KushCo Holdings (KSHB) has been growing revenue at a rapid pace, but on the operational side of its business it has faltered in several areas, giving many investors pause as to whether to take a position in the cannabis packaging and branded packaging company.

The company is an attractive picks-and-shovel play because it helps marijuana firms comply with the stringent regulations on the packaging side of the business.

With the strong demand KushCo’s revenue soared to $52 million for all of fiscal 2018, an increase of 177 percent. In the latest quarter it generated sales of $25 million, up 186 percent year-over-year. For all of fiscal 2019, management has guided for sales to double again.

It would be expected that KushCo would be considered a terrific growth story, and one that should continue on for years as the cannabis industry should continue to grow for many years. But that’s not the case.

Where it fumbled the ball

There are three major areas KushCo has failed to deliver on, two of which resulted in it taking a significant hit to its reputation. The two are the accounting debacle that resulted in it having to restate its financials for 2017 and 2018, and its failure to properly prepare for the very visible increase in demand coming from the legalization of recreational pot in Canada, and the trend toward individual states in America to legalize recreational pot as well.

The last negative catalyst was its inability to stop the decline in its margin, part of which wasn’t its fault, and part of which it was.

Concerning the accounting debacle, that was definitely the fault of the company, as it failed to hire a CFO for that sole purpose, instead opting to have it be combined with the office of the COO. This became an issue when the company made acquisitions that weren’t properly handled in order to be in compliance with Sarbanes-Oxley. That appears to have been taken care of, but to allow that to happen in the first place doesn’t place a positive light on the Board or the management team.

While it was a blow to its reputation, it was also something that has to be solved in order to make the company’s financials compliant with Sarbanes-Oxley in order to have its shares listed on a major market in the future. This has likely delayed the process.

Lack of preparation for growing demand

Another major issue with the company was it not being prepared for the obvious surge in North American cannabis demand. This was part of the problem in Canada, where shortage of packaging was blamed on KushCo. It wasn’t the only reason for the embarrassment to the Canadian government, which deserves a portion of the blame as well, but it in fact did play a part in the shortage.

Not being ready for the demand onslaught resulted in supply shortages. But it also forced the company to employ more costly means of delivery in order to get the packaging to dispensaries quicker, once it was manufactured. That resulted in further downward pressure on already low margins.

With plenty of time to prepare for the obvious coming demand, this is probably the thing that concerns and disappoints me the most. It’s baffling as to how the company wouldn’t have contingencies in place in case of demand exceeding expectations, including enough inventory to support that demand.

When combined with the disaster surrounding the accounting failure, it does make the management look like its over its head.

Margin challenges

There are a couple of things related to margins that provide an answer as to why they haven’t been able to improve in that area for some time. The one thing out of the company’s control are the tariffs; particularly those that have an impact on the vapes it imports from China. It has applied for relief for some of the tariffs, and believes it has a chance of getting some of them taken off.

Management also said it’s going to pass on at least some of the tariff costs onto its customers. With demand so high at this time, I don’t think that will have an adverse impact on its results.

The other major part of its low margin was self-inflicted, again, related to having to use more expensive means of delivery in order to meet supply demands. The combination of tariffs and expensive delivery costs may be behind the company, and that means it could reach the approximate 20 percent margin management guides for. Interestingly, that’s still less than the 34.8 percent it enjoyed just a year ago.

Another expense associated with being unprepared for demand was the need to invest in new facilities to meet demand. These three things resulted in gross profit margin plummeting to 12.8 percent in the quarter, against the 34.8 percent mentioned above.

The question going forward is how much of its margin it’ll be able to recoup by passing on tariff costs onto customers, lower delivery costs, and presumably much of its investment in additional facilities being largely completed. With growth in the sector having no end in sight at this time, I think the company will still have to invest in additional facilities so it won’t repeat what happened this time around.

My biggest concern is even if it is able to boost margins to 20 percent, is what happened to the other 14 percent it generated last year. It appears this may be something associated with its business model in relationship to growth. It also looks like scale, which could help the company increase margins above the 20 percent guidance, is probably not enough to return it to past margin performance.

Conclusion

Kushco may look dismal after what I mentioned above, but the reality is it does have some good things going for it, including the long-term revenue growth prospects from the burgeoning cannabis industry.

