In one fell swoop, Curaleaf (CURLF) upset the balance in the cannabis sector. The U.S. multi-state operator (MSO) announced today an $875 million acquisition of Grassroots that promises to change the balance of power in the U.S. and around the globe. Without the rich valuations, Curaleaf or other MSOs remain attractive investments as market leaders that aren’t valued that way.

Grassroots

Curaleaf is spending ~$875 million to acquire GR Companies that owns Grassroots. The deal includes 102.8 million shares and ~$115 million in cash.

Grassroots has a portfolio of 61 dispensary licenses and 17 cultivation facilities. The company has 20 dispensaries in operation now and provides Curaleaf with substantially more access to big cannabis markets like Illinois and Pennsylvania. As well, the deal provides access to new markets in Arkansas, Michigan, North Dakota, Oklahoma and Vermont.

After the merger, Curaleaf will have a massive 131 dispensary licenses, 68 operational locations, 20 cultivation sites and 26 processing facilities. In total, Curaleaf will expand operations to 19 states from only 12 now.

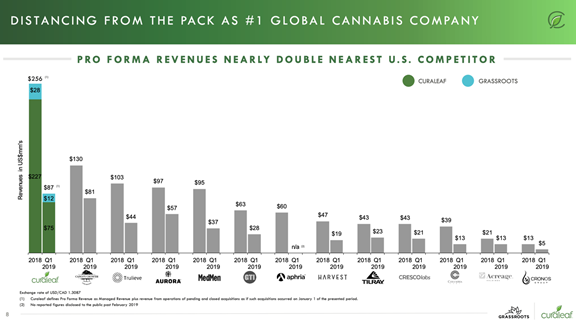

For Q1, Grassroots had $12 million in revenues and the Curaleaf pro-forma revenues were an incredible $87 million. The company lists itself as the market leader by revenues, but the other companies aren’t listed based on pro-forma numbers. In this case, Curaleaf includes both Grassroots and Select deals that aren’t approved yet.

(Source: Curaleaf presentation)

The important part of the story is that Curaleaf will have market access to 177 million people now. A lot of the Canadian LPs only have access to slightly below 40 million people in Canada and have looked to expensive global expansion to make up for the lack of domestic consumers.

Market Value

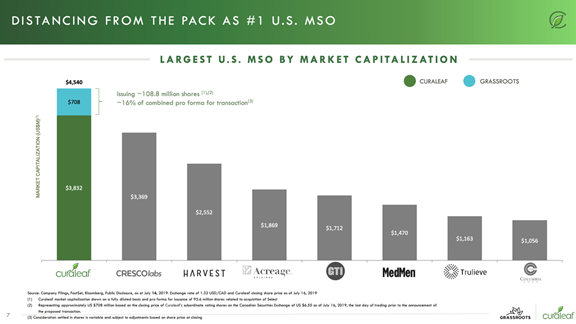

The more important story than whether Curaleaf has a larger revenue base is the comparative market valuations. The U.S. MSOs have offered the best valuations with Curaleaf having a proposed market valuation of $4.5 billion and a Q1 revenue run rate of $350 million with tons of growth ahead. The U.S. stocks trade at 10x trailing revenues while the Canadian companies trade at 10x forward revenues.

Curaleaf will have the largest U.S. market valuation, but the market leaders in Canada still have market values 2-3x that of the U.S. companies. As Cresco Labs (CRLBF) and Harvest Health (HRVSF) close acquisitions, the stock market will start seeing the value in the U.S. companies.

(Source: Curaleaf presentation)

As a stand-alone company, analysts were forecasting revenues topping $700 million in 2020. These combinations should push Curaleaf estimates far in excess of $1 billion in annual revenues and push the 2021 numbers towards $1.5 billion and possibly even close in on $2.0 billion.

Eventually, federal legalization will allow for these stocks listing on major U.S. stock exchanges that will boost market valuations. The merged operations will provide cost synergies and brand benefits that will further allow Curaleaf and other large MSOs to stand out in a crowded market.

Takeaway

The key investor takeaway is that Curaleaf is building a cannabis market leader without the related rich market valuation typical of fast-growing markets. As these large domestic cannabis deals close over the next year and the MSOs gain market size and brand recognition, the stock valuations will eventually flip with the Canadian LPs.

The stock is up 17.5% on the news and more gains are ahead for Curaleaf.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: No position.

Read more: Why It’s Time to Become Bullish About Curaleaf