Near the end of November 2019 Aurora Cannabis (ACB) found it would no longer be able to sell medical cannabis to the German market until the company obtains a permit to sell cannabis that has undergone ionizing irradiation.

In this article we’ll look at the impact the temporary loss of sales in Germany will have on the company.

Irradiation

Many investors have thought that having facilities approved of for the stringent guidelines associated with European Union Good Manufacturing Practice (GMP) were enough to sell into Germany.

But the recent discovery that Aurora Cannabis wouldn’t be allowed to sell medical cannabis in Germany until it achieves a specified level of microbiological quality related to the flower.

That must either be accomplished by extremely clean facilities that meet the German requirements, or have the flower irradiated, which is a process that decontaminates the flower.

If a company must irradiate to conform to required microbial levels, it also has to apply for a permit that allows irradiated cannabis to be sold in the German market.

Any importer into the German market will have to apply to the Federal Institute for Drugs and Medical Devices (BfArM) for every flower variety that will be distributed in Germany.

As of this writing, the cost per application was just under US$4,951.

Aurora management believes it will take about a month or so to get approval to sell irradiated cannabis in Germany.

According to CCO Cam Battley, the company “realized” it needed a permit, suggesting it simply forgot about it or didn’t perform due diligence concerning the requirements.

Implications

Combined with other challenges related to revenue growth in the short term, including the lack of cannabis retail outlets in Ontario and the time it will take to ramp up derivative sales, the loss of sales in the German market is going to make a challenging fourth calendar quarter even more challenging for the company.

How much it will impact its performance will depend upon how much demand for derivatives will drive the last couple of weeks of December sales. If it has more than adequate supply to meet pent-up demand, it could to some degree, offset the decline in German sales in December.

Battley expects sales in Germany to resume in early 2020.

With expectations already low for the current quarter, I don’t think this is going to be a big deal for Aurora unless its sales decline even further because of the slow pace of retail stores opening, and derivatives have no immediate impact on revenue in December.

The bigger issue is how this will impact long-term German sales because of Pharmacies possibly being reluctant to use Aurora because of being perceived as an unreliable and consistent source.

In the past I’ve mentioned this was one of the strengths of Aurora, and if it falters there, it international potential would be diminished for a couple of quarters, until it wins back the trust of the Pharmacists.

That may not happen. But because Aurora is not allowed to sell in Germany, medical cannabis patients will have to get their product from another source. Whether or not they return to Aurora is a significant issue over the long term.

Analyst Commentary

The market has divided itself into two camps. The bulls argue that the worst is behind Aurora, while the bears argue that the market is too optimistic about Aurora’s recovery, which could take a long, long time. Piper Jaffray analyst Michael Lavery has found himself in the middle. The analyst rates the stock a Neutral alongside a $3.00 price target, which implies about 15% upside from current levels. (To watch Lavery’s track record, click here)

In a research note issued yesterday, Lavery wrote, “It may take time to recover lost German sales. The temporary sales halt could have a lasting impact in the German medical cannabis market. According to our contact in the EU, doctors tend to prescribe products that have strong track records of availability. Aurora’s current patients will have to be prescribed a competitor’s product while Aurora pauses sales, and it could be challenging to switch them back again. Additionally, it could take longer than expected for Aurora to begin selling products in Germany again as it typically takes months for German regulatory approval of products, and German regulators are used to reviewing applications for gamma radiation (not e-beam sterilization). Aurora is confident that sales can continue early in the new year, but there is some uncertainty in the process timeline.”

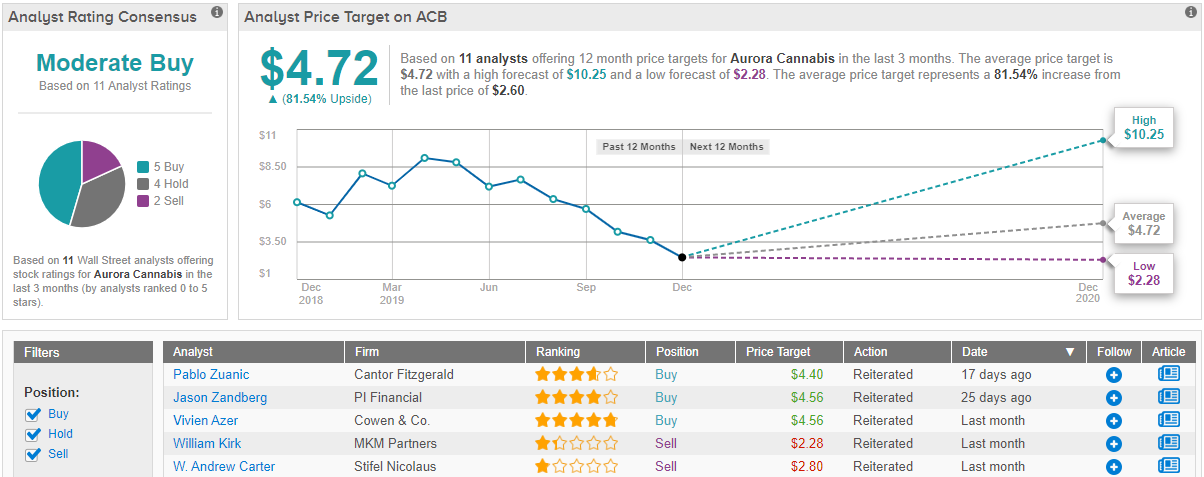

If we turn to the Street in general, we can see that sell-side analysts are fairly divided in their expectations on Aurora stock. Out of 11 analysts tracked by TipRanks in the last 3 months, 5 say “buy,” 4 suggest “hold,” and two recommend “sell.” (See Aurora stock analysis on TipRanks)

Conclusion

We won’t know until the next earnings report the level of revenue Aurora has lost because of having to wait to receive its permit. Worse, it won’t be until the following earnings report that we discover whether or not former customers have come back to the company after having to use alternative sources.

One positive here is it appears there is demand from German patients for some derivative products. If so, that could be an attractive and compelling reason to once again choose Aurora as the preferred distribution source.

To me, the major issue here is it once again places uncertainty over the company at a time when it needed to provide a clearer picture of its future short- and long-term outlook.

Now what we have is the ongoing concerns over the pace of retail cannabis stores opening in Ontario, how much impact derivative products will have on Aurora’s revenue, and how long it will take it to recover and grow sales in the important German medical market.

In my view, the next couple of quarters are going to be vital to the company. At this time I think the negative surrounding the lack of retail stores is already priced in, but if there is any disappointment in derivative or German sales over the next two quarters, Aurora is going to have a difficult time maintaining support levels.

Over the long term I remain optimistic over its prospects, but it could go through a prolonged period of growing pains if it doesn’t do well in the first half of calendar 2020.

To find good ideas for cannabis stocks trading at fair value or better, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.