While the overall cannabis sector has been going through a correction, it isn’t hard to find cannabis companies that have laid the groundwork for long-term success, once capital starts flowing into the space once again.

Curaleaf Holdings (CURLF), Green Thumb Industries (GTBIF), and Trulieve Cannabis (TCNNF) are among the top performers in the U.S., and in this article we’ll look at how they’ve been performing as well as how the future looks.

Curaleaf Holdings

In its last quarter, Curaleaf Holdings generated $61.8 million in revenue, representing a 27% gain sequentially. That included sales from dispensaries, wholesale business, and management fees. It is widely expected that the company is going to improve on sales by opening up new retail stores going forward.

Curaleaf had 49 locations opened at the end of the third quarter. If all its pending acquisitions close, the company will have the second position in retail licenses in the U.S., while competing in 19 states. With Grassroots, it’ll be licensed to operate 131 stores.

Once the purchases of Select and Grassroots are finalized, the company believes it’ll be able to generate $1 billion in sales for 2020. It should have a potential market of about 177 million customers next year.

Before adjustments, gross profit in the quarter was $43.7 million, up from $13.9 million in the year-ago quarter. Adjusted earnings in the quarter came in at $9 million, up from the $3.2 million loss in the same reporting period last year. Curaleaf had a net loss of $7.4 million, or $0.01 per share in the reporting period, against the net loss of $35.06 million, or $0.05 per share, a year ago.

Most of Curaleaf’s improved performance came from retail and wholesale sales of $50.7 million in the Florida and New York markets. Acquisitions in Arizona and Maryland contributed to the total as well.

The bottom line for Curaleaf is it’s positioned to accelerate growth over the next couple of years. It should only get better for the company.

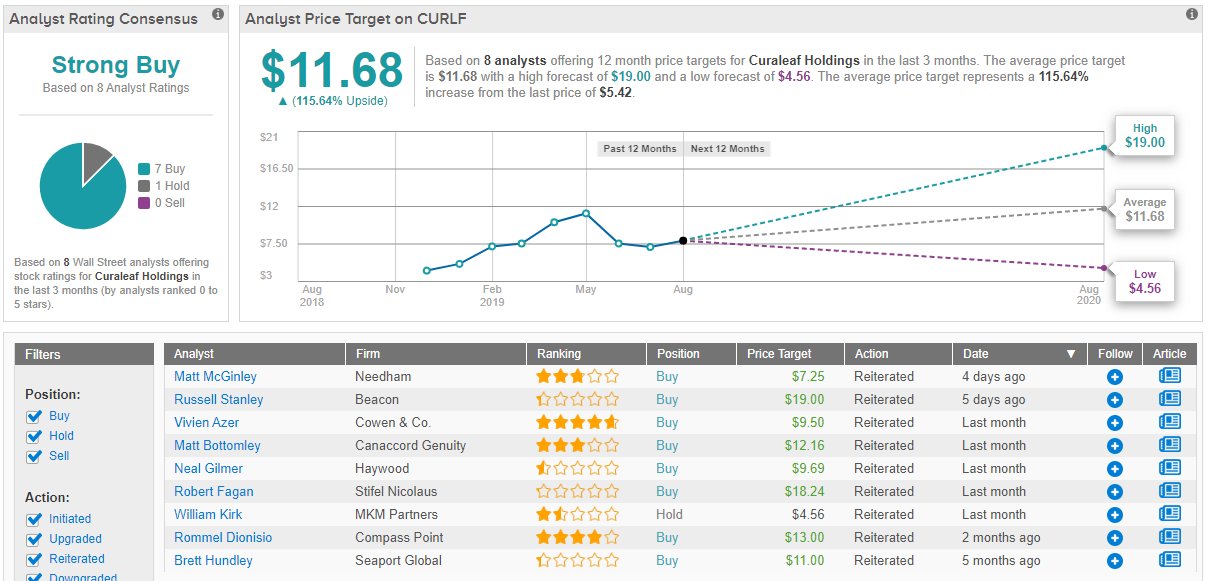

Turning now to Wall Street, it’s clear that the analysts also have high hopes for the cannabis stock. According to TipRanks, a company that tracks and measures the performance of analysts, 7 Buy ratings and a single Hold were received in the last three months, giving it a Strong Buy consensus rating. At the $12 average price target, shares could soar 116% in the twelve months ahead. (See Curaleaf price targets and analyst ratings on TipRanks)

Green Thumb Industries

During its most recent quarter, Green Thumb Industries generated $68 million in revenue, up 52% sequentially, and had an adjusted operating loss of under $2 million. It had positive EBITDA for the second quarter in a row, with the figure reaching $1.6 million. Adjusted operating EBITDA climbed to $14.1 million, a significant gain from the $5 million generated in the prior quarter.

