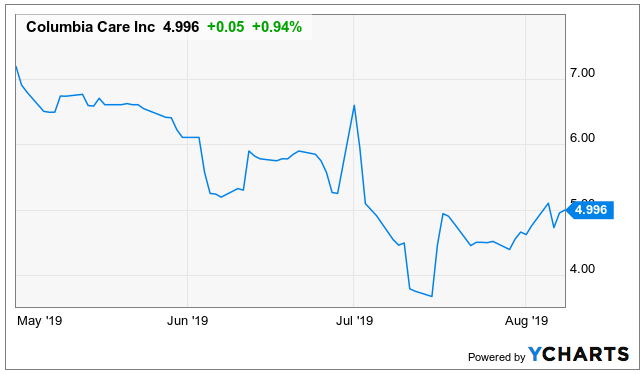

The cannabis sector is full of relatively unknown jewels mostly hidden to the market. Columbia Care (CCHWF) is another example of a company that recently listed on the OTC while having operations bigger than some of the best-known Canadian cannabis LPs. In a lot of cases, the under the radar stock offers the better value.

Strong Q2

With most cannabis companies reporting quarterly results long after the quarter ends, Columbia Care provides one of the first looks at the June quarter numbers. The global medical cannabis company reported revenues that surged 50% sequentially to $19.3 million.

Columbia Care has mounting losses with adjusted EBITDA losses surging to $11.4 million and a net loss of $33.7 million. About $20 million of those costs were one-time charges for listing expenses or non-cash SBC of $7.2 million.

These losses are mostly related to the New York based cannabis company ramping up operations in up to six new license jurisdictions. The company entered Florida, Ohio and Puerto Rico after the quarter closed and still has another three licensed jurisdictions to enter in order to reach all 15 licensed locations.

Columbia Care will get a pass for now on gross margins of only 28% due to the ramp up in these new jurisdictions. The company has quarterly operating expenses in the $20 million range so gross margins in the 50% range next year will quickly wipe out the large losses as quarterly revenues are targeted to touch $75 million.

Share Repurchase

The domestic cannabis company made the odd move to announce a share repurchase program back on July 23. Columbia Care is in an aggressive growth phase with expansion into multiple new jurisdictions, so a share repurchase plan is highly unusual.

The plan suggests Columbia Care will buy up to $25 million worth of shares on the open market from time to time. At $5, the stock has a valuation in the $1 billion range. With analysts forecasting sales reaching $400 million in 2020, one can easily see the interest in repurchasing shares.

The issue is that Columbia Care only has a cash balance of $125 million while burning $27 million in cash via operating activities in Q2. Without the $11 million listing fee, the company only burned about $16 million from operations in the quarter.

Either way, the company doesn’t appear in the cash position to repurchase shares. The aggressive signal from management is a positive, but Columbia Care would be far better keeping this cash on the balance sheet to fund future expansion. If the stock is really cheap, the market will figure the value out in due course.

Takeaway

The key investor takeaway is that Columbia Care fits the profile of a lot of cannabis stocks recently listed on minor exchanges without much fanfare. The stock only trades at ~2.5x analyst revenue estimates for 2020 while holding very valuable licenses to 15 jurisdictions. The cannabis company recently entered large markets like California, Florida and Texas making the stock one to own before the market catches on to the opportunity here, if the company doesn’t blow the cash on unwarranted share buybacks.

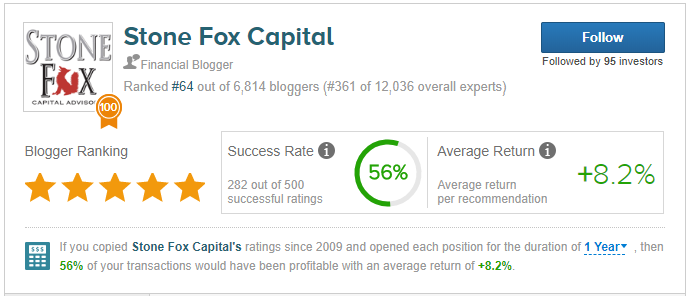

Author’s Ranking on TipRanks:

To discover Wall Street’s best-rated trending stocks on TipRanks, click here.