The biggest negative thesis surrounding Canopy Growth (CGC) stock was the lack of access to the American cannabis market. The 2018 Farm Bill appeared to provide the giant Canadian company with access to the cannabidiol, or CBD, market in the U.S., but the Federal Drug Administration has made the smooth path to CBD sales less certain.

Public Hearing

On Friday, the FDA held a public hearing to discuss the safety of the cannabis product for human use. Commissioner Ned Sharpless made this comment that sent the industry stocks substantially lower on the day:

“When hemp was removed as a controlled substance, this lack of research, and therefore evidence, to support CBD’s broader use in FDA-regulated products, including in foods and dietary supplements, has resulted in unique complexities for its regulation, including many unanswered questions related to its safety.”

The Commissioner appears to question whether CBD will have a quick path to inclusion in food and beverages. CNBC stated that the FDA had about 140 speakers lined up to testify so sifting through the data presented will take some time.

The agency is taking public comments through July 2 and could takes years to craft regulation. The sector remains the wild west with FDA mostly policing companies that attempt to make medical claims regarding CBD products, though the open debate leaves the industry in a volatile period.

Plowing Into The U.S. CBD Market

Canopy Growth used the approval of the 2018 Farm Bill removing hemp from the controlled substance list as a reason to rush into the U.S. market. The company promised spending up to $150 million on investments in creating a hemp industrial park with a primary focus on creating hemp-derived CBD.

The company recently secured a 308,000 sq. ft facility on a 48-acre property in Kirkwood, New York to aggressively move into hemp-derived CBD production by 2020. Canopy Growth has the goal of establishing a hemp-derived CBD extraction and manufacturing industrial park that provides the company with a strong foothold into the U.S.

Other companies impacted include Charlotte’s Web Holdings (CWBHF) and Village Farms International (VFF) that are both plowing forward into expanding the acreage dedicated to growing hemp that will be turned into CBD oil and other products infused with CBD. Both of these companies have business models primarily focused on creating CBD products such as skincare and pet products or even wholesaling CBD oil that might not fall under the FDA regulations, but any uncertainty in the sector is troubling. The value of hemp growth for CBD products will have less value, if the use is restricted to only a few products causing the market to be flooded with CBD.

Takeaway

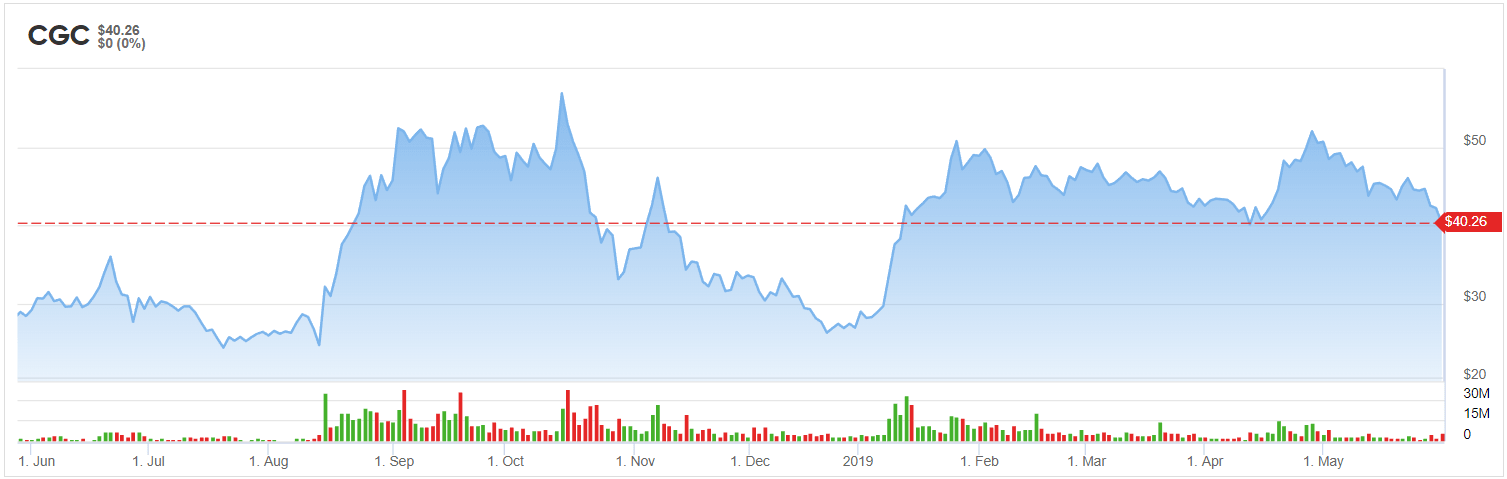

The key investor takeaway is that the market hates uncertainty and any signs that cannabis won’t have federal approval in the U.S. is problematic for stocks like Canopy Growth. The stock was down 5% on Friday as the market now questions whether the cannabis giant will have a business model that works in the U.S.

The Acreage Holdings (ACRGF) rights to purchase deal could see massive doubts, if a government organization chooses to restrict the use of CBD in food and beverages. Federal approval of cannabis might not be as certain as investors previously thought.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: No position.