Tech is a funny thing. Have you seen Amazon stock lately? It’s been on a rip this past year. But competition hasn’t caught up or even close to what amazon is able to do. What about cannabis? Nope, Amazon can’t deal with cannabis just yet. It is stuck in a limbo of legality. While it does have Canadian subsidiaries which can potentially offer cannabis products like CBD, it’s still a long way from incorporating it into it’s mainstream platform. The problem lies in its inability to associate with cannabis while the American cannabis prohibition is still in effect. This leaves a bright runway for companies like Namaste Technologies (NXTTF) which can leverage the difference in legality between countries.

Just like Google is leveraging its power to potentially dominate the Chinese market whenever it gets approval to do business in China. Namaste is ready to go but just needs the legal issues to vanish.

Even if Amazon wanted to acquire Namaste, it wouldn’t be able to at the moment. It’s going to have to wait until the U.S. starts removing the barriers to cannabis. This is a good thing for Namaste but also its Achilles heel. Although it’s ahead of most online retailers with a strong client base, it’s also a big barrier for its success globally. It takes strong strategic partners to push tech to the next level. It also leaves room for Amazon to create its own in house platform ready to go whenever legalization hits America.

Why does Namaste still have tons of potential? Well, the 2020 U.S. elections are coming up and there are plenty of candidates ready to push cannabis out of the shadows. Although many years away, for a tech company like Namaste, it might be a light at the end of the tunnel. With new money from America and an already established platform with clients, Namaste might very well be its own Amazon of cannabis in the years to come. More importantly, while companies like Amazon stockpile cash, Namaste can be a potentially large acquisition in the future which would spell incredible returns for shareholders.

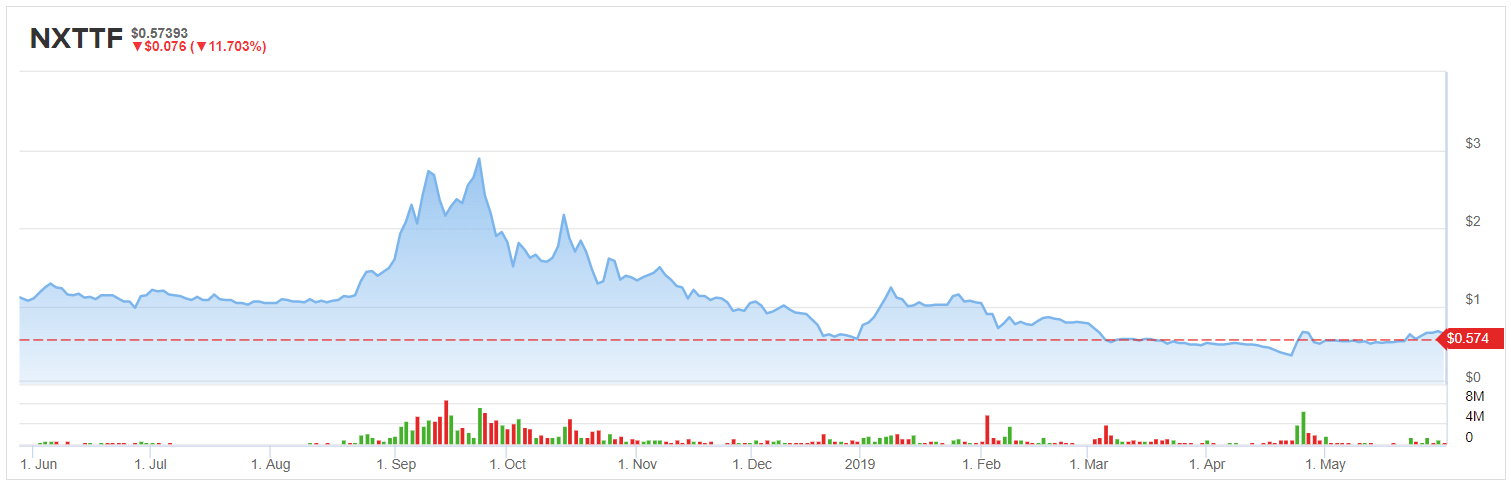

Looking at technical data, Namaste is consolidating now. Desperately awaiting financial results in the weeks to come, we’ll just have to wait and see what happens when the numbers are revealed. Many people are hopeful for a new revelation that will put Namaste back into the spotlight but unfortunately, it’s had a rough past few months. With the whole fiasco around Sean Dollinger’s fight with his own board, Namaste has been in a negative light. Why would you trust money in a company that feels incredibly unstable at the moment?

The bigger picture matters. Setting aside the negative press and events, Namaste is a company like any other. It’s got a fight on its hands and it needs to keep going forward. There are still plenty on milestones it needs to reach before it becomes the tech giant it aims to be. Looking forward, it has plenty of great tech ready in its arsenal and many things to look forward to. Remember, Amazon stock use to be a few dollars at one point. It all takes time, persistence and a little bit of luck.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: The author has a Long position in Namaste stock.