It also has a diverse customer base where it doesn’t rely on any one company for over 10 percent of its sales. It serves over 5,000 marijuana companies, providing it with reduced risk when there is some customer churn.

Since it has more than 5,000 customers, it points to the fact its product is in compliance with standards in different markets, and is a source of choice for many companies.

Of course it must execute on the supply side to meet demand, or it could find itself losing customers in droves if they can’t packaging and packaged branding that allows them to generate sales. Hopefully the company is dealing with that issue in a permanent way.

On the revenue side, I don’t see it slowing down in the near future, as it estimates sales should jump to as high as $243 million by the end of 2020. If it’s able to sustainably improve margin, it could result in the company becoming profitable by the end of the year, as management has stated is highly probable.

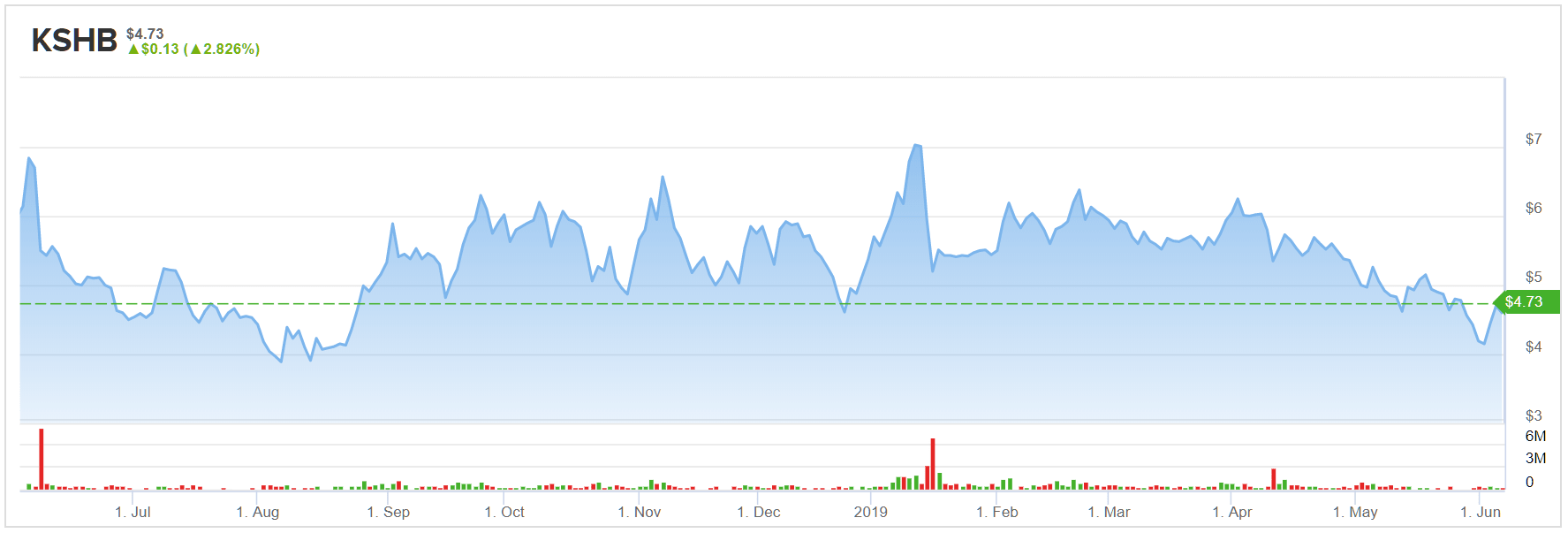

The company is cheap, but there’s a reason for that. But if it is able to surprise in any way in the quarters ahead, it could get a significant boost in its share price, and if it executes in a way that convinces investors its performance is sustainable, it could move up quickly in value.

Last, management can not afford to make any of the operational mistakes it already has. If it does in any way, the company will struggle to recover in my view. That would almost certainly mean a change in management and the company taking a lot longer to reward shareholders.

As the company stands, it may be good for an occasional trade, but taking a position and holding is very risky. KushCo must prove it can execute and deliver on its promises before the market will jump back in.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.