The recent acquisition by AgraFlora Organics (PUFXF) of Organic Flower Investments Group could be the catalyst the company needs to drive long-term revenue growth. The transaction was closed on June 7, 2019.

While AgraFlora has had a clear path to significant increase in its production capacity – reaching approximately 250,000 kilograms a year when fully operational – it has been less clear how it would sell its growing inventory, and to whom.

With Organic Flower Investments Group, it looks like it could have found the answer, as it not only gets the remaining 20 percent interest in the giant Delta Greenhouse Complex, but more importantly, it secures access to the all-important European cannabis market, and entry into a number of cannabis segments that have the potential for significant growth.

This should be a strong complementary growth opportunity to its agreements with Namaste Technologies and ICC International Cannabis Corp. With Namaste, it secured a deal in the latter part of 2018 for up to 25,000 kilograms in sales of premium dried cannabis flower on an annual basis. For ICC International Cannabis Corp., the deal consists of the company being able to buy up to 20 million grams of premium dried cannabis flower annually over a period of five years.

International opportunity

Organic Flower already has EU-GMP cannabis processing capabilities in place, providing AgraFlora with an enormous opportunity to leverage its growing production at the international level. This reduces its risk associated with heavy exposure to the Canadian recreational pot market.

Investors in Canadian companies need to understand that recreational pot, while important for revenue at this stage of the industry growth, is limited on its upside potential over the long term, and because of lower prices, results in low margins and downward pressure on earnings.

For AgraFlora, that is more of a challenge because it primarily competing in the wholesale side of the recreational pot market. It should do okay in the near term, but further out it will have to find alternative cannabis markets if it wants to produce consistent profits in the years ahead.

For that reason, having immediate access to the European market is a great opportunity for it to sell in a higher margin market. Cannabis prices in the EU are generally higher than in North America. The company says that in the EU it plans on expanding into the retail distribution market for dried cannabis going forward.

Included in its distribution and GMP cannabis processing/finishing agreements are about 80,000 retail outlets, including pharmacies, located in 16 countries.

Food and beverage cannabis segments

Another benefit of the deal is the exposure the company has to products like beers, ciders, bottling performance products, beverages, candy, chocolates, and various edibles.

One of the more interesting aspects of these ancillary businesses is Candy, Chocolate & Edibles. There are development plans in place to build a 50,000 sq. ft. “manufacturing and product formulation facility” in Winnipeg, Manitoba. The facility will be able to produce CBD products for adult, medical and functional use.

When fully operational, the company says it should be able to generate over $750 million in annual sales.

The other segments include exclusive supply, manufacturing and distribution agreements and partnerships that should provide significant revenue streams as they expand and mature.

In cosmetics, there is a proposed acquisition of Canutra Naturals Ltd, a Canadian-based cosmetics/topicals manufacturing company. Included in this deal would be an industrial hemp license, co-packing agreements, and a cannabis research license from Health Canada.

There are other valuable assets that come with Organic Flower, but these will probably have the most impact on the performance of the company in the near term.

Conclusion

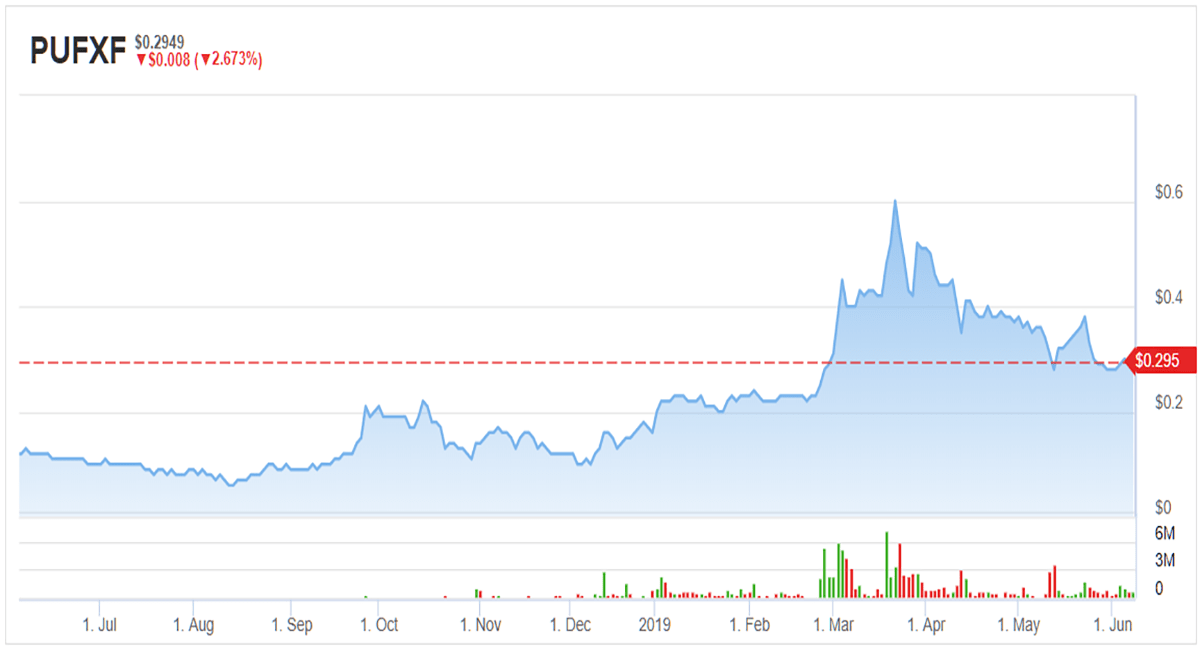

AgraFlora has struggled to attract a lot of investors so far, primarily I believe, because of a weak management team being in place. Not too long ago the company addressed that problem, and hired Brandon Boddy to be Chairman and Chief Executive Officer. He was the co-founder of Auxly Cannabis Group Inc., formerly Cannabis Wheaton Income Corp. That should improve investor sentiment for the company.

With the projected production capacity of 250,000 kilograms a year, and the addition of numerous ways to leverage its supply via different segments and international markets, AgraFlora could be one of the most undervalued publicly traded cannabis stocks.

It underscores the value that comes with a lot of production capacity, as it attracts a variety of companies that aren’t able to generate enough supply for the markets they serve.

With the management change, rising production capacity, and access to international markets and industry verticals, AgraFlora has rapidly transitioned from a dried flower, recreational cannabis play to one that can compete in more profitable segments.

It still has a lot of exposure to recreational pot, and that is a short-term risk, but over time it appears it has the pieces in place to grow revenue and earnings in the years ahead. I would recommend at least on your watch list and follow it progress closely. I think once the general market becomes aware of this sleepy stock, it could start to take off.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.