The cannabis boom in Canada has created an amazing opportunity for so many unique businesses that have came into existence in just a few short years, weather you are a new investor in the cannabis space or a seasoned expert, its safe to say that there are plenty of options to choose from. In my opinion one of the most profitable niches that will continue to benefit from the adaptation of cannabis over pharmaceutical treatments is going to be the medical cannabis market, and that’s where a very unique company comes to mind.

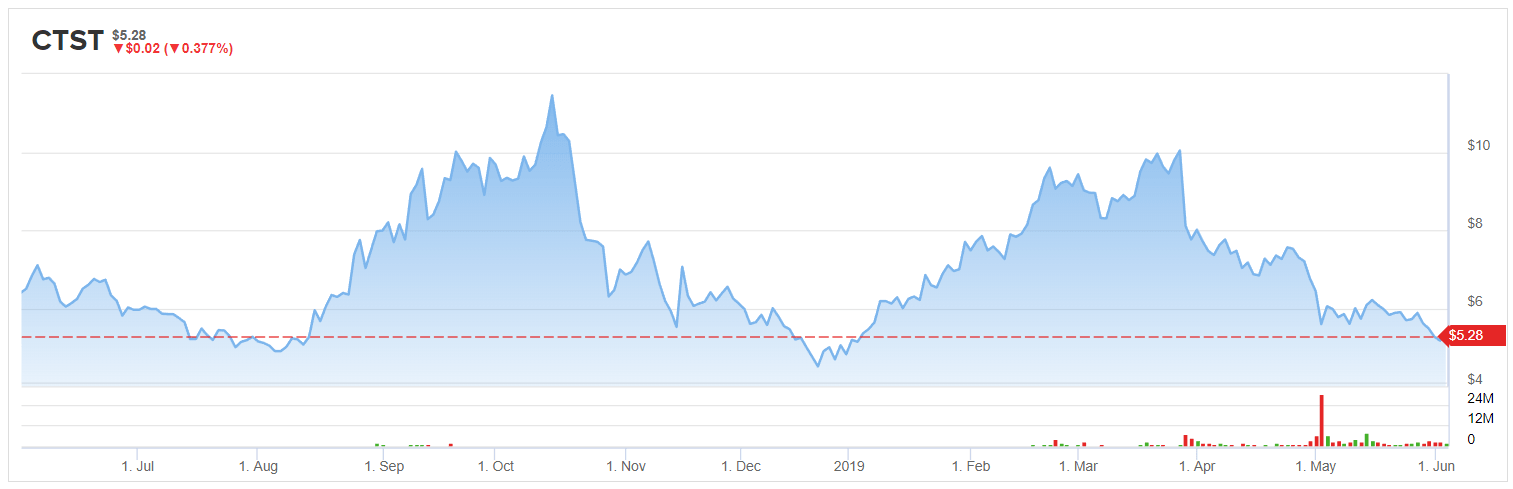

The company is called Canntrust (CTST), and it might not receive as much attention as some of the largest cap companies in the cannabis sector like Aurora Cannabis or Canopy Growth but this is one company that you probably shouldn’t overlook. With a current market cap of just 1 Billion Canadian dollars, currently trading at just over C$7 after its recent pullback from almost C$14 Canntrust looks to be sitting at a very attractive valuation.

Canntrust sits in one of my favorite niches, the medical cannabis market. The company was founded by pharmacists in 2013 and was the 19th company to receive their medical cannabis license issued by Health Canada. As of May, the company currently has over 70,000 active patients, 2500+ physicians on board and holds the record for the #1 market share when it comes to cannabis oil products. For many of the viewers that tune into our channel you will know that I strongly believe that higher margin products and extracts are going to drive profitability in the future as companies strive to develop new technology that allows for cleaner applications when it comes to cannabis as opposed to burning dried flower. Not only will companies be able to generate more profit from the crop they produce but will also be able to offer patients numerous options when it comes to choosing a product they wish to consume.

Canntrust currently has a number of operations underway when it comes to producing and cultivating cannabis, namely their phase 2 450,000 square feet perpetual harvest greenhouse in Niagara that will yield 50,000 kgs of cannabis in 2019. Phase 3 of the Niagara facility will add approximately 390,000 square feet and produce 100,000 kgs of cannabis by 2020. They also have a manufacturing center of excellence in Vaughn ontario which produces 10,000+ finished goods each day. On top of the facilities in Ontario, Canntrust has also acquired 81 acres in British Columbia on the West Coast of Canada which was part of their previous plan to acquire over 200 acres in order to grow cannabis outdoors. The outdoor growing facility is set to yield between 100,000 and 200,000 kgs in capacity by the end of 2020.

In my opinion, this company has very attractive assets, ambitious production capacity with plans to expand, and more importantly a strong sales channel in a very profitable niche. That coupled with the recent pullback in their share price and only a 1 Billion dollar valuation compared to other companies of similar size, makes Canntrust one stock to put on your watchlist.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: No position