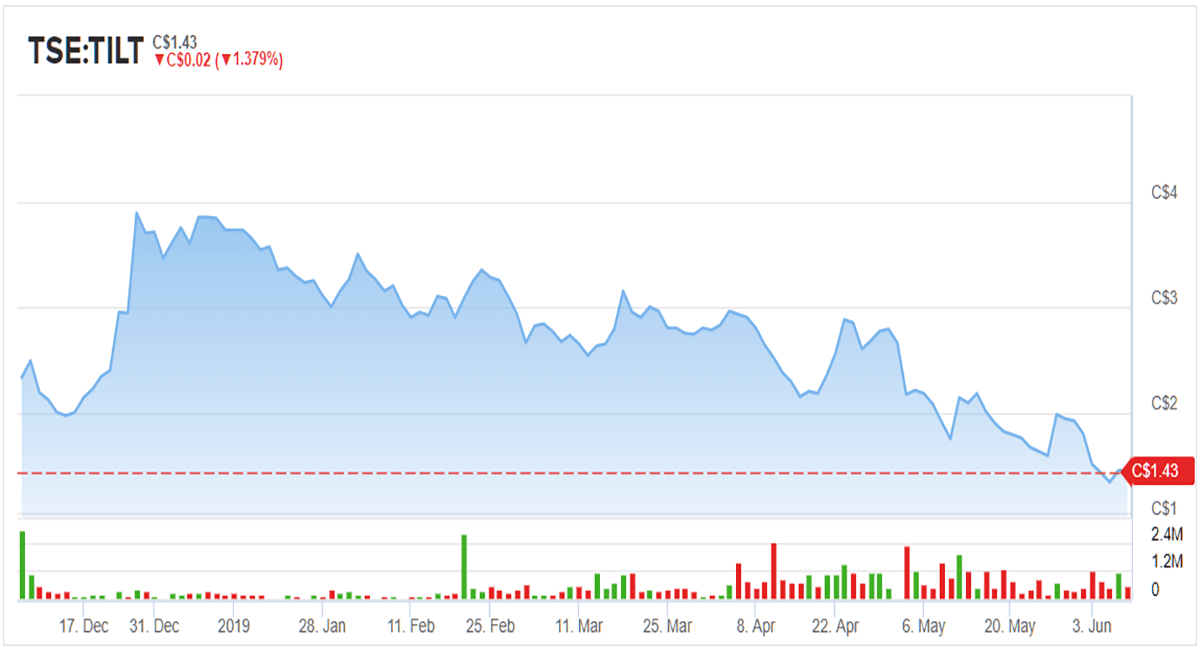

Due in part to the weak stock market, Tilt Holdings (SVVTF) trades at the lows near $1. The Q1 report didn’t help clear up any questions regarding running a far-flung cannabis business and the interim CEO responding to investor questions suggests too much focus on the stock market and not enough on the operations. The stock likely needs a quarter where the EBITDA losses are cut to spark investor interest.

Mixed Q1

For Q1, Tilt reported pro-forma revenues jumped to $39.6 million. The company was formed via a merger of four unrelated companies focused on the U.S. cannabis sector further rolled into three additional acquisitions to create a hedge podge of businesses.

A prime area of focus will be the bottom line with Tilt. The company has to prove the ability to integrate and manage a variety of businesses that range from cultivation and production to consumer devices to software and services.

For the quarter, Tilt reported an adjusted EBITDA loss of $8.0 million. The pro-forma number dipped to $7.3 million, up from $5.5 million in the prior quarter. The pro froma adjusted EBITDA loss was a rather large 18.4% of quarterly revenues.

As with a lot of these new and smaller cannabis stocks, the quarterly earnings release was very sparse. The company doesn’t even list the crucial diluted share count in the press release so that investors can tie this amount to the pro-forma numbers provided. The listed market valuation is about $325 million.

Questions Remain

Clearly the market is highly skeptical of the deals made to form Tilt Holdings. So much so that the interim CEO took the time to officially respond to shareholder questions.

The biggest question is likely the financial position with only a $12.1 million cash balance position at the end of March. The quarterly adjusted EBITDA loss would eat up that cash in no time.

The company lists a new $20.0 million credit facility that will help fund future growth and oddly mentions the potential to use this cash for M&A activity despite having more pressing needs. Tilt is opening retail stores in Massachusetts and expanding cultivation facilities in Pennsylvania to highlight the highly diverse nature of a business already offering vaporized products, cannabis delivery in Los Angeles and a CRM system for the cannabis sector.

The company forecasts that 2019 revenues will grow in roughly the same manner as Q1 or the equivalent of ~169%. Such a growth rate this year places revenues at ~$263 million in comparison to the pro forma revenues of $98 million reported last year.

Takeaway

The key investor takeaway is that Tilt Holdings needs a more concise story to tell investors for the stock to rally. The company needs to better explain how a cannabis B2B provider needs retail locations and cultivation facilities.

The company tries to sell the business as the industry’s leading end-to-end provider of products and services in support of the North American cannabis industry, but the stock market isn’t buying it. Tilt needs a permanent CEO and to spin out some businesses to improve the focus and the balance sheet. The market might just gravitate towards a B2B company in the cannabis sector without the cultivation and production facilities.

For now, the stock is only interesting from the sidelines.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: No position.