Anybody following the Canadian cannabis sector shouldn’t be surprised by the weak quarterly results from Aurora Cannabis (ACB). The cannabis supply flood killed the company’s FQ1 numbers and pushed it farther away from the original goal of already being EBITDA positive.

Massive Revenue Hit

The market thought these Canadian cannabis companies were on a race to reach C$1 billion in annual revenues, yet Aurora Cannabis actually saw FQ1 revenues decline 24% sequentially. The company could now be years away from reaching those targets.

Aurora Cannabis took a C$23.7 million hit due to extreme weakness in the consumer cannabis market and a failure to repeat the large wholesale sales of the prior quarter. Aurora Cannabis dumping C$18.0 million in additional revenues on the wholesale market for only C$3.61 per gram in the June quarter was one of the warning signs that the market was out of sync.

In total, the large cannabis company generated FQ1 revenues of only C$75.2 million, down from C$98.9 million in the prior quarter. Despite the large revenue dip, Aurora Cannabis was able to generate a 58% gross margin.

The margins were actually flat with the June quarter due to in part to a 25% reduction in costs per gram. Aurora Cannabis only had cash costs of $0.85 per gram in the quarter.

As mentioned previously, the company needed to constrain operating expenses in order to thrive in the difficult market. For the quarter, SG&A expenses jumped 11% to C$81.1 million. The C$8.3 million increase in expenses weren’t mirrored correctly with the revenue decline.

The end result was another step major away from adjusted EBITDA profits. The company dipped to a C$39.7 million loss in the quarter, up from C$11.9 million in the prior quarter when Aurora Cannabis had originally targeted breakeven EBITDA numbers.

Supply Flood

The kilograms produced in FQ1 highlight the major problem in the industry. The Canadian cannabis industry faces major struggles from a competitive black market and a lack of retail stores, yet Aurora Cannabis produced 43% more cannabis sequentially in the quarter.

In fact, the additional production in the quarter of 12,402 kg was nearly equal with the total kg sold in the quarter of 12,463 kg. Due in part to the reduced bulk wholesales sales, Aurora Cannabis sold 5,330 less kg in the quarter. The company only sold 30% of total production in the quarter.

The large cannabis company didn’t fact the same pricing pressure in the quarter probably leading to the sales hit. Aurora Cannabis actually saw consumer cannabis prices rise a slight 3% while the industry as a whole was hit by substantial price pressures.

Analyst Commentary

Aurora Cannabis stock tumbled another 17% today, leaving investors at odds over when it will hit a bottom. Adding insult to injury, Piper Jaffray analyst Michael Lavery cut his 12-month price target for the stock to $3.00 (from $4.00). (To watch Lavery’s track record, click here)

Lavery commented, “The slow rollout of Ontario retail stores may continue hindering growth near-term, and the launch of derivative products in December remains uncharted territory. The consumer is being introduced to several new categories and products at once and companies and provinces may face new supply chain challenges. While we expect next wave products to ultimately drive growth, attract new consumers, and lift margins, we believe industry-wide challenges may be likely, just as challenges arose in the first wave of product launch over the past year. Accordingly, management did not give insight to whether sequential growth would return in F2Q20, though we are modeling sequential gains in F3Q20E and F4Q20E.” (See Aurora Cannabis’ price targets and analyst ratings)

Takeaway

The key investor takeaway is that Aurora Cannabis and Canopy Growth provided a lot of data points for the market to absorb and analyze. The quarterly results were horrible with revenues taking a hit as production levels and expenses soared.

The stock is likely to trade in the $2s due to the weak results, but Aurora Cannabis made some moves in the quarter to break the downtrend that will need more analysis by the market. For now, the stock will appear expensive at a $3.6 billion market cap with 1.2 billion shares outstanding as revenues dip to only $57.2 million.

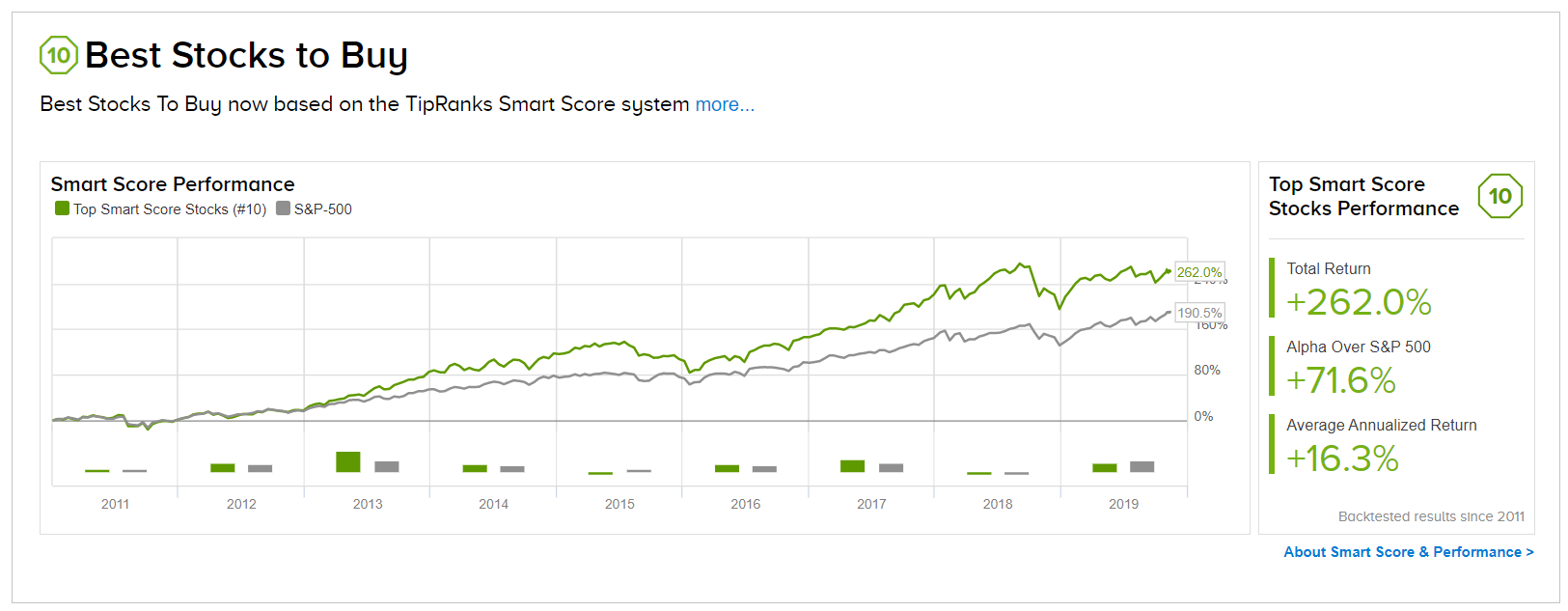

To find better ideas for cannabis stocks trading at fair value or better, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.