With cannabis stocks beaten down in the last few months, the big rally by Aphria (APHA) following the release of FQ1 numbers is a major relief rally. The numbers weren’t exactly spectacular for a cannabis sector expected to generate substantial revenue growth, yet the stock didn’t deserve the 35% decline since the September peak above $7.

Flat To Down Quarter

The quarterly numbers just weren’t that impressive. Aphria reported revenues down 2% from the prior quarter as a change in business strategy in Germany caused a reduction in sales.

In total, FQ1 net sales of C$126.1 million were down from C$128.6 million in the prior quarter. The key adjusted EBITDA figure was C$1.0 million, up from C$0.2 million in the prior quarter. The adjusted EBITDA from the important cannabis operations was actually down about C$0.5 million from C$1.8 million in the prior quarter.

Due to the purchase of the cannabis distribution system in Germany, the company has a confusing set of financials. CC Pharma generates most of the revenues while the Canadian cannabis operations generates all of the positive EBITDA and most of the gross profits.

Reaffirming Guidance

After the debacle at HEXO, the market was relieved to see Aphria maintain full year guidance. The company forecasts net revenues of C$650 million to C$700 million with distribution revenue representing slightly above half of total net revenue. The cannabis company maintained adjusted EBITDA of ~C$88 million to C$95 million.

The key to FY20 guidance is the expectation to drastically expanded cannabis operations revenues. One might question if that actually can occur with how weak Canadian sales have been over the Summer. Aphria needs to boost the cannabis operations sales from C$30 million in FQ1 to end the year closer to C$100 million on a quarterly basis.

In FQ1, Aphria only sold 5,969 kg of cannabis, up about 10% from the prior quarter. The company remains on track to up production to 255,000 kg when all facilities are fully licensed and operational.

The goal is to increase quarterly capacity 10-fold to 63,750 kg. No doubt, this amount of capacity growth will generate revenue growth for the division with about 50% margin already, but the question remains how Canada will absorb all of this additional capacity.

In the quarter, Aphria saw average retail selling prices of both medical and recreational cannabis remain relatively stable. In fact, the company saw recreational prices increase to C$6.02 (before excise taxes) sequentially while just about every other cannabis player in Canada has seen pricing pressure. Major pricing pressure in the December quarter could reduce any benefit of higher production output.

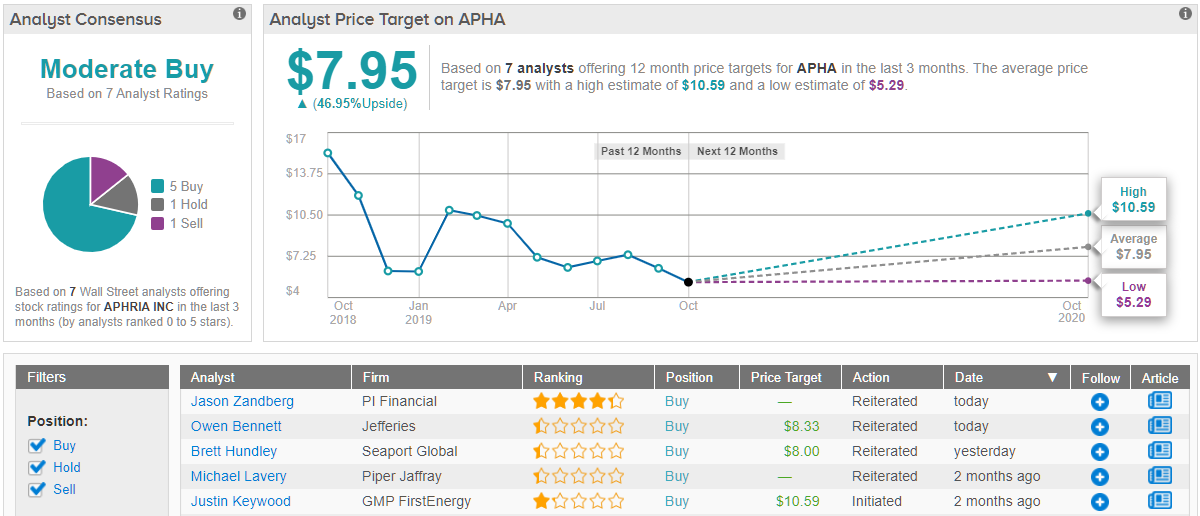

Consensus Verdict

The rest of Wall Street largely buys into what this cannabis player has to offer, as TipRanks analytics reveal APHA as a Buy. Out of 5 analysts polled in the last 3 months, 3 are bullish on Aphria stock while one remains neutral and one is bearish. With a return potential of 47%, the stock’s consensus target price stands at $7.95. (See Aphria stock analysis on TipRanks)

One of these analysts, Jefferies’ Owen Bennett, reiterated a “buy” rating on APHA stock today, along with C$11.00 price target. Bennett noted, “We highlight Aphria as one of our three top picks, with strong execution, profitability, and possible near-term positive newsflow around the US all helping. Today’s update supports our bullishness. On execution, it continues to take market share in Canada and also reiterated its sales and EBITDA outlook. The confirmation of sales should be seen as a big positive given that there have been concerns around wider industry pressures, with a wave of recent street downgrades […] We continue to believe Aphria can be one of a few global leaders long term, yet it remains one of the cheapest names across our coverage and at a significant discount to the likes of Canopy, Tilray, Aurora and Cronos.” (To watch Bennett’s track record, click here)

Takeaway

The key investor takeaway is that Aphria has now proven to the market that the management and operational concerns are in the past. The company continues to produce solid numbers in a competitive cannabis market.

With about 252 million shares outstanding, the stock has a current market cap of ~$1.35 billion. After converting the adjusted EBITDA target to ~$70 million in US dollars, the stock trades at about 20x the forecast. Aphria is reasonably valued after the rally, though the company has a long ways to go in order to prove all of this cannabis production increase can be turned into positive numbers.