The Q3 earnings reports in the cannabis sector provided the first clear separation between the U.S. and Canadian players. While most of the U.S. multi-state operators (MSOs) shined, the Canadian LPs struggled to grow revenues much less even meet analyst estimates.

A big key to the global market forecasts for sales to top $200 billion in the distant future is the substantial market share assigned to the U.S. market in the initial years. For 2020, analysts have forecast U.S. sales topping $16 billion while the total global sales may not even reach $20 billion following the weak recreational sales in Canada.

The U.S. cannabis companies aren’t lacking in issues such as a lack of federal approval to limited banking access and unfavorable tax scenarios. The companies don’t lack for growth opportunities with new states opening up their markets on a regular basis including Illinois adding a $2 billion opportunity with the approval of the adult-use market on January 1.

The stock market has been just as bad for the U.S. cannabis stocks in 2019 despite strong revenue gains and EBITDA improvements. Several MSOs are now the largest cannabis companies in the world based on revenues once pending mergers are complete while most investors hardly know their names due to the inability of the companies to list their stocks on the major stock exchanges.

We’ve delved into these three U.S. cannabis companies that hit the mark during Q3 and poised for continued growth.

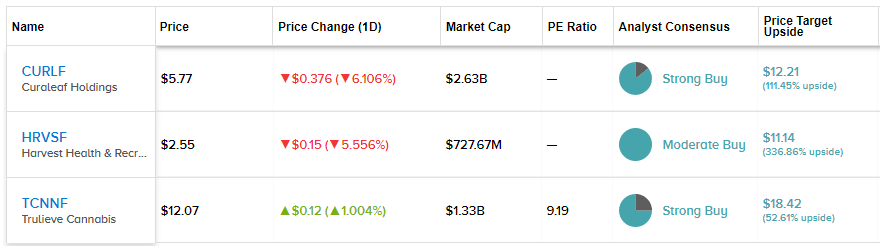

Stock Comparison Tool | TipRanks

Curaleaf (CURLF)

Curaleaf reported Q3 pro-forma revenues of $129 million, and for those paying attention, the U.S. MSO now has far more than double the revenues of the large Canadian cannabis LPs.

Of course, the reported revenues were only $72 million as the company still works on closing big mergers for Select and Grassroots. Absent any apparent hiccups in closing those deals, Curaleaf is set to claim the position as the leading cannabis company in the world. Despite this fact, the company is hardly a household name.

The best part of the Q3 report is the adjusted EBITDA surging to $9 million, up from only $3.4 million in the prior quarter. The company is getting more efficient with cultivation and operations and already generating solid leverage in the system.

The results were achieved with gross margins dipping to 47% from 55% last Q3. The big unknown is what the financials look like with the inclusion of Select and Grassroots. These unknowns aren’t helping the stock.

The U.S. MSO stocks have generally been held back by the lack of these major deals closing that push the companies up to the largest values in the cannabis sector. Curaleaf has a fully diluted market value of $3 billion based on 464 million shares outstanding. After closing the deals that push the diluted share count to 668 million shares including the 41 million contingent shares, the stock has a market value approaching $4.4 billion.

The company guided to 2020 revenues of between $1 billion and $1.2 billion. Additionally, analysts have 2021 revenue targets at $1.6 billion. With this type of growth, Curaleaf remains a stock to own in the sector.

Based on the six “buy” and just one “hold” ratings assigned in the last three months, other Wall Street analysts agree that this ‘Strong Buy’ is a solid bet. It also doesn’t hurt that its $12.21 average price target implies 111% upside potential. (See Curaleaf’s price targets and analyst ratings on TipRanks)

Harvest Health & Recreation (HRVSF)

Similar to Curaleaf, Harvest Health & Recreation has pro-forma revenues that now far surpass the depressed levels of the top Canadian players. For Q3, the company saw reported revenues jump 25% sequentially to $33.2 million with pro-forma revenues up at $95.0 million or ~$17.0 million higher than the prior quarter.

Harvest Health still struggles on the profit side of the equation with gross margins of only 35% and a reported adjusted EBITDA loss of $10.9 million. The EBITDA loss improved from the prior quarter, but the amount is still nearly a third of revenues.

As with most of the MSOs, the company has seen substantial retail location expansion in the recent quarters. Harvest Health probably has one of the largest growth profiles having gone from only 16 locations at the end of June to 26 locations when September closed. The company opened new stores in Arizona, Florida, North Dakota and Pennsylvania along with stores bought in Arizona, California, and Maryland.

The company doesn’t need expensive global aspirations with so many opportunities to expand in the U.S. The listed stock valuation is a meager $800 million with the Verano deal amongst others still pending. Analysts estimate 2020 revenues top $700 million making the stock an ultimate bargain.

Harvest Health has slipped under most analysts’ radar; the stock’s Moderate Buy consensus is based on just two recent ratings. With shares trading at $2.53 (close match with ACB), the $11.14 average price target suggests room for a 340% upside. (See Harvest Health’s price targets and analyst ratings on TipRanks)

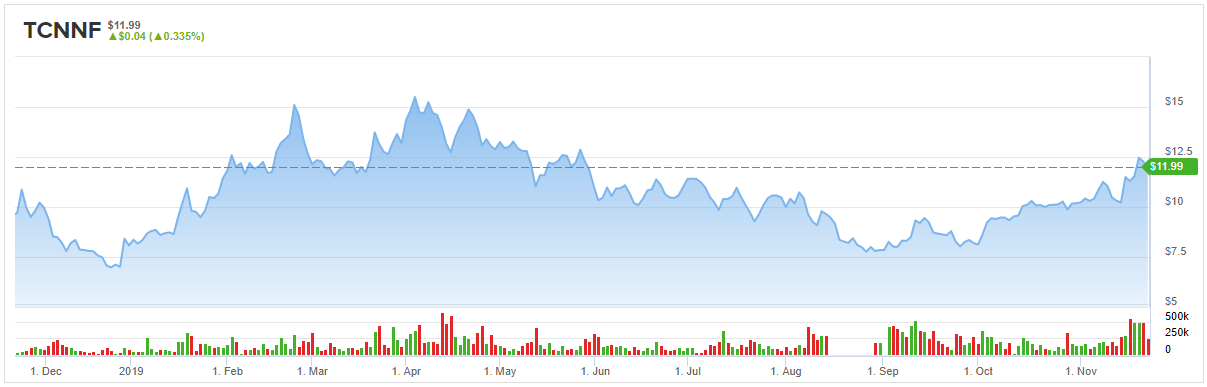

Trulieve Cannabis (TCNNF)

Trulieve Cannabis is the slow and steady play in the U.S. cannabis MSO sector. The company beat analyst estimates with a 22% sequential revenue increase to $70.7 million.

Unlike these other picks and most of the major MSOs, Trulieve isn’t relying on a major deal to generate substantial revenue growth. The company generates substantial adjusted EBITDA margins having already reached $36.9 million in Q3 or greater than 50% margins.

The company is nearly entirely focused on Florida with 35 dispensaries open after adding six during the quarter. In addition, Trulieve has slowly expanded into California and Connecticut, but the biggest opportunity is when Florida approves recreational cannabis in the state at some point in the future.

The stock has a market value of only $1.4 billion while the company kept guidance for 2020 revenues of up to $400 million and adjusted EBTIDA of $160 million. Very few stocks in the cannabis sector have legitimate EBITDA targets while trading at only 9x those estimates.

Trulieve is also a Wall Street favorite, earning one of the best analyst consensus ratings in the market. TipRanks analytics exhibit the stock as a Strong Buy. Out of 4 analysts tracked in the last 3 months, three are bullish on the cannabis player while one remains sidelined. With a return potential of 54%, the stock’s consensus target price stands at $18.42. (See Trulieve’s price targets and analyst ratings on TipRanks)