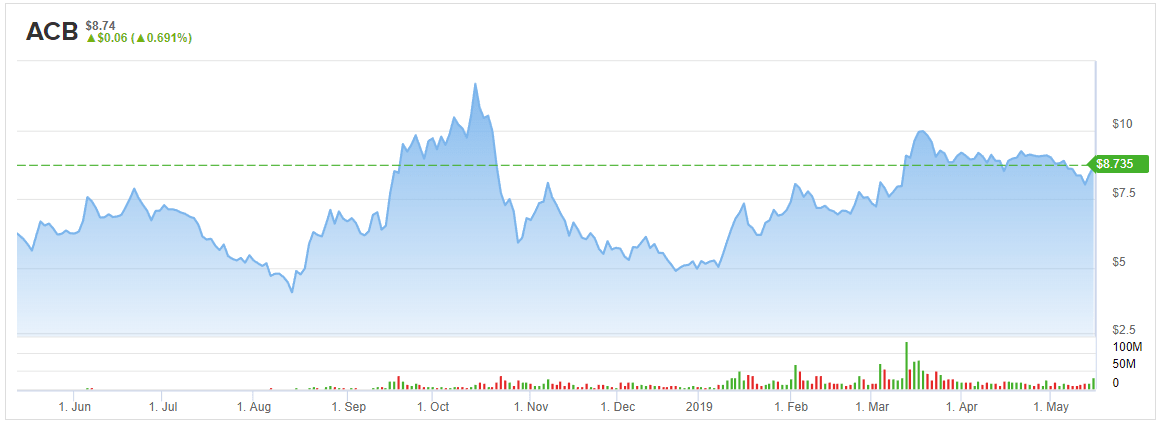

In not a huge surprise, Aurora Cannabis (ACB) reported FQ3 numbers for the March quarter that missed analyst estimates. Also not a big surprise, the stock is flat to up on the miss. The numbers provide a crucial insight into the troubling sales of legalized cannabis in the Canadian adult-use market, but the company still has a huge market opportunity to spin the stock market back towards a positive long-term view.

Looking Past Disappointing Quarter

For the quarter, Aurora reported revenues of C$65.1 million compared to estimates up at C$67.5 million. Typically, such a revenue miss would crush a company with a $9 billion market cap that is only delivering about $50 million in quarterly revenues, but a lot of the global market opportunity isn’t open yet including consumables in Canada.

The market is quickly looking past the quarter despite the company reporting a large EBITDA loss of C$36.6 million. The big issue with the Canadian companies is the push for wide global expansion that has a company like Aurora spending wild on future sales that aren’t guaranteed. For this reason, SG&A expenses were C$67.1 million in the quarter; though relatively flat from the prior quarter.

A couple of key figures for the quarter are the gross margin and the average net selling price. In FQ3, Aurora saw the gross margin rise slightly to 55% and the selling price per gram dipped 6% sequentially to C$6.40 per gram. The weakness here is problematic with a ton of additional supply hitting the market over the next year.

Supply Questions

The question Aurora hasn’t really answered for investors is what happens with the additional supply hitting the market this quarter and in the future. The large cannabis company has long projected reaching an annual production rate of 150,000 kg by the end of March and still maintains 25,000 kgs on the market in the June quarter.

The large cannabis company harvested 15,590 kgs in the March quarter, up from 7,822 kgs in the December quarter. The FQ3 kgs sold was 9,160, up from 6,999 kgs in the previous quarter.

Both numbers were substantially above prior year levels, but the key is what happens when the current quarter inventory supplies are 150% more than the amount sold in the March quarter. The average net selling price per gram dipped 20% from last FQ3 to C$6.40 per gram.

The company is still promoting the concept of Aurora being EBITDA positive in the June quarter. The stock price would’ve taken a hit, if management walked back from this target, but closing the gap on a C$36.6 million EBITDA loss is an incredible amount and requires strong pricing in the cannabis sector.

Aurora didn’t really quantify the need for raising their total projected capacity from 500K kg to 625K kg back in early April. The company is still harping on the potential upside that comes from Ontario opening up additional retail stores and the consumables market opening up in October. The company plans to set aside some of the inventory to build supplies for the vapes and edibles products when the market opens up new revenue streams later this year.

Takeaway

The key investor takeaway is that Aurora remains in a precarious position where the company will have a difficult time maintaining previous lofty projections despite the suggestions otherwise with the FQ3 results. With about 1.1 billion shares outstanding and an additional at-the-market offering open for C$400 million worth of shares, the stock has a market value of ~$9 billion with additional dilution on the way.

The risk to the downside wasn’t eliminated with this report. If management ever confirms some of the worst fears regarding pricing, mounting losses and wild capacity expansion, the stock will get crushed. For now, Aurora is getting a pass for missing estimates, but this positive outcome won’t always occur.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: The author has no positions in ACB stock.

Read more on ACB: