While the market has loved the global growth appetite of the large Canadian cannabis LPs, the biggest fear is that protectionist governments around the globe will eventually favor local companies. Canopy Growth (CGC) acquired Spanish licensed cannabis producer that in theory appears logical until you question why the owners cashed out on such a golden opportunity. Regardless, the stock is up strongly on the news of the day that also includes a reinforced revenue target from the CEO.

Spanish Acquisition

Canopy lists cannabis operations in over a dozen countries on 5 continents so an acquisition in Spain fits with the corporate plans for global expansion. The company bought Cáñamo y Fibras Naturales, S.L. (Cafina) in an all-cash deal.

Cafina is one of three companies authorized to cultivate, distribute and export cannabis containing more than 0.2% THC for medicinal and research purposes. The company only has a minimal 1,600 sq. ft. greenhouse that is smaller than most houses in the U.S. The facility far trails their 430,000 sq. ft production site in Denmark and the total facility footprint of Canopy that has reached 4.3 million sq. ft. of production space.

Canopy plans to inject capital in the Spanish operation that just received their license in November 2018 to scale operations through calendar 2019. The opportunity in Europe appears large and undeniable. A large swath of countries have already approved some form of medical marijuana with recreational-use approval likely the next moves as countries like Italy, Netherlands, Portugal and Spain area nearly there already.

Cashing Out

The Spanish opportunity with an ideal growing climate for cannabis sounds too good for the owners of Cafina to cash out here. Why not find investors to become the Canopy of Spain with what would appear a valued license?

Even taking shares in Canopy with the backing of Constellation Brands (STZ) might seem logical. Spain could easily be the launching point of domination of the European continent.

In such a case, Canopy would surely garner a market valuation in excess of the current $15 billion market cap making shares at this price point a value. Unfortunately, the deal value wasn’t provided so maybe the amount offered was too good to pass up for a company without anything much more than a license.

Takeaway

The key investor takeaway is that investors need to be skeptical of these deals where the insiders from the foreign companies are so willing to cash out of such a great opportunity. Maybe our skepticism is too high, but every transaction has a buyer and seller along with other potential bidders. One should wonder why Canopy was able to get such a great deal on such a large opportunity. The devil is in the details and investors don’t have any of the details to make such a decision.

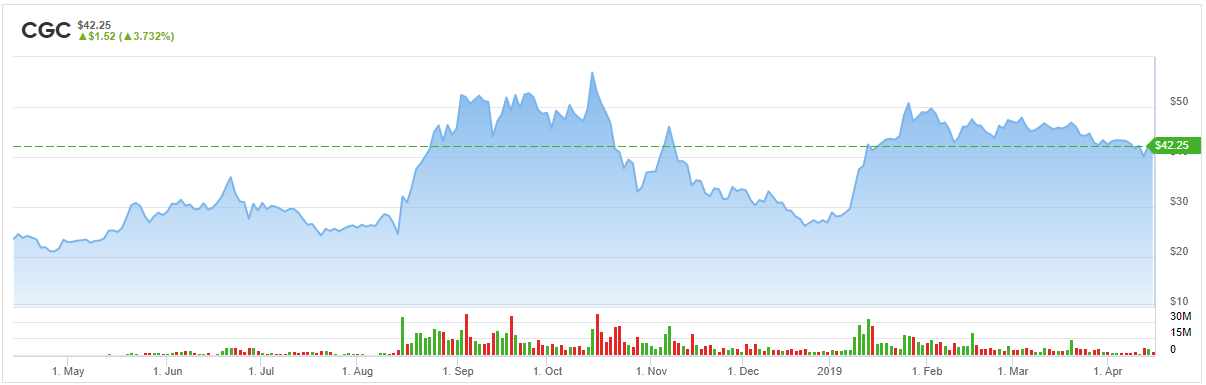

At an investor conference, CEO Bruce Linton disclosed that Canopy is still on track for next 12 months revenues of C$1 billion ($750 million), sending shares rising nearly 3% as of this writing. The stock trades at nearly 20x these internal forward revenues.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: The author has no position in Canopy Growth stock.

Read more on CGC: