Organigram Holdings (OGI) is putting its pieces together at the right time. As the sentiment for the cannabis industry has temporarily turned negative, the company dropped the ball in the last quarter on its changing of growing protocalls, emerging improvements at the Canadian provincial and national governments, and it prepares for the upcoming legalization of derivative cannabis product sales in Canada.

Getting ready to go

There are several things Organigram has done to position itself for a rebound in the cannabis sector, including its partnership with leading vape company PAX Labs, its $10 million investment in Hyasynth Biologicals, and another $15 million investment a chocolate production line.

The investment in Hyasynth Biologicals is particularly compelling because it involves cannabinoid biosynthesis, which represents a potentially high level of disruption in the sector. This will take longer to pay off, cut it has a lot of probable upside to it.

As for vapes and edibles, these are among the top expected sales leaders when companies are allowed to start to sell them, which should be in the last couple of weeks in December, even though they’ll be officially approved in October. That means the full results won’t show up in its earnings report until the first calendar quarter of 2020; that’ll be true of all Canadian-based cannabis firms.

Costs of dried flower will fall back down to normal

When Organigram decided to change its growing protocols, it ended up being a temporary disaster, as the results in a smaller test weren’t able to be reproduced when went with a larger planting regimen when operating under real-world conditions.

The result was for its market-leading cost per gram of dried flower jumped from a range of $0.65 and $0.95 per gram in second quarter of 2019, to a much higher range of $0.95 and $1.29 per gram in the third quarter.

In response to the poor results, the company has quickly reverted to the way it grew cannabis in the past, and expects the cost per gram to drop back to former levels. Over the last five quarters quarters Organigram’s cost per dried flower gram averaged approximately $0.90.

Considering it’s going to go back to prior costs per gram and it’s preparing to sell into a much higher-margin derivatives market, starting in the latter part of 2019 and fully, into 2020, the company should generate some impressive results in fiscal 2020. Gross margins are among the best in the industry, and should continue to maintain that high level of performance.

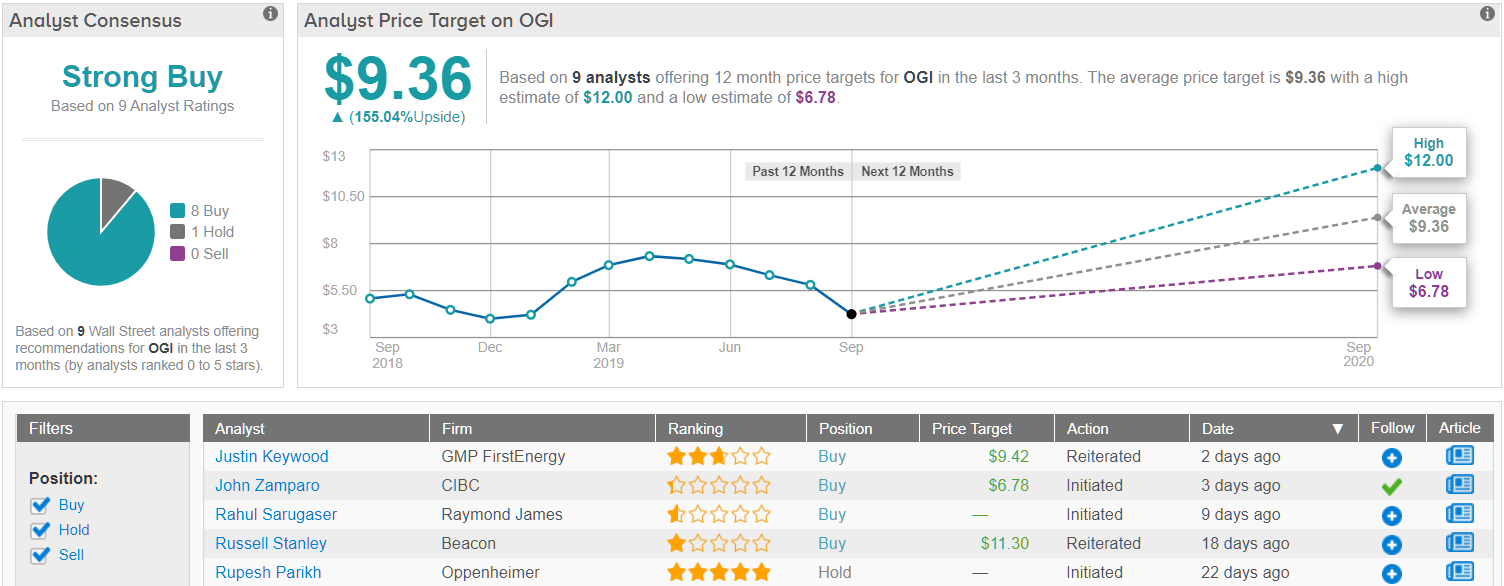

Raymond James analyst Rahul Sarugaser recently initiated coverage on Organigram, and sees net revenues increasing from $97 million in fiscal 2019 to about $552 million in fiscal 2024, when sees Canadian cannabis sales reaching $6 billion. His EBITDA projection for 2019 is $36 million, and 2020 he sees it jumping to $87 million.

Consensus Verdict

Overall, this cannabis player stands as a ‘Strong Buy’ name among Wall Street analysts. In the last three months, OGI has won eight ‘buy’ ratings along with one ‘hold.’ With a return potential of over 150%, the stock’s consensus price target lands at $9.36. (See OGI’s price targets and analyst ratings on TipRanks)

Conclusion

To say the legalization of cannabis in Canada has been disappointing at this point would be an understatement. A lot of that must be directly attributed to Health Canada and the parameters its working within.

The number of licenses rewarded to retailers is far behind expectations, and some that have received their licenses, to this day, haven’t even started to construct their buildings. That has led to Health Canada changing the rules for those applying for licenses, but that does nothing in the short term to deal with the problem.

Even so, there is finally some movement in Toronto and Ontario, where there should be another 50 stores to sell from in the near future. That will help, but it’s still far too small for a region that has millions of potential customers.

The good news there is it’s only going to get better, and with Organigram starting to complete some of its facilities which will boost production, the timing couldn’t be better.

In early September Organigram received approval from Health Canada to boost its overall production capacity to 76,000 kilograms annually.

Presumably this additional scale will bring down costs per gram even further, generating even better profitability.

The first harvest in this new rooms is expected to come in November, just in time to meet the upcoming demand for wider-margin derivative products. I’m not saying that specific product will be used to make derivatives, but it can be used to meet the needs of its existing customers while its current harvests are being made into derivatives. the company sees dried flower from the new harvest to be available for sale by fiscal fourth quarter that ends February 2020.

In Phase 5 of the current expansion the company will have more extraction capacity for a edibles and derivative product facility.

For these reasons, Organigram looks like it’s going to outperform over the next couple of years. This is a good time to take a position because of the correction in the cannabis sector which has driven down share prices. Once the rebound begins, we’re unlikely to see prices this low for a long time, if ever.