Similar to most other cannabis stocks, HEXO (HEXO) trades at multi-year lows. The Canadian cannabis company hasn’t been a favorite in the sector for a while now due to struggling revenues in part due to its focus on Quebec, but the company made the wise decision to move into the value brand before the market. Due to weak analyst expectations, HEXO might be one cannabis company to beat estimates this quarter.

Value Brand Shift

Back in 2019, HEXO made the bold move to establish a value brand selling bulk dried cannabis at low prices to match the illegal market. The company launched Original Stash in October and rolled out the value brand to Ontario via the Ontario Cannabis Store on Black Friday. The product retails for 28 grams (1 oz) at C$140 (C$5 per gram), including taxes.

HEXO originally provided positive indication of the value brand having market success, but the key indicator the company was onto the right market direction was the news from Aurora Cannabis (ACB). As the Canadian cannabis leader announced a major restructuring plan, it signaled plans to launch a value brand called The Daily Special.

After the Original Stash had been on the market for months, Aurora Cannabis brought credibility to the big market shift towards value cannabis where the price point is below C$9 per gram.

Noteworthy, HEXO took the drastic decision early to go way below the value price cutoff. Health Canada released the average cannabis price of the illegal market was C$5.73 per gram in December pitting HEXO below the cost of the illegal market.

Consensus Estimates

Analysts are forecasting HEXO to reach FQ2 revenues of $12.6 million or C$16.9 million after the company only reported FQ1 revenues of C$14.5 million. The opportunity here is for HEXO to actually surprise on the upside considering the market shift so drastically to the value sector during the last quarter and the company’s quarterly results will include two months of Cannabis 2.0 products.

Aurora Cannabis has acted so quickly to launch a value brand for this reason. Investors will key into the margins from HEXO selling product at these lower price points. The general Canadian sector has struggled with generating solid margins, even when revenues are up because so much product is being dumped below expected prices.

The company had an EBITDA loss of C$24.6 million in the last quarter. The number was a big improvement of the prior quarter.

A lot of the value in the stock is tied to the partnership with Molson Coors, where sales won’t be reflected in the income statement. Any positive from the value brand sales would give the management team some credibility and place less pressure on the cannabis-infused beverage play.

Analysts Verdict

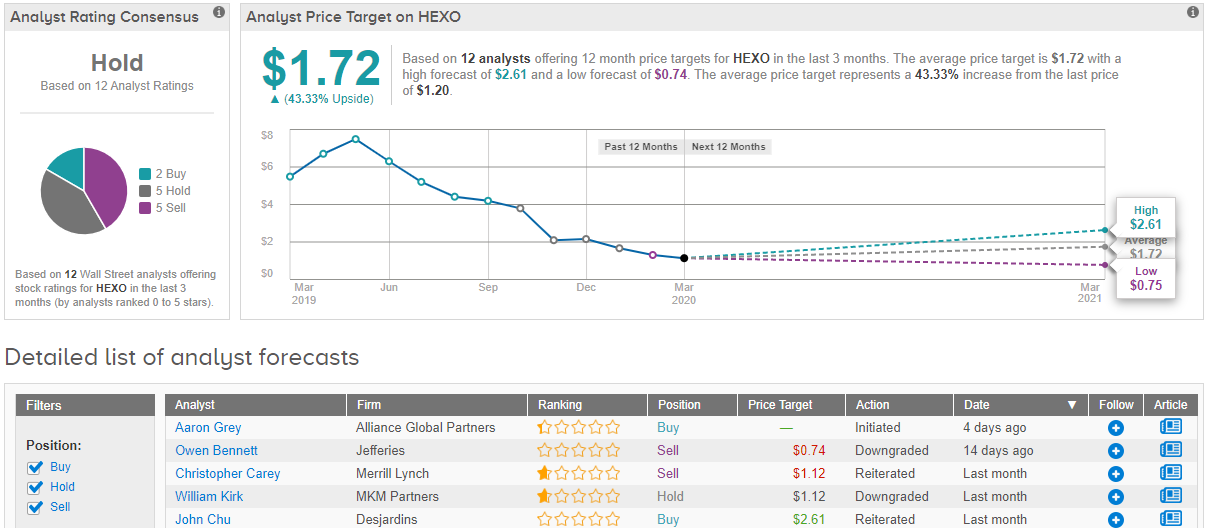

According to TipRanks, an investing platform that tracks and measures the performance of financial experts, the consensus on Wall Street is that HEXO stock is a “hold” for investors. But TipRanks might as well have said “buy” — because analysts, on average, think the stock, currently at $1.20, could zoom ahead to $1.72 within a year, delivering 43% profits to new investors. (See Inovio stock analysis on TipRanks)

Takeaway

The key investor takeaway is that HEXO is well positioned to benefit from a Canadian cannabis market where the leaders were too focused on premium products. The launch of a value brand last year sets the company up for beating analyst consensus estimates and finally improving the financial prospects of the beaten down stock.

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.