By Genia Turanova

Money is cheap and, with the Fed apparently re-embarking on an easing course, it will be getting even cheaper. This is a negative for your savings account. On the flip side, though, borrowing is not expensive — personal and corporate alike.

This historically low cost of money (i.e. interest rates) has been a factor in the surge of merger and acquisition (M&A) activity over the past few years. Last year, for instance, the volume of M&A transactions jumped 16% globally from 2017 to $4.1 trillion.

One of the recent standouts here is biopharma. The need to supplement or replace revenue streams from expiring patents, consolidation, rising stock prices (which equals more equity that can be used as a takeover currency) are some of the reasons pharmaceutical and biotech companies, large and small, continue to merge. It’s eat or get eaten out there.

And the subsector of the biopharmaceutical industry that includes the ever-growing number of cannabis-focused companies (a sector including companies that either discover, develop, or manufacture chemically-based therapeutic and preventive medicine and medicinal products) has also had its share of mergers and takeovers.

We’ve witnessed this firsthand with the acquisition of Newstrike Brands Ltd by our portfolio’s HEXO.

Announced in March and closed in May, Newstrike brings to HEXO the licenses necessary to expand faster than would otherwise be the case. But HEXO isn’t the most active company in the business when it comes to the M&A activity. This honor belongs to Aurora Cannabis, a Canada-based company engaged in the production and distribution of medical cannabis.

Over the past three years, the total value of Aurora’s M&A transactions, according to FactSet, amounted to $3.473 billion; six transactions have been reported, with one canceled and five already closed.

These transactions include the May 2018 acquisition of MedReleaf. At $1.8 billion, this was Aurora’s largest deal. The others included the $573 million purchase of the 97% of CanniMed (the stake not owned at that time) in November 2017, the September 2018 acquisition of ICC Labs (for $216.1 million), and a couple of smaller buys.

Let’s Find Some Cannabis M&A Targets

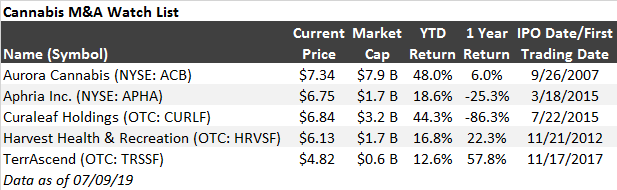

This brings me to today’s watch list. On it, I highlight a few companies where rising share-prices can be used as acquisition currency; these are the companies that I’ll be watching for their M&A potential. One or more of these companies could lead the next wave of pot industry growth — and become its beneficiaries by virtue of the acquired size.

Aurora Cannabis (ACB)

Not surprisingly, the list features Aurora Cannabis. The company — which sports industry-leading production capacity (it’s expected to reach about 882,000 pounds of cannabis over the next few years) and is present in 24 countries — has seen its stock rally by almost 50% this year.

With its share-price up this much, ACB is getting more potential M&A power — if the company indeed decides that it should keep collecting pot-related assets. In any case, ACB is the industry leader that must stay on our radar.

Harvest Health (HRVSF)

Another company with a strong year-to-date and one-year stock appreciation, Arizona-based Harvest Health & Recreation engages in the cultivation, processing, distribution, and sale of cannabis and cannabis-related products, including inhalable and ingestible products (vaporizer cartridges and edibles); the company already has 16 stores open and is working on extending its reach to more locations. The company plans to have 60 stores at year-end.

Because of its smaller size, Harvest Health isn’t set to make a mega-deal any time soon. But it’s been steadily executing smaller acquisitions, and, over the past year, has done eight transactions with a total value of more than $1.1 billion. This well-run company is one to watch.

TerrAscend (TRSSF)

Canada-based TerrAscend, a medical marijuana company and the smallest company on this list, has also been active recently, with two transactions over the past year valuing almost $372 million. The larger one, a bid to acquire RHMT LLC, for $348.7 million in stock and cash, is still pending.

Intended to establish TerrAscend’s retail presence in the United States — RHMT is based in San Francisco — the deal was announced in February 2019 and is expected to close this quarter.

Aphria (APHA)

Canada-based Aphria engages in the production and supply of medical cannabis, with products that include cannabis capsules, oral solutions, concentrate syringes and tetrahydrocannabinol and cannabidiol vaporizers. It has been the target of a failed acquisition itself. In December 2018, it was targeted by Green Growth Brands, at that time known as Xanthic Biopharma Inc, in a $1.5 billion in stock transaction, a 45.5% premium to Aphria’s last closing price on December 24, 2018, the day before the deal was announced.

The offer was rejected by Aphria’s board on the grounds that it significantly undervalued the company.

Curaleaf (CURLF)

Canada-based Curaleaf Holdings is engaged in the production and sale of cannabis via retail and wholesale channels. It also offers professional services (cultivation, processing, intellectual property licensing, real estate leasing services, and lending facilities) to the industry. And it’s an active acquirer. Over the past year, eight deals with a total value of almost $1.3 billion have been made, including the pending acquisition of Portland, Oregon-based Cura Partners Inc for $1.1 billion in stock and contingent payout.

Bottom Line

I must say that there is no official/public indication that any of these companies is about to pounce on a smaller rival, nor there is any guarantee that these stocks won’t become acquisition targets themselves. As usual, only publicly available information plus investment logic went into the creation of this list.

With that being said, aggressive growth investors will want to comb through the stocks on this list in search of a favorite (or favorites) to take a modest position in the event these become the new leaders in the cannabis space.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: No position.