At first glance, the final fiscal Q4 results should have HEXO (HEXO) shareholders running for the exit. The Canadian cannabis company is making moves to ultimately position itself for survival, but the numbers were so horrible that investors need to question where the ultimate bottom takes place in the stock.

Final Numbers Weren’t Any Better

Just a few weeks ago, HEXO guided the market to expect FQ4 revenues in the C$14.5 million to C$16.5 million range versus previous expectations were revenues double those amounts. The horrible guidance was backed up with actual revenues of C$15.4 million and weak guidance for FQ1 that ends this week of only C$14.0 million to C$18.0 million.

The company had to recently cut 200 positions and close some cultivation facilities due to the substantial weakness in sell through. HEXO produced 16,824 kg of dried cannabis and only sold 4,009 kg in FQ4.

Investors can probably easily deduce a huge problem occurs when production nearly quadrupled from the February quarter while kg sold were only up 50% in the period. The end result was operating expenses soaring to C$46.9 million due in part to including the operations of the acquired Newstrike Brands while sales were virtually flat when stripping out the C$2.8 million in sales from the acquired company.

The company had an absurd C$60.7 million loss in the quarter. While these amounts include non-cash charges of stock-based compensation and inventory impairment charges, an investor doesn’t exactly need to scrub the income statement to determine the ongoing cost structure. With so many moving parts including the creation of the Up brand to provide a low-cost brand to attack the black market, the best solution is to just sit on the sidelines waiting to review the next quarterly results and guidance.

Survival Is Key

While previously warning investors that over supply issues would impact the Canadian cannabis industry, the expectation wasn’t that HEXO would lead the charge to cut cultivation. After quarter end, the company suspended cultivation at the Niagara facility and part of the Gatineau facility. The end result is a new target for nearly 50% less annual production at around 80,000 kg.

Along with cutting 200 employees and raising another C$70 million in convertible debt, the company is positioning for survival. The key here is whether big players in the industry like Aurora Cannabis cut back on cultivation or they push forward in order to take market share from HEXO.

The company ended the last quarter with C$135 million in cash for a total cash balance of over C$200 million now. HEXO has made the correct moves to right the ship and better align costs with more realistic sales forecasts considering the slow rollout of retail stores, but the departure of more executives including a couple of CMOs leaves limited executive talent surrounding the CEO that got the company into this jam.

Analyst Ratings

Over the past week, HEXO has been hit with not one, not two, but three separate “sell” ratings from Wall Street analysts following the release of its fiscal fourth-quarter results. One of these analysts, CIBC’s John Zamparo, believes the stock could drop further to C$2.50 (12% downside).

“Even after heavy investment in operations, HEXO’s cash requirements remain significant. We estimate nearly $200MM is needed in F2020, which roughly matches the company’s pro forma cash balance when including last week’s financing (but excludes ~$30MM in available debt). Our primary concern on this stock is that as balance sheet strength and profitability gain importance among investors, HEXO is quickly burning through cash (which we assess in detail herein) and is likely over a year away from becoming EBITDA-positive,” Zamparo said.

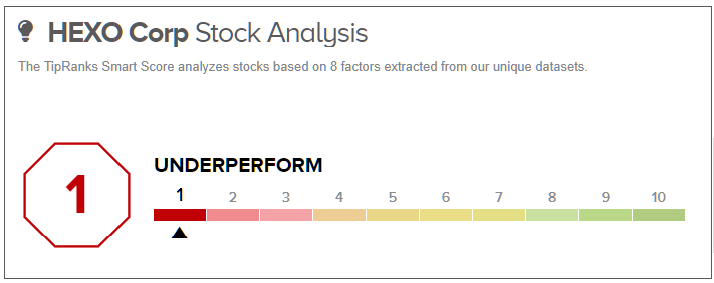

Overall, Street-wide caution circles the cannabis player, as TipRanks analytics model HEXO as a Hold. This boils down to 2 “buy,” 7 “hold,” and 3 “sell,” ratings in the last 3 months. (See HEXO stock analysis on TipRanks)

Takeaway

The key investor takeaway is that HEXO is still a stock to avoid. The company is reporting quarterly numbers nearly three months after the quarter close and the major shakeup in the executives, business plan and operations leaves the stock untouchable even with the market valuation down to $600 million. HEXO needs to clean up the income statement and show a path to much higher revenues before the stock is a buy above $2.

To find better ideas for cannabis stocks trading at fair value or better, visit TipRanks’ Best Stocks to Buy tool, a newly launched feature that unites all of TipRanks’ equity insights.