The company stated in its earnings report that in the short-term, it will focus on expanding distribution of its branded products by opening new retail stores. It is also positioning itself to scale as legalization of recreational pot in its home state of Illinois approaches on January 1, 2020. It should be noted that GTBIF has been selling medical cannabis in Illinois since 2015.

On January 1, the company will have three recreational pot stores ready to open, and expects other stores to open not too long afterwards.

In preparation for increased demand, the company has added capacity in 2019, and will continue to do so in 2020. Beyond the large Illinois market, the company is working on increasing capacity to meet demand in other major markets like New Jersey, New York, Ohio, and Pennsylvania.

Green Thumb Industries has a visible and effective growth plan in place, and if it can continue to lower costs while scaling, it should do very well in 2020, even if sentiment for cannabis remains subdued.

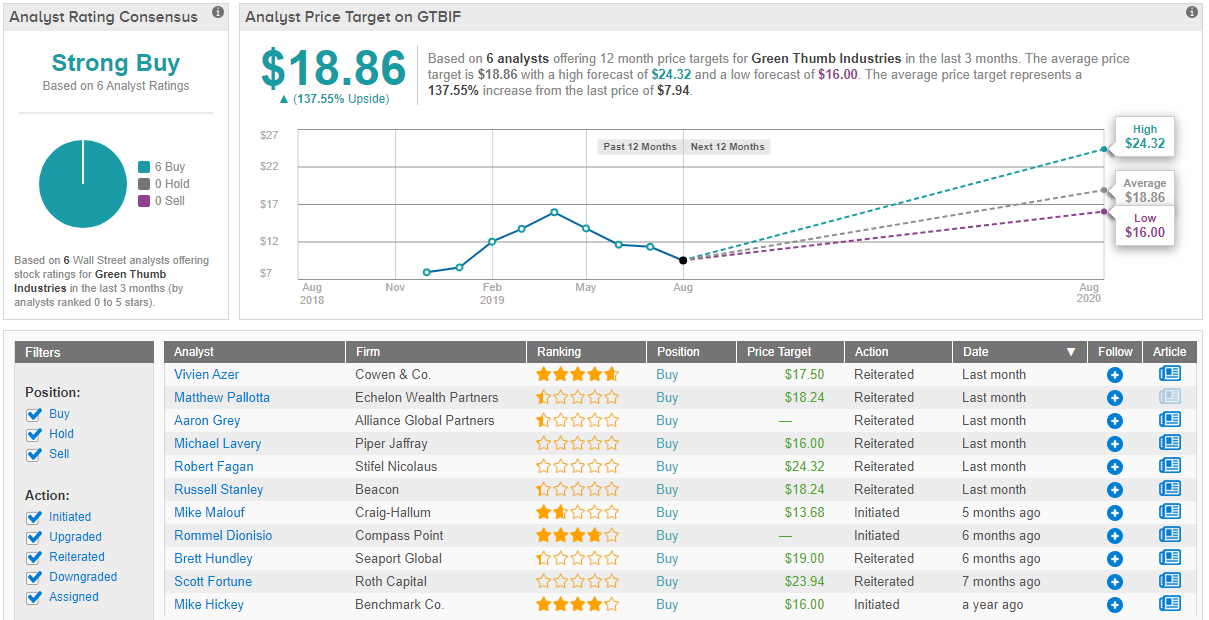

Looking at the consensus breakdown, this is a conclusion shared by the Street. Out of total 6 analysts covering the stock, 100% published bullish calls, making the consensus a Strong Buy. To top it off, the $19 average price target puts the upside potential at 138%. (See Green Thumb price targets and analyst ratings on TipRanks)

Trulieve Cannabis

Since the end of August, Trulieve Cannabis Corporation has been one of the top performers in the cannabis sector at a time when market sentiment has been dismal for the industry.

However, a recent short attack from Grizzly Reports caused some panic selling, and shares got crunched as they had already been pulling back a bit in early December after the strong upward move.

