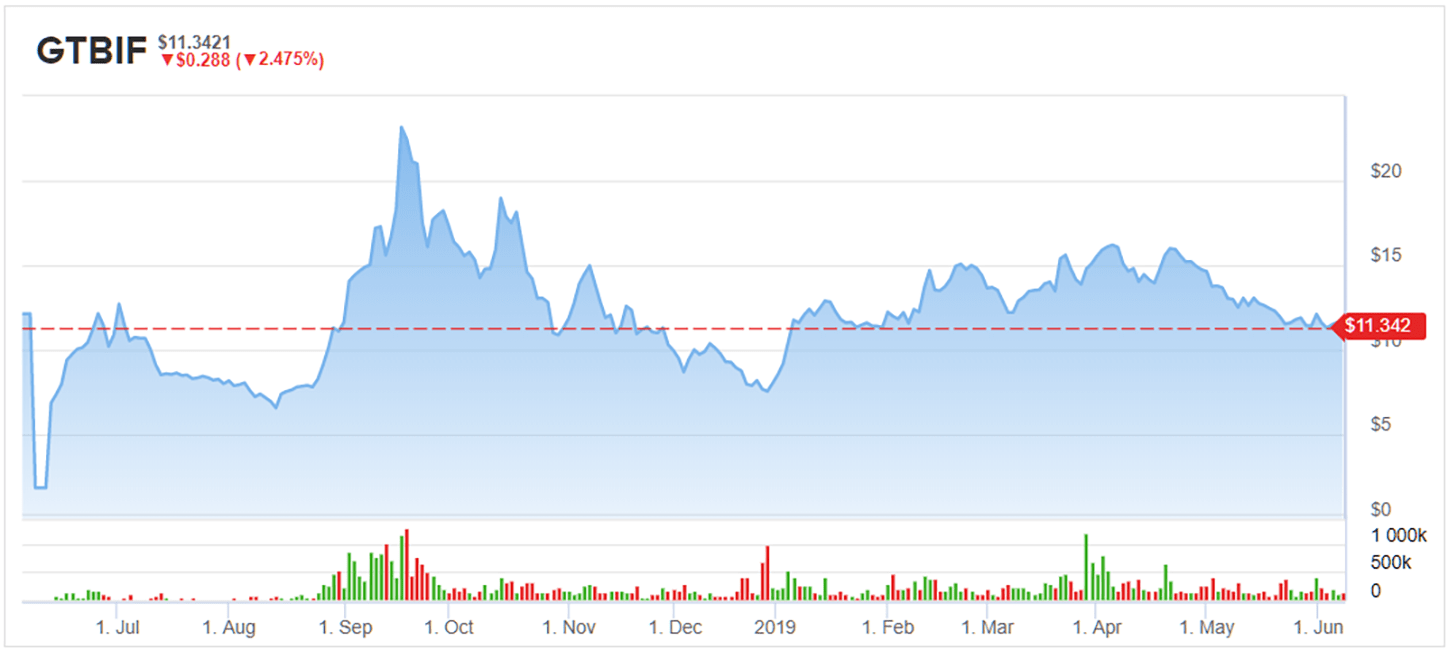

At this point, investors can’t go too wrong with most U.S. cannabis multi-state operators (MSOs). Another prime example is Green Thumb Industries (GTBIF) that offers a reasonable valuation for the expansion plans the company offers.

Booming Q1

For Q1, Green Thumb reported revenues of $27.9 million, up 34% over the prior quarter. As with most MSOs, the company has closed several recent acquisitions and opened a bunch of new stores to set up substantial growth in the year ahead.

Gross margins were only 47% so the management team will need to improve the gross profits as the company scales. The number is roughly in line with where the industry sits at this point in the growth phase.

As with the other companies, Green Thumb is in massive growth mode, so adjusted EBITDA came in at a small loss. Though, the key is that the company only reported an EBIDTDA loss from operations of $0.4 million.

The ability to achieve rapid expansion without burning tons of cash is crucial to long-term shareholder returns. As store openings ramp up in 2019 and acquisitions are integrated, a crucial metric entering 2020 will be gross margins and adjusted EBITDA margins. The ability to keep losses at a minimal will help curtail diluting shareholders via secondary offerings.

Expansion Ahead

Green Thumb ended March with only 15 stores open. With four more stores already open and pending acquisitions, the company will have 25 locations open.

The company is already looking at a 67% increase in store openings just from closing deals. On top of that, Green Thumb expects to add another 15 to 20 stores this year to bring the year-end total up to 45 stores. In the course of the last 3 quarters of the year, the cannabis company expects to triple the store count.

Just as important as the store counts are the states in which they are opening locations. The company opened Rise stores in Florida, Ohio and partnered with 3 stores in New York. More importantly, the acquisition of Evergreen Dispensary, LLC gave Green Thumb a store in Peoria, Illinois to bring the total retail stores in the state to five. Illinois just approved recreational cannabis sales on January 1, 2020 making the company perfectly positioned for expanding sales in one of the largest states in the U.S.

On top of that, Green Thumb has licenses for 88 locations to further double the store count. For this reason, analysts forecast 2020 revenues to approach $500 million.

With the listed market cap around $2.2 billion, the stock only trades slightly above 4x forward sales estimates. The state approval in Illinois should provide a nice catalyst for revenue actually reaching the $500 million market next year.

Takeaway

The key investor takeaway is that Green Thumb is positioned for substantial growth over the next few years via new stores openings and expanding CBD and brand products. The approval of adult-use cannabis in Illinois leaves the company perfectly positioned for the next wave of legalized growth in the U.S.

The U.S. MSO stocks remain some of the best bargains in the sector as slow legalization state by state has left out the large Canadian operators and the inability to list on major stock exchanges has left the stock at a reasonably cheap valuation.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: No position.