It’s no secret that the overall cannabis market has been going through a correction, with many of the well-known names like Canopy Growth (CGC) and Aurora Cannabis (ACB) getting hammered.

While I expect a turnaround by mid-year 2020, there are some companies that are likely to catch many in the market by surprise, and be among the top performers of 2020.

In this article we’ll look at why those three stocks have enormous potential over the next 12 to 18 months.

Cresco Labs (CRLBF)

Of the three companies covered in this article, Cresco Labs is projected to be the industry leader for revenue in 2020, although it also comes with the caveat of needing to close its deal with Origin House to achieve its projected sales numbers.

Also, if the deal does pass regulatory scrutiny, another issue will be the timing of the approval and closing of the deal, which will determine how much of Origin’s sales will be included in the performance of Cresco Labs in fiscal 2020.

The four 2020 revenue estimates for Cresco are in a range of $670 million to $775 million, with an average of $738 million. For some perspective, the projected No. 2 revenue leader for 2020, Canopy Growth, has a revenue estimate of $580 million for the year. That’s a huge gap by any measure if the projections are accurate.

There are a couple of reasons for the potential revenue growth. The first is the Origin House acquisition for $823 million.

The importance there is Origin House is licensed for cannabis distribution in California, which includes over 500 dispensaries it can sell its products in.

Outside of the Origin House deal, Cresco Labs also has 56 retail licenses and 23 cultivation licenses in 11 states, which includes many of the largest cannabis markets in the U.S.

Even without the Origin House deal Cresco would post some solid numbers, but if it does receive approval from U.S. Justice Department, it’s probably going to rapidly become the largest cannabis company in the world as measured by revenue.

I’m not totally convinced yet that the deal for Origin House is guaranteed to be approved, primarily because the Justice Department has started to take a narrower view of potential market domination by larger players. But if it does pass, it’s going to be a huge game changer for Cresco.

I don’t believe it’s priced into Cresco at this time, and if it able to close on the deal, combined with its expansion in other states, it’s going to shock and surprise a lot of people at the amount of revenue it is able to generate.

On the negative side, there is also the fact it will heavily dilute itself in the all-stock deal.

While I think the revenue projections may be on the high side, even if they don’t quite reach those levels, Cresco is going to become a top player in 2020. It doesn’t trade at a lot of daily volume at this time, so when the market starts to take notice of its growth potential, volume is going to skyrocket along with its share price.

On the other hand, if Origin House doesn’t close, the market will punish it heavily, even if it does enjoy growth from its existing business.

The word of the Street is an overwhelmingly bullish one for this cannabis stock, as TipRanks analytics exhibit Cresco as a Strong Buy. Out of 5 analysts polled in the last 3 months, all 5 are bullish on the stock. With a return potential of 155%, the stock’s consensus target price stands at $14.13. (See Cresco’s price targets and analyst ratings on TipRanks).

Harvest Health & Recreation (HRVSF)

Harvest Health & Recreation, like Cresco Labs is reliant upon closing acquisitions to reach the projected 2020 revenue potential the market is looking for.

The company has a number of pending deals to be closed, including CannaPharmacy, Devine Holdings, Falcon, and Verano Holdings.

The largest of these should be the first approved of, as Harvest Health waits for Verano Holdings to pass the waiting period associated with the HSR Act on December 4.

In the second quarter Harvest Health generated revenues of $26.6 million. After these deals close it’s expected to produce pro forma quarterly revenues of $78 million. Analysts covering the company project 2021 revenues to soar to an astounding $1.28 billion.

One downside for Harvest Health is there are no visible numbers investors can sift through because of the companies it’s acquiring being private. So until the deals are closed and a quarter or two are under its belt, the market probably won’t reward the company in the near term, as much as it will further out if the projected revenue results prove to be accurate.

If they are, I think Harvest Health could easily triple from there.

Analysts agree. Among those who do cover the stock, the consensus is a Moderate Buy, and the 12-month average price target stands tall at $15.313, implying room for a robust 477% upside from current levels. (See Harvest Health stock-price forecasts and analyst ratings on TipRanks)

Medicine Man Technologies (MDCL)

Medicine Man Technologies has potential to have its share price soar more than even Harvest Health and Cresco in 2020. The company is expected to close on 12 deals in the first half of 2020.

