Most U.S. cannabis companies are poised to be big winners from the eventual passing of the SAFE Banking Act, including Acreage Holdings (ACRGF). Approval by the U.S. Senate and President Trump remain a major question, so investors need to fully understand the risk in the stock whether federal approval of cannabis ever occurs or not.

SAFE Bank Act

On September 25, the U.S. House approved the SAFE Banking Act by a vote of 321-103. The act shields banks from federal prosecution when conducting business with cannabis companies in states allowing legal cannabis. The act is expected to allow cannabis companies with easier access to capital in addition to basic banking functions.

Next up is the U.S. Senate where the bill is expected to face tougher scrutiny. The Senate has a companion bill with 33 cosponsors, but Senate Majority leader Mitch McConnell is seen as not supporting the passage of any legislation helping the cannabis industry. In addition, President Trump is a major wildcard on approving any cannabis act. With general public approval of legalizing cannabis use, the issue could dictate the 20202 elections and force McConnell and Trump to approve cannabis legislation ahead of the elections.

The act wouldn’t make cannabis federally legal. Rather, it allows the companies easier access to capital and normal banking functions.

Canopy Growth Deal

Where Acreage Holdings becomes a big beneficiary of the deal is the merger agreement with Canopy Growth (CGC). While the SAFE Banking Act isn’t seen as a triggering act that would allow Canopy Growth to complete the acquisition of Acreage, the bill has the potential to allow Canopy Growth to invest in the U.S. multi-state operator (MSO).

The deal is for Acreage shareholders to obtains 0.5818 shares of Canopy Growth for each share owned. With Canopy Growth trading at $25, Acreage would have a conversion value of $14.55 or 70% upside from the current stock price of only $8.50. The company as already verified that the STATES Act would trigger closing of the merger so any approval of a cannabis bill like the SAFE Banking Act likely sets up the merger for an eventual close.

Longer term, shareholders will have to deal with the large losses of Canopy Growth that become even more complicated with the company trying to integrate a large U.S. MSO and navigating the complicated regulatory markets in the U.S. Regardless, an investor wanting access to the global opportunities of Canopy Growth can purchase Acreage for a cheap entry point.

For the last quarter, Acreage generated an adjusted net loss of $17.1 million and a pro forma adjusted EBITDA loss of $12.0 million. Canopy Growth doesn’t need to add money losing businesses. For its part, Canopy Growth had an EBITDA loss of C$92.0 million in the last quarter and the merger doesn’t offer a ton of cost synergies while creating a lot of integration costs.

Consensus Verdict

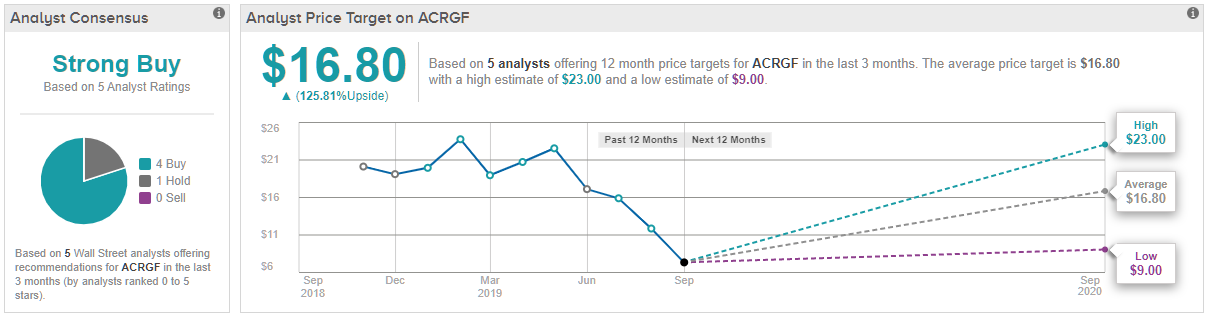

Wall Street is on the same page. This ‘Strong Buy’ received 4 Buy ratings vs. 1 Hold over the last three months. Not to mention its $16.80 average price target suggests 126% upside potential from current levels. (See Acreage’s price targets and analyst ratings on TipRanks)

Takeaway

The key investor takeaway is that Acreage Holdings is one of the cannabis companies inline to see the biggest benefits from the passage of any major cannabis bills by the U.S. government. The SAFE Banking Act won’t likely trigger the close of the Canopy Growth acquisition, but the bill will set the federal government in the motion of eventually approving the STATES Act or another bill that federally approves cannabis. In such a situation, the Acreage stock will soar, but investors won’t want to hold the new Canopy Growth shares long term.

Disclosure: No position.