The reorganization has apparently started at Aurora Cannabis (ACB) without any formal announcement by the Canadian cannabis LP. The latest news is a surprise listing of a future cultivation facility for sale. The move appears wise considering cash constraints, but it also leaves the company as a sudden laggard in the sector with an unclear path forward.

Exeter Greenhouse

Earlier this week, the market caught wind that Aurora Cannabis had listed their Exeter, Ontario facility for sale. The 22-acre greenhouse on 70 acres is listed for sale at C$17 million. The property has another 95 acres of additional land for sale at C$2 million for potential total proceeds of C$19 million.

The facility was inherited in the acquisition of Medreleaf in 2018. Reportedly, Medreleaf paid C$26 million for the facility justy back in 2018 before the buyout by Aurora Cannabis.

The implications for Aurora Cannabis are that the Exeter facility was listed with a potential of 105,000 kg of future cultivation capacity. When combined with halted construction of the Aurora Sky 2 in Edmonton and the Aurora Nordic 2 in Denmark, the company has taken three of the four facilities with expected annual production in excess of 100,000 kg off the market.

The company once forecasted industry leading capacity of 625,000 kg by mid-2020 and will now have production capacity somewhere below 200,000 kg. The Aurora Sky 2 and Aurora Nordic 2 facilities are in still inline for completion in the future once global cannabis demand improves and the company has the funds.

Mixed News

The departure of the CCO Cam Battley and the decision to sell the Exeter facility are the initial steps in a needed large reorganization. The Canadian cannabis sector needs a major reset and other companies have already made similar moves.

The problem facing Aurora Cannabis is that a C$19 million cash infusion (if the company can even sell the facility and adjacent land) doesn’t drastically alter the cash needs.

The bigger issue is the market realization that the company will no longer be the industry cultivation leader. Both Aphria (APHA) and Canopy Growth (CGC) have plans to exceed 250,000 kg in annual cultivation capacity. A big industry key is how Canopy Growth choses to reset corporate goals with the new CEO. A real possibility is the industry giant using a large cash balance to press for market share.

As mentioned in prior articles, investors should brace for a large write-off considering the ~C$4 billion balance assigned to the Goodwill and Intangible categories on the balance sheet. In addition, investors should hope for a reduction in operating expenses in order to set the company up to turn EBITDA positive off a lower reset of expectations for the sector due to the ongoing lack of Ontario stores and weak start to Cannabis 2.0.

Consensus Verdict

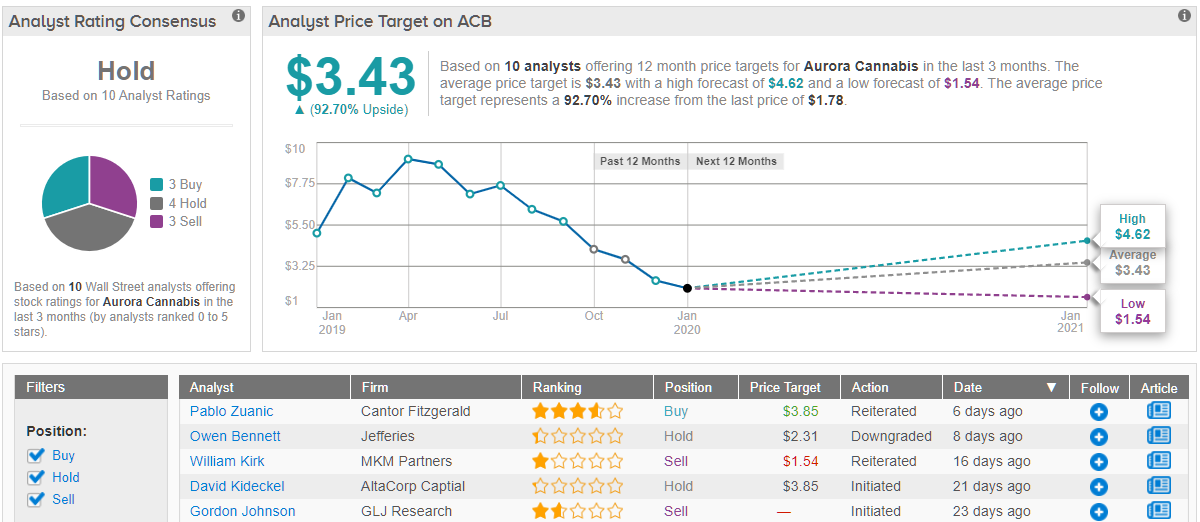

According to TipRanks, the consensus on Wall Street is that Aurora stock is a “hold” for investors. But TipRanks might as well have said “buy” — because analysts, on average, think the stock, currently at $1.78, could zoom ahead to $3.43 within a year, delivering 93% profits to new investors. (See Aurora stock analysis on TipRanks)

Takeaway

The key investor takeaway is that Aurora Cannabis has a lot of positive catalysts to play out in 2020, but the company needs to reorganize the firm to reduce operating expenses following delayed catalyst in 2020. Once the company gets the business better aligned with market realities, investors can own the stock knowing the catalysts will benefit shareholders going forward.

To find good ideas for cannabis stocks trading at fair value or better, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.