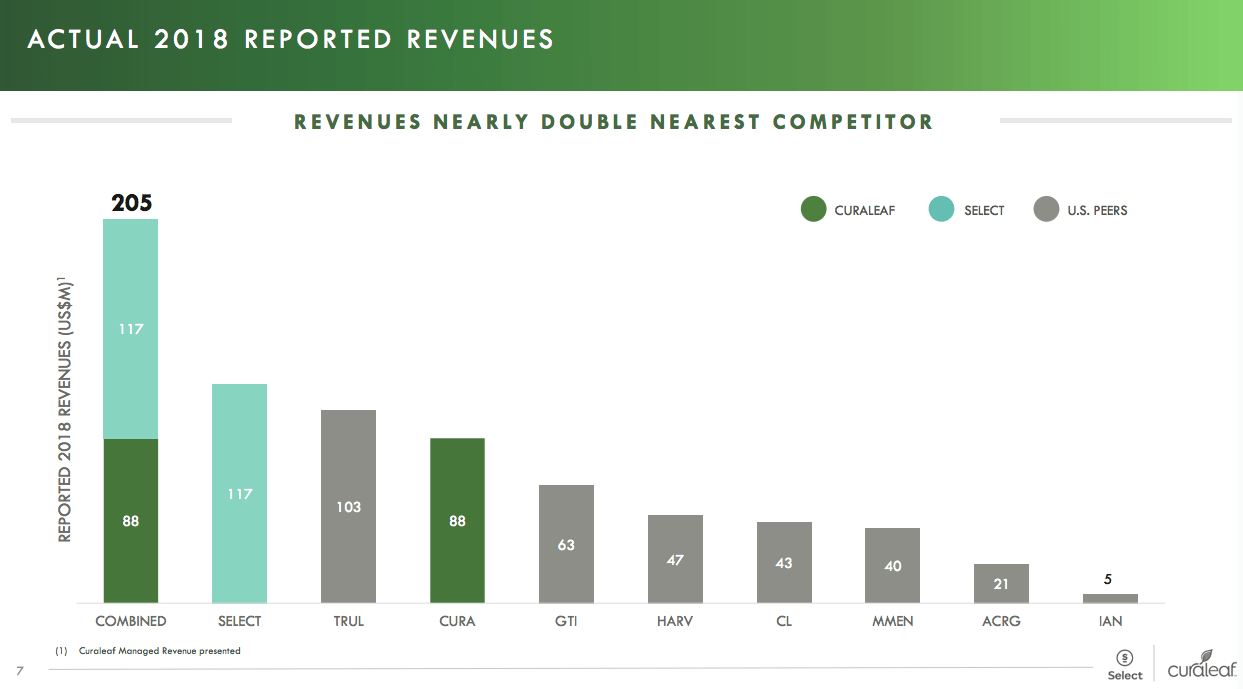

According to Curaleaf estimates, the company now has double the trailing revenues of any other player in the key U.S. cannabis market. Some other MSOs have big 2020 targets so looking at past revenues is important, but the key is where the company goes from here as plenty of state markets are just now opening up.

Source: Curaleaf presentation

Curaleaf alone had already forecasted that 2019 revenues would reach $400 million with free cash flow of $100 million. The company is very busy expanding on the East Coast with new operations in Florida, Maryland and New York and states like Ohio and Pennsylvania in the works.

Takeaway

The key investor takeaway is that the way to play the cannabis market remains these U.S. MSOs that are expanding operations and acquiring business in the largest global market. Stocks like Curaleaf have major catalysts such as uplisting on major exchanges and the federal legalization of cannabis in the U.S.

A company like Curaleaf is a potential acquisition target by major players either in Canada or beverage and tobacco companies from the U.S. and potentially around the globe. All of these companies will want access to a U.S. cannabis market estimated by Cowen to reach $80 billion by 2030. Curaleaf is now in the drivers seat without the lofty valuation.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: The author has no positions in Curaleaf stock.

Read more on Curaleaf :