The US multi-state operator (MSO) cannabis sector has taken severe stock hits in the last few months. Companies like Cresco Labs (CRLBF) have generally all hit financial goals, but the market has shaken off the positive developments due to a lack of progress of closing key mergers and federal approval of cannabis. The stock is down sharply as the company stacks another merger on top of other large pending deals.

Another Merger

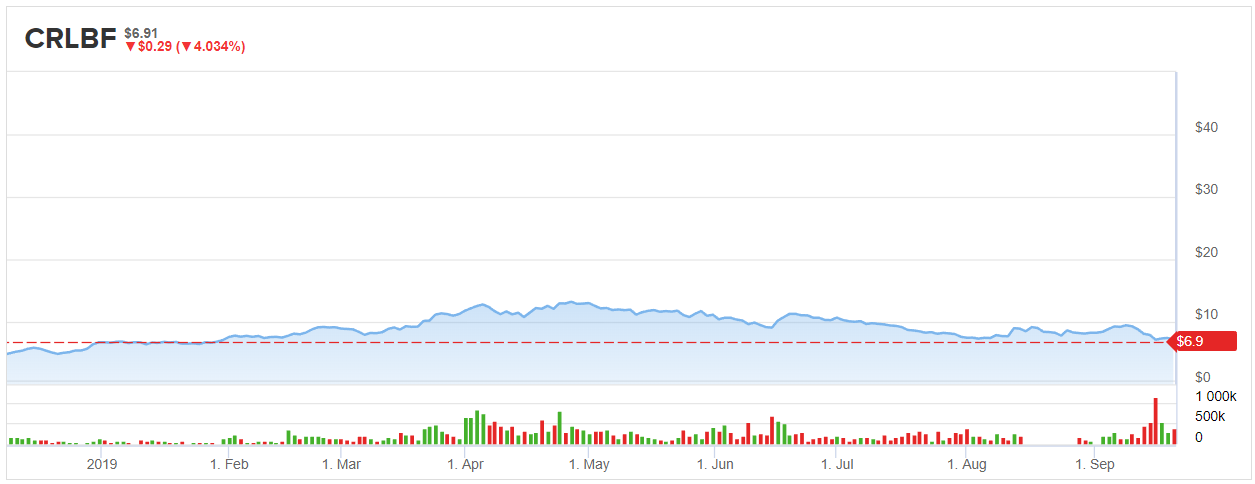

The stock slumped to nearly $7 following a rally above $13 just back in April. The nearly 45% loss is in line with most domestic MSOs as the excitement over large-scale acquisitions has faded with none of the deals closing in a timely manner.

Cresco Labs announced the acquisition of Tryke of $282.5 million. Tryke operates six retail stores in Arizona and Nevada under the Reef Dispensary brand.

On the surface, the deal appears solid with the company generating 2018 revenues of $70.4 million and an impressive EBITDA of $24.6 million. A deal costing 12x trailing EBITDA in a fast-growing sector is typically encouraged.

The problem here is that Cresco Labs has several pending major acquisitions and the market is naturally concerned the regulators will balk at these MSOs gaining too much scale.

The company announced the acquisition of Origin House on April 1 in a deal promoted as the largest ever public company deal in the U.S. cannabis sector. The deal had a listed value of C$1.1 billion or roughly $850 million at the time. Origin House has a listed market value of only $440 million now as investors lose interest in the sector and the deal closing.

The market clearly has concerns about the deal closing with Origin House trading at only $5.50 now. The company originally forecast the deal closing by the end of June and the date was recently pushed out as closing after the waiting period for HSR expires on October 17. The market isn’t comforted by the ongoing delay.

In addition, VidaCann hasn’t closed adding more regulatory uncertainty. The pending acquisition target expects to have 20 stores open in Florida by the end of 2019 to greatly expand on the market opportunity for Cresco Labs. The Tryke merger makes for three relatively large-scale deals pending.

Focus On The Future

The Origin House deal along with VidaCann are crucial to the future of Cresco Labs. The company only reported Q2 revenues of $29.9 million while pro-forma revenues were up at $52.7 million. The pending acquisitions already accounted for nearly 45% of the revenue stream counted on by the company and this Tryke deal adds another $17.5 million in quarterly revenues based on FY18 numbers.

The company already has the Illinois market projected to reach annual sales in the $2 to $4 billion range with adult-use cannabis starting on January 1. In addition, Cresco Labs got regulatory approval for an acquisition of Valley Agriceuticals, LLC providing for access into New York. Along with a license in Michigan, Cresco Labs is poised for substantial growth with or without all of these pending acquisitions closing.

Consensus Verdict

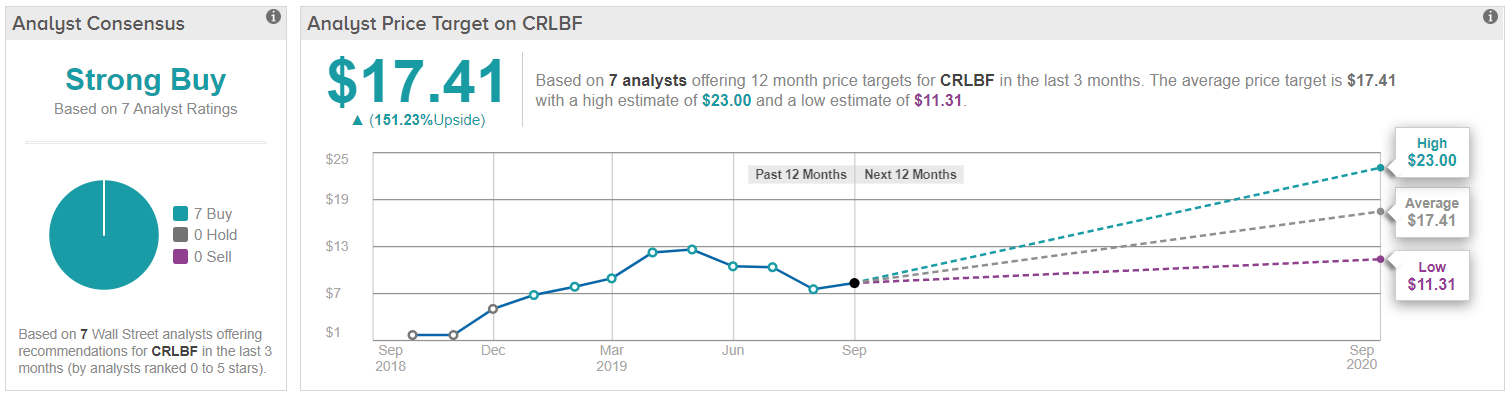

With 7 ‘Buy’ ratings in the last three months, the word on the Street is that Cresco Labs is a ‘Strong Buy’. Its $17.41 average price target suggests about 150% upside potential. (See Cresco Labs’s price targets and analyst ratings on TipRanks)

Takeaway

The key investor takeaway is that regulatory uncertainty is a big factor in the weakness of Cresco Labs. For investors that believe in the sector, Cresco Labs now offers the potential for a $1+ billion business trading with a fully diluted market valuation of only $2 billion. Unfortunately, the stock is likely to trade weak until progress is made on all of these pending deals.

Visit TipRanks’ Trending Stocks page, and find out what companies Wall Street’s top analysts are looking at now.

Disclosure: No position.