Management said this in the last earnings report:

“Upon closing of these acquisitions, which we anticipate in the first half of 2020, the company will have 12 cultivation operations, 7 product manufacturing operations, 34 dispensaries including two currently under construction, world-class research and development capabilities and infrastructure, all built for scalability.”

I have no problem agreeing with the assertion by management that it’ll be one of the largest cannabis competitors in the North American market, once these deals are closed.

The company stated that on their own, the combined revenue coming from the acquisitions will be $170 million. It also said it expects “healthy EBITDA margins.”

Assuming the company is willing and able to close on these deals, I see it getting its huge increase in share price from a ongoing string of media reports on the closing of the 12 deals and the impact they’ll have on the performance of the company.

With little in the way of short-term visibility for these acquisitions, there won’t be a lot of knowledge concerning fundamentals until the company starts to report the impact of the new businesses on its top and bottom lines. That won’t come till further out.

For that reason, I do believe the share price of Medicine Man Technologies has the potential to skyrocket in 2020, but I’m not certain it will be able to maintain support levels once the numbers start coming in. (Get TipRanks’ free stock analysis report on Medicine Man)

Conclusion

All three of the companies covered in this article have the potential to surprise the market to the upside in 2020. The caveat for all three of them is they are dependent upon acquisitions to achieve their numbers. The other issue is there’s not guarantee all the proposed deals will be allowed to go forward or close.

While I think the majority of them will close, the question is which ones won’t close, and what impact it’ll have on revenue.

More important, my thesis is that all three of these companies should enjoy a strong boost in share price in 2020. It has yet to be proven whether or not these increases in value will be sustainable based upon revenue and earnings outcomes.

For that reason I see Medicine Man Technologies, Inc., Harvest Health & Recreation, and Cresco Labs having a lot of potential upside over the next 12 to 18 months, but once more visibility comes concerning revenue, earnings, debt and dilution, and how strongly the cannabis market rebounds in 2020, it’s questionable as to whether or not they’ll be able to grow organically once the companies are under their wings.

If these companies perform as I expect them to, once they get rewarded by investors for the deals being made, I would take my profits and wait to see if they will be able to grow beyond the initial positive impact of the immediate revenue added to their numbers.

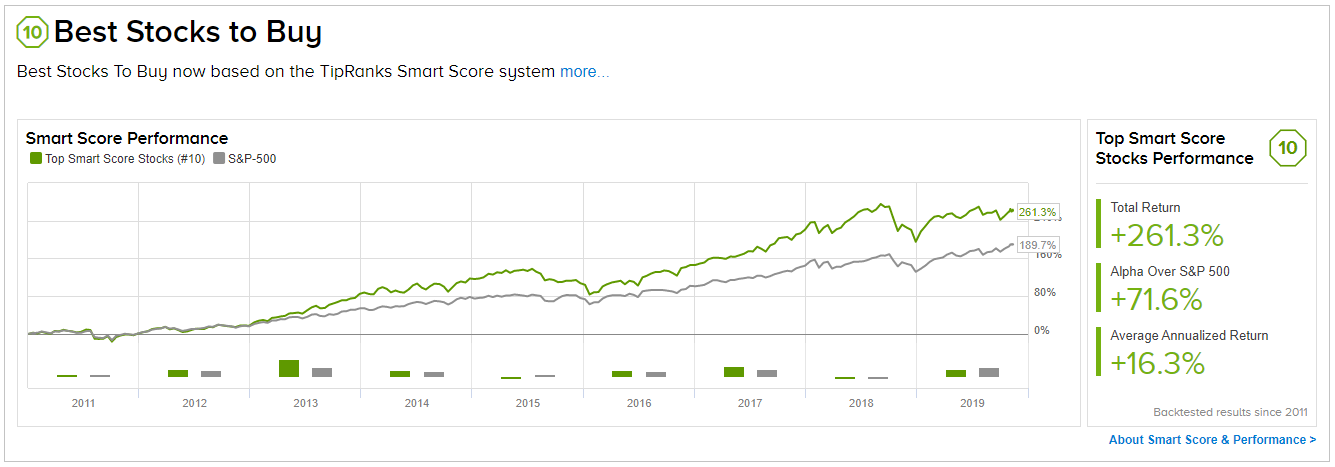

To find other good ideas for cannabis stocks trading at fair value or better, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.