Without much fanfare, Canopy Growth (CGC) finally launched cannabis infused beverages to the Canadian recreational market. New CEO David Klein is making the right moves for the company by launching beverages for the Tweed brand last week without any major press coverage. The Covid-19 impact to the cannabis sector is highly unknown, but the stock is quickly losing the downside risk here at $10.

Cannabis Beverages

Canopy Growth started sending the Tweed Houndstooth & Soda drink to provincial boards and retailers back late last week. The products left their regional distribution center on March 11. So far, the company is only shipping a soda containing 2mg of THC and <1mg of CBD.

The move is definitely just a small positive with Canopy Growth promising dozens of drinks available back when the Cannabis 2.0 market was legalized in December. The new CEO had to squelch the plans for massive distribution after taking over the business in January and figuring out that THC-infused beverages weren’t scaling correctly at high production levels.

Canopy Growth didn’t release any details on when other beverages will be ready, but investors should have more confidence of those hitting shelves in the coming weeks and months. According to Deloitte, the cannabis-infused beverage business in Canada will amount to $529 million in sales. In addition, once rolled out to Canada, Canopy Growth can eventually look at global distribution with the help of Constellation Brands.

Down To $10

With fear only ramping up due to the coronavirus, Canopy Growth stock has been hit hard, and is now only worth a market cap of $3.5 billion while the company still has a cash balance of $1.6 billion.

The global cannabis leader still has plenty of issues with burning cash on a quarterly basis, but it has started taking drastic steps to reduce costs including the recent closing of several cultivation facilities to reduce cannabis output. The market will find the stock far more appealing as the new CEO reduces those quarterly EBITDA losses in the C$90 million range to something lower than C$50 million.

In the last quarter, Canopy Growth cut millions from quarterly operating expenses, but the company still spent C$150 million in operating expenses during the quarter. Investors have to hope the company is able to strip C$10 million from those expense levels on a quarterly basis without impacting production such as the expected ramp up in beverages. As mentioned before, Canopy Growth spent C$38 million in adjusted EBITDA in the last quarter alone on business development costs that should be quickly stripped out when a segment can’t turn into one generating sales in the near term.

Wall Street Verdict

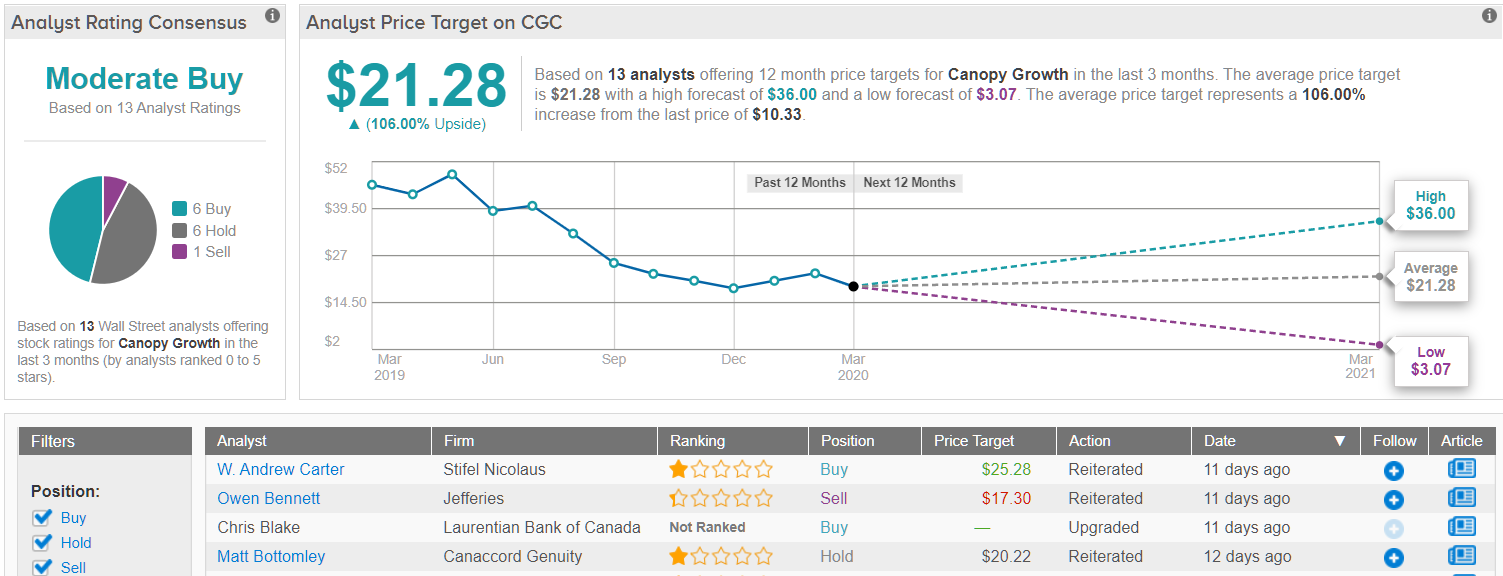

Ultimately, Wall Street is just not sure yet about the cannabis giant, but the optimists still win out in the bigger picture. Out of 13 analysts polled in the past 3 months, 6 rate CGC a “buy,” 6 issue a “hold,” and only one says “sell.” The 12-month average price target notably stands at $21.28, marking a healthy return potential of 106% for new investors. (See Canopy Growth stock analysis on TipRanks)

Takeaway

The key investor takeaway is that Canopy Growth is finally making the moves to position the Canadian cannabis LP to survive and thrive in the global cannabis market. When the market panic is over as the coronavirus panic subsides in a few weeks, the stock actually has decent value in the $10 range and a market valuation down to only $3.5 billion. The global cannabis opportunity of up to $200 billion hasn’t changed making the cannabis stocks that will survive very appealing here.

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.