A lot of cannabis stocks have slipped over the last few months providing some interesting entry points. One particular stock of interest is U.S. multi-state operator (MSO) iAnthus Capital Holdings (ITHUF) that trades at yearly lows after having bounced off $3. The stock plays perfectly into the thesis of national expansion, major stock exchange uplisiting and future consolidation candidate as the U.S. government eventually approves cannabis.

Making Progress

The U.S. cannabis stocks appears to have lost momentum in the last few months as the majority of MSOs announced market altering deals that haven’t closed. The stock market tends to lose focus, and this appears the case here.

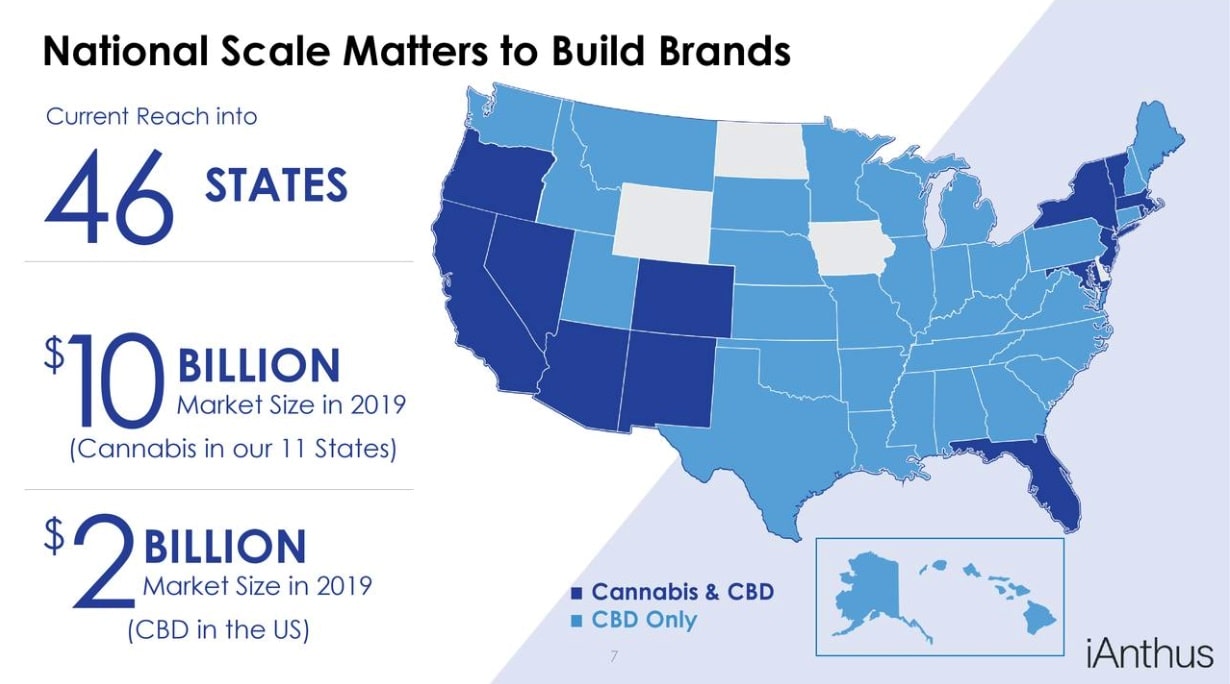

iAnthus Capital continues to process with deals closing and adding dispensaries GrowHealthy, owned by iAnthus Capital, recently opened two new dispensaries in Florida. The company now has operations in 11 states with 23 dispensaries open.

The ultimate scale is impressive for a cannabis company with a market cap that has slipped below a $1 billion market valuation. iAnthus Capital has licenses for 68 dispensaries and access to a market size that approaches $12 billion. In a lot of ways, the second tier U.S. MSO has a larger market size opportunity than the large Canadian LPs trapped into the Canadian market and small global markets.

(Source: iAnthus Capital presentation)

The recent closing of CBD For Life gives the company a national platform for CBD products. The acquisition closed on June 28 with the small CBD player already having a distribution network of 1,000 retail locations in 46 states.

The CBD business generated $714,000 in Q1 revenues for a $2.8 million annualized pace. Not bad for a business acquired for only $10.4 million. iAnthus Capital plans aggressive expansion in both products such as into premium skincare and adult products along with more retail locations in the U.S. plus eventual international expansion.

New Lows

iAnthus Capital traded at a high above $7 back last September. The stock is now down over 50% from the highs in slightly longer than 9 months. The U.S. cannabis story hasn’t changed so investors need to seize this opportunity in the stock dip.

The company lists about 245 million diluted shares outstanding after these deals close placing the market valuation at about $833 million. Very few companies in the cannabis sector have 2020 revenue targets in the $360 million range and trade below 2.5x those estimates. In fact, iAnthus Capital hardly trades above 1x 2022 revenue targets up at $778 million.

Takeaway

The key investor takeaway is that iAnthus Capital remains in a group of emerging MSO companies mostly unknown to U.S. investors. The cannabis company has substantial growth plans right under the surface of investor view due to the recently closed acquisitions and the stock market focus on the Canadian LPs.

The stock offers the rare opportunity to buy a cannabis company with a market valuation below $1 billion. iAnthus Capital is poised to reap the biggest benefits of federal approval and an eventual uplisting to a major U.S. stock exchange. The time to own this sock is when the market loses focus on these eventual big catalysts.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: No position.