Cronos Group (CRON) soared 11% Wednesday on news that a Wall Street analyst double upgraded the cannabis stock. The bullish call is puzzling considering the already stretched valuation of the Canadian company.

Big Call Reversal

Analyst Christopher Carey from BofA/ML upgraded the stock from Underperform to Buy. In the process, the analyst raised the price target from $17 to $27.

The stock had dipped into the $13s prior to this call so logically the analyst needed to look at upgrading Cronos to Neutral based on the previous target of $17. Instead, the analyst made the bold call to raise the price target by an incredible $10 or nearly 60%. The new $27 target equated to a roughly 100% gain from the starting price on the previous day.

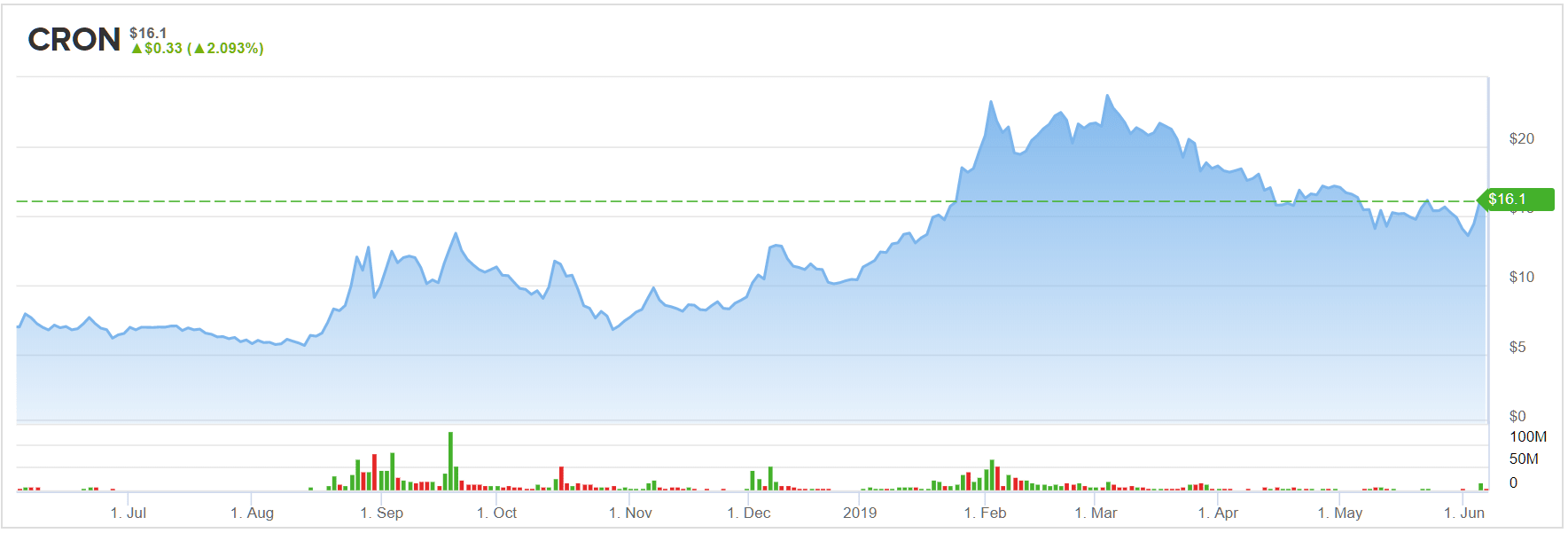

Such a large price hike on a stock that had declined by over $10 from the highs above $25 early this year is rather odd. The weak Q1 results of Cronos and fellow Canadian stocks like Tilray (TLRY) had originally made investors question the bullish thesis on these two stocks.

Problematic Call

At least until this problematic call by BofA/ML. Cronos already had a stock valuation approaching $5.0 billion before this move. The company only reported Q1 sales of C$6.5 million or roughly $4.8 million.

The valuation already had a massive mismatch requiring substantial growth by Cronos to justify. The problematic part of the call is the need to raise the target price so dramatically to a market valuation of ~$7.7 billion.

Part of the call was related to the theory that Cronos will be able to accelerate a move into the U.S. by leveraging Altira’s (MO) distribution network of 230,000 retail locations. With the FDA still banning CBD in food and dietary products and general questions about safety from the regulatory body hosting a public hearing last Friday, vast expansion into the U.S. isn’t guaranteed.

Bank of American projects that the U.S. CBD market surges from somewhere around $2.0 billion today to $11.5 billion by 2032. The problem for Cronos Group is that so many U.S. companies have already established market positions and distribution in local retail stores. No guarantee exists that the Altria distribution network will randomly want the CBD products from Cronos.

Analyst revenue estimates are only in the $250 million range for 2020. Again, the thesis that the Canadian cannabis stocks listed on U.S. stock exchanges are the most overvalued stocks in the sector are reinforced by this mismatch following this analyst call.Outside of the $1.8 billion investment from Altria Group, Cronos Group doesn’t have a lot to show the market. The company only sold 1,111 kilograms of cannabis during the March quarter leaving it far behind the market leaders despite the valuation target that approaches one the largest valuations in the sector.

Takeaway

The key investor takeaway is that Cronos Group has the cash to make a big splash in the cannabis sector, but the company so far hasn’t provided investors with much to actually support the current market valuation. The stock didn’t warrant an upgrade making this call so problematic for investors in the sector still being misled to investor in the Canadian operators just because they are listed on the major stock exchanges.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: No position.