Some of the commentators and pundits that have been somewhat bullish on MedMen (MMNFF) are far too optimistic at this stage of the development of the business and the execution of its strategy, in my view.

While the company does have an interesting strategy of targeting consumers with significant disposable income, there is no guarantee it will be able to ward off the growing number of vertically integrated dispensaries in the U.S. markets.

There is also the fact the current clientele of MedMen, as cannabis becomes more acceptable and normal in the U.S., won’t necessarily buy solely at MedMen dispensaries, or possibly gravitate to a competitor. MedMen works for now with its customer base because of a lack of alternatives to serve that market, but that is changing rapidly, and as people accept the usage of cannabis more, they won’t be as resistant to buying from other dispensaries.

At this time MedMen has been able at times to generate a lot of sales per square foot, but as more dispensaries are built, some of that advantage will dissipate.

So far I haven’t seen MedMen differentiate in a way that would defend it against the growing number of competitors it is facing, and will face in the future.

Its strategy

Although the strategy of MedMen, which is to compete in the top U.S. markets, isn’t a bad one, it’s no different than most dispensaries that have similar goals in place.

MedMen has suggested in California, that the regulations in California are a moat for the company because of requirements that cannabis stores must, by law, be a specific distance away from places like churches, schools and other cannabis retail stores.

That means the business that establishes a physical presence in a particular locality will have a distinct advantage over a competitor looking to compete in the same area.

Although that’s true in California, it will also work against MedMen for those companies getting to certain localities before MedMen does. To me it appears to be somewhat of a wash; it’ll benefit from its existing locations, but it’ll struggle for the same reasons against competitors that are established in other California markets as well.

Other states the company has a presence in are Arizona, Florida, Illinois, Nevada, and New York.

The two with the most near term potential are Illinois and Florida. In Illinois it’ll get the 10 retail stores associated with the PharmaCann acquisition, and in Florida, where it plans to have 12 retail stores opened not too long from now.

Florida is going to be a tough market because of the rapidly growing number of competitors in the state. It’ll take a long time before it is clear who the winners are going to be there.

In Illinois, the major market it will serve is Chicago, where PharmaCann is easily the market leader.

The challenge for MedMen is it’s really not doing anything much different than its competitors, and it remains to be seen if its focus on upscale consumers is a defensible position, as the stigma of cannabis use continues to retreat.

Management and cash burn woes

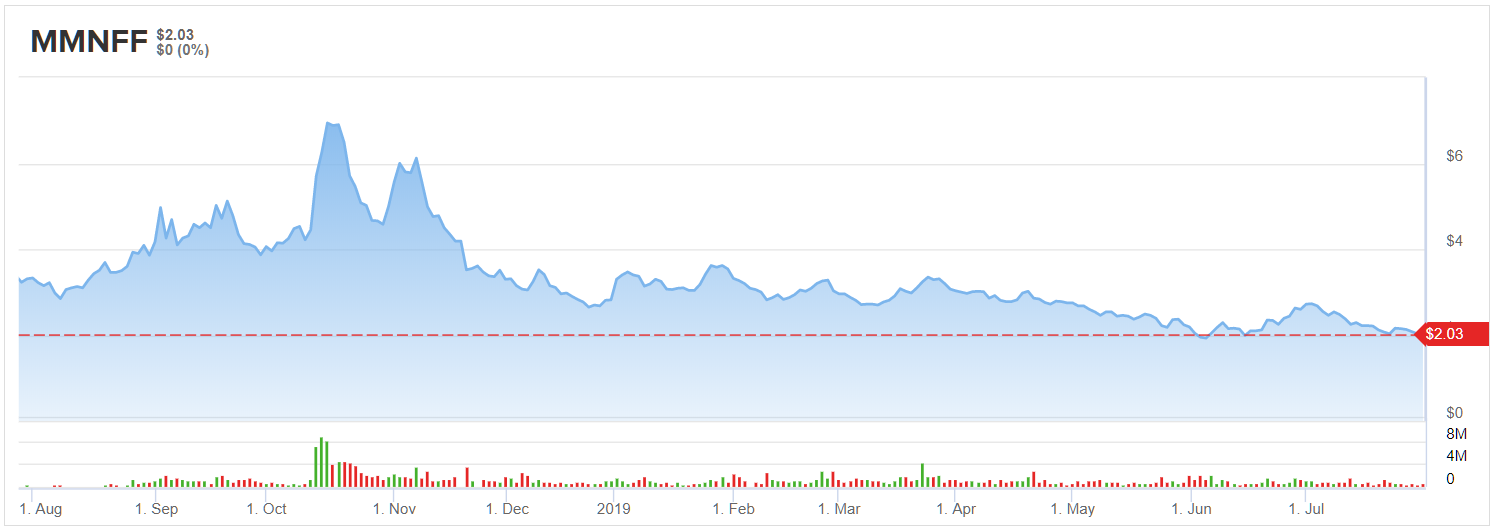

The two biggest negative catalysts for MedMen has been the revolving door of executives and its cash burn rate, which has resulted in rising losses for the company. Uncertainty surrounding leadership and increasing losses must be addressed by the company if it wants its share price to find support once again.

Operational costs have skyrocketed over the last year during the first two quarters, soaring from $16.6 million for the first half of fiscal 2018, to $150.7 million for the first fiscal half of 2019.

Overall, in the first six months of fiscal 2019 has lost over $125 million. At that rate, even with the $250 million investment from Gotham Green Partners, the capital isn’t going to last long, and that doesn’t include some of the projects MadMen said it is going to use the capital for, including its expansion into Florida, more acquistitions, high-end product development, and the integration of PharmaCann and other acquired assets.

It’s readily apparent the company doesn’t have even close to the capital needed to do what it wants to do. It’ll struggle as it is just to use the $250 million to cover its cash burn, let alone spend on the above-mentioned projects. That means it will need to raise a lot more capital to achieve its ambitious goals.

Conclusion

MadMen has positioned itself as one of the leading vertically integrated dispensary companies in the U.S. market, but it has done so at enormous cost, which has yet to be seen if its aggressive growth strategy is sustainable.

The dispensary space in the U.S. is a Wild West at this time, and it’ll take a long time before we know who the winners will end up being. Even with its growing presence, MedMen remains a highly speculative and risky company.

For those looking to take positions in companies in the cannabis sector, there are a number of companies far more compelling than MedMen at this time.

With no competitive advantage and an unproven business model, it’s a toss of the dice which way MedMen will go. It could end up being a great company, or quickly devolve into a cash-burning performer that consistently struggles to survive quarter to quarter.

However it plays out over the long term, MedMen is going to have to raise a lot more capital in order to execute its plans. The means a lot more dilution and cash burn. It’s probably going to get much worse before it gets better.

See price targets and analyst ratings on TipRanks