After reading the report, it doesn’t provide any hard evidence of wrongdoing, but rather asks some questions that are left unanswered. The one argument that actually dealt with the performance of the company was the impact increased competition in Florida could have on the company. For that reason, until or if there is confirmation of illegal activity, I don’t see it having a long-term effect on the company. In the near-term, TCNNF may have a lower ceiling until there is more clarity concerning the assertions made by Grizzly.

In the last quarter, the dominant player in the lucrative Florida cannabis market also generated the most revenue of the multi-state operators (MSOs), finishing the third quarter at $70.7 million, a gain of 22% sequentially and 150% year-over-year. The company had adjusted operating income of $23.4 million in the quarter.

Regarding the above-mentioned competition in Florida, there is some concern as to whether or not Trulieve will be able to maintain margins. That’s important because its expansion to other state markets isn’t likely to have much impact on the performance of the company in the short-term. Further out, other markets could have a positive impact, but it’s probable the margins in Florida will come under pressure before expansion makes a difference.

Also important going forward will be how it does in the recreational pot market, which it hasn’t significantly competed in. Depending on its exposure there, it could also put downward pressure on margins if it ends up being a large percentage of sales.

If investors like what they see with Trulieve, it could be a good time to take or add to a position in the company now that the share price has dropped by about $3.00 since earlier in December.

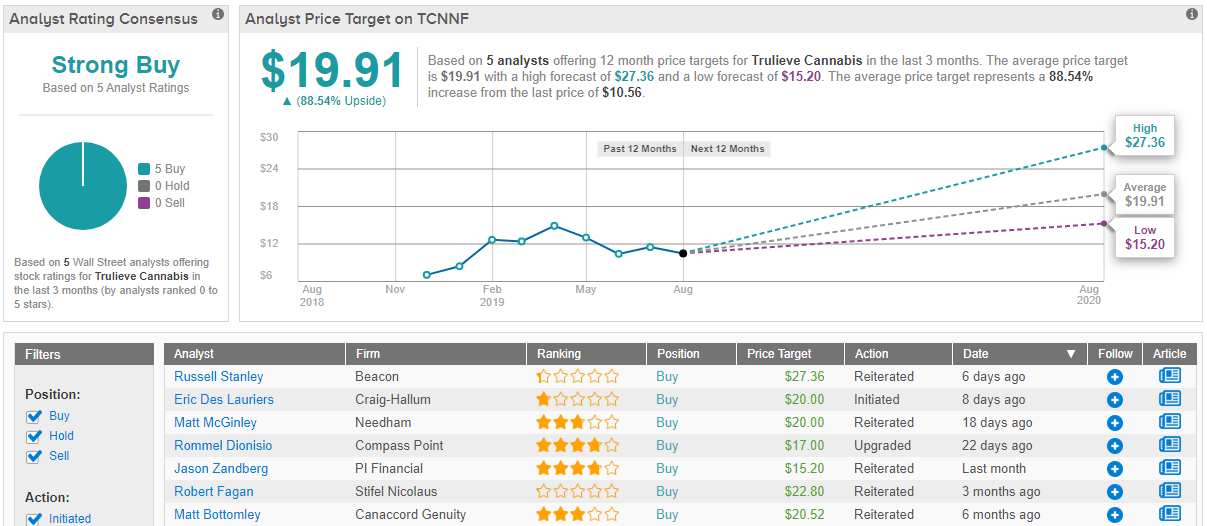

Wall Street analysts are recommending doing just that. Based on 100% Street support, the consensus comes in as a unanimous Strong Buy. In addition, the $20 average price target suggests 89% upside potential. (See Trulieve price targets and analyst ratings on TipRanks)

Conclusion

All three of these stocks mentioned in the article are positioned well for a rebound in the sector. That being said, all three have taken a dive in December, with Trulieve being hit the hardest because of the short attack.

Something to consider with all of these companies is they don’t have a lot of volume, so if a large position is taken, it could be hard to get rid of them all at once if the share prices started to collapse.

While I think it’ll take a little while before the cannabis sector comes into favor with investors again, a series of decent earnings reports could start to turn things around, and these three companies have a good chance of leading the way.

However long it takes, these three cannabis companies, as they stand today, should be good holding in the long-term, and could surprise with returns in 2020.

To find good ideas for cannabis stocks trading at fair value or better, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.