Canopy Growth (CGC) has been taking a beating after its latest disappointing earnings report, the ouster of popular CEO Bruce Linton, weak allocation of capital, and a gross margin that’s less than impressive.

As with all cannabis stocks that have endured the current sell-off, investors do need to look closely at the stronger companies in the industry and ask themselves which firms will outperform once the sector reverses direction.

Many believe Canopy Growth is a good candidate for that, and in this article we’ll look at whether or not that thesis is a good one, and if the company can pull itself out of the mire after so many negative catalysts weighing upon it.

The Current Sell-Off

The cannabis sector has overall, been going through a prolonged correction in 2019, which to one degree or another, punished cannabis stocks. Companies like Canopy Growth, which have had other issues, have experienced even further degradation of their stock price, as the combination of negative sentiment and issues specific to Canopy Growth, have resulted in its share price plunging.

While supporters point to the usual cash infusion of about $4 billion from Constellation Brands (STZ), its potential acquisition of Acreage Holdings (ACRGF), and the prospect of generating a lot of revenue in the U.S. market from infused products, the reality is even with these perceived positive catalysts, the company has been wildly under performing.

As mentioned earlier, disappointing earnings report, the ouster of popular CEO Bruce Linton, weak allocation of capital, and a gross margin that continues to struggle, more than offset the positive catalysts.

The major reasons for that is that Acreage Holdings is far from a done deal, and even with billions at its disposal, it has done nothing to improve the performance of the company so far. The latter relates to capital allocation, which is observably weak with Canopy Growth, although that is also true of most management teams in any industry.

Concerning Constellation Brands, the problem there in my view is, from the beginning of its deal with Canopy it had measures in place to take control of the company. That’s not necessarily a negative in and of itself, but when considering the timing of Linton’s firing, the correction associated with the cannabis sector, and the uncertainty surrounding who is going to replace Linton, and what their management style and objectives will be, continues to weigh on the company.

Since it’s taking awhile to replace Linton, I think Constellation Brands is struggling to find the person that aligns with the company’s wishes.

Also related to Constellation is the probable outcome of the matter, which is the probability it’ll eventually buy all of Canopy’s shares, making it only another subsidiary in its business.

Under that scenario, shareholders won’t get the most potential upside to Canopy, when it finally recovers and turns things around.

For these reasons I believe Canopy will still be a good company in the cannabis sector, but it’s not going to reach the potential many following the company believed just a few short months ago.

While some investors are starting to suggest Canopy Growth as a contrarian play, I see it becoming more of a traditional play associated with the modest growth potential of Constellation Brands.

Conclusion

From the time I heard about the cash infusion from Constellation Brands, I’ve publicly stated I don’t think, over time, it’s going to be advantageous for Canopy Growth. Since then, there is nothing I’ve seen that has changed mind.

Its gross margin remains terrible, and even though it is will improve some going forward, it isn’t near what peers like Aurora Cannabis generate.

Even though companies need to make moves that enhance their long-term performance, most of the things Canopy Growth has done are related to the far future; specifically its acquisition of Acreage Growth, which it put a 90-month time table on. If it was optimistic about the U.S. legalizing cannabis at the federal level in the near future, it would have made the length of the deal much shorter.

The fact is the U.S. may never legalize recreational pot, and if it does, I don’t think it’s going to happen for many years. For the most part the media doesn’t report the opposition to legalization, but it’s there, and resistance is stronger than believed. The reason it isn’t covered much is it hasn’t needed to be because of issues that are far more pressing on politicians.

On the other hand, if legalization does come at the federal level sooner than I believe it will, if ever, it will be an enormous catalyst for Canopy Growth, even though it will still have to solve its inability to control costs.

For now, there is no visible path to profitability, and for that reason, even when the sell-off reaches a bottom, the bounce Canopy gets isn’t going to be as strong as many of its competitors.

In the end, Canopy needs to find a CEO, and then that CEO needs to reveal what the growth strategy for the future is. That’s important because Constellation Brands said that was the main reason for getting rid of Linton.

The bottom line is Canopy Growth remains a ship without a rudder, and until that is rectified and a growth strategy is put in place, the stock is going to continue to be volatile and flounder.

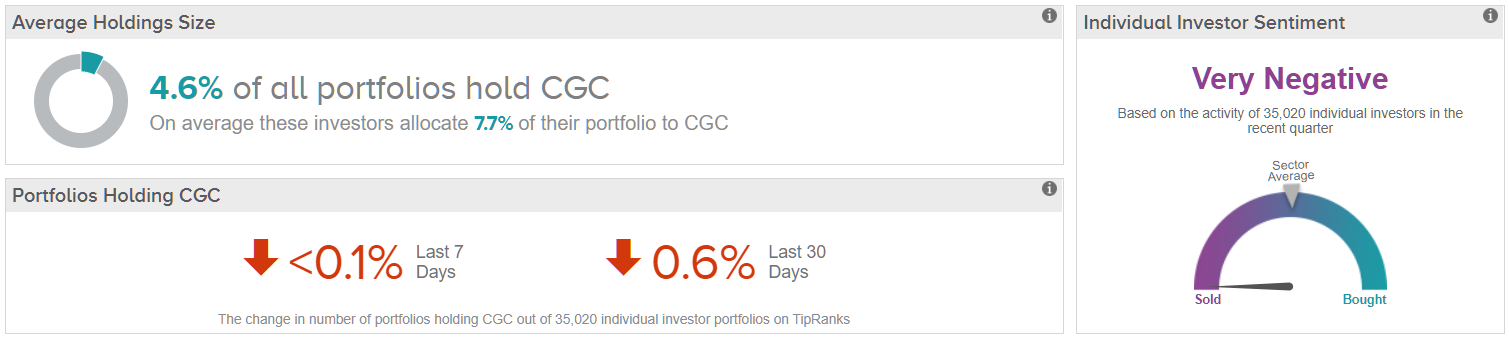

With the stock price trading near the 52-week low, it’s not surprising that investor sentiment is Very Negative, with individual portfolios in the TipRanks database showing a net pullback from CGC.

See Canopy stock analysis on TipRanks