After less than two months on the job, new Canopy Growth (CGC) CEO is making the right moves for the company. The Canadian cannabis LP hasn’t been a favorite in the sector due to bad leadership with out of control spending and production levels in the past. Now, CEO Davie Klein is making smart moves to mothball greenhouses to remove costs from the business and cut excess production making the stock more investable for the long term. The coronavirus can impact revenues in the short term, but the stock selloff to $13 more than accounts for this risk.

Closing Greenhouses

Canopy Growth made the decision to close two massive greenhouses in British Columbia and eliminate 500 jobs in the process. Also, the Canadian cannabis company isn’t going to not open a third greenhouse in Ontario.

The Aldergrove and Delta, British Columbia greenhouses had ~3 million square feet of licensed production space and were placed into commission back in early 2018 at an estimated cost of C$400 million. In addition, Canopy Growth is taking up to a C$800 million pre-tax charge in the current quarter.

The charge isn’t meaningful as anybody should know a company with results missing targets are going to need to write down assets. The important part of the story is the assets moved out of production with Canaccord Genuity’s Matt Bottomley estimating these greenhouses remove ~40% of the company’s Canadian footprint from production.

In the past couple of quarters, Canopy Growth had produced more than double their actual sales leading to their inventory balance ballooning to C$623 million, up C$363 million in the last two quarters alone. The big unknown from the announcement was were quarterly cultivation capacity will end up after these greenhouse closings and where the company is going with the suggestion of shifting more production to outdoor sites.

Improving Cash Flows

The stock is now down to $13 more due to the coronavirus issue as the market wanted Canopy Growth to reduce production levels. Without the 2,000-point drop in the U.S. DJIA, the stock might not even be down based on the news.

In the first three quarters of FY20 ending in March, Canopy Growth has burned C$548 million in cash from operations, which include building of those substantial inventories. These moves will strip out the excessive cost of building inventory, but the company will still need to cut millions from quarterly operating expenses still in the C$150 million range starting the March quarter.

The good news is that new CEO Davie Klein appears ready to make the tough decisions to wipe out the wasted spending causing Canopy Growth to burn C$38 million in adjusted EBITDA in the last quarter alone on business development costs. The company has a lot of low hanging fruit to eliminate in order to bring the cash burn down to more acceptable levels.

Consensus Verdict

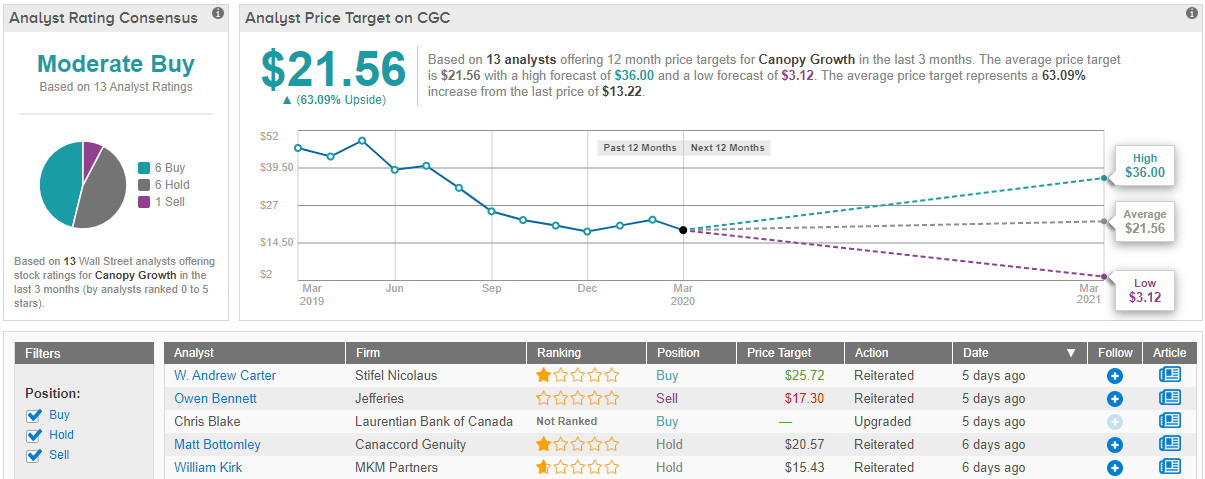

Cautious optimism circles this cannabis player, as TipRanks analytics exhibit CGC as a Buy. Out of 13 analysts polled by TipRanks in the last 3 months, 6 are bullish on Canopy Growth stock, 6 remain sidelined, and one is bearish on the stock. With a return potential of nearly 63%, the stock’s consensus target price stands at $21.56. (See Canopy Growth’s price targets and analyst ratings on TipRanks)

Takeaway

The key investor takeaway is that Canopy Growth is finally making the tough decisions to position the Canadian cannabis LP to survive and thrive in the global cannabis market. When the market panic over the coronavirus subsides, the stock actually has decent value in the $13 range and a market valuation down to only $4 billion. With their market leading position in the cannabis market and a CEO willing to make the tough decisions, Canopy Growth is finally investable.

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy.