The cannabis sector has run into major liquidity issues with the lack of access to the banking system in the U.S. and market issues in Canada. In the process, the market has seen a substantial decline in mergers with a shift in deals towards stock-for-stock ones. Several companies set to close big U.S. deals could stand out in a sector where competitors can’t merge to compete on scale.

According to Viridian Capital Advisors, the cannabis sector ended 2019 at a crawl. Capital raises were near non-existent with only 2 for the week ending December 13 and no M&A activity during the week. In the prior year period, 7 capital raises occurred.

For the year, 2019 cannabis M&A activity saw 293 deals down from 311 in 2018. As the below chart shows, M&A activity came to a near stop in the last few months. Earlier in the year, 10 deals were happening on a weekly basis.

In a lot of cases, deals formed in 2019 were either modified to eliminate cash requirements or completely canceled. Some high-profile deals are still set to close to create leaders in the U.S. multi-state (MSO) operator space. With the opening of recreational cannabis in Illinois on January 1 and potentially additional states in 2020, several companies are set to stand apart from the market.

We’ve delved into three companies set to benefit from closing large-scale mergers right as the market freezes up. According to TipRanks’ stock screener, the trio have earned a Strong Buy consensus rating from the analyst community over the past three months. Let’s take a closer look:

Curaleaf Holdings (CURLF)

Curaleaf is still poised to become the biggest cannabis company in the world. The company remains set to close both the Select and Grassroots deals in early 2020 to set Curaleaf up for over $1 billion in pro-forma sales.

The Select deal is set to close in early January setting up some positive sentiment on the stock as Curaleaf finally gets to move forward with integration. In addition, closing the deal will provide more confidence on the Grassroots deal, a deal that provides access to the potentially lucrative Illinois market.

Select provides the company with access to the California wholesale market with a leading cannabis brand. The deal was modified due to market conditions placing a part of deal based on the obtainment of revenue goals.

The Grassroots deal is expected to close in Q1. The deal requires a cash payment of $75 million, 109.2 million shares based on the current stock price of $6.25.

In total, Curaleaf expects a business with access to 19 states with 71 retail locations open, 26 processing facilities and 21 cultivation facilities operational. The company is heading towards 131 stores along with a large wholesale distribution network with the Select brand.

The stock has 464 million shares outstanding now and nearly 670 million when the two major deals are complete. The updated share count assumes 40.5 million shares will be payable to Select shareholders under the amended agreement. At the current stock price of $6.25, Curaleaf will have a fully diluted market valuation of only $4.2 billion. The stock trades at only 2.8x 2021 sales estimates of $1.5 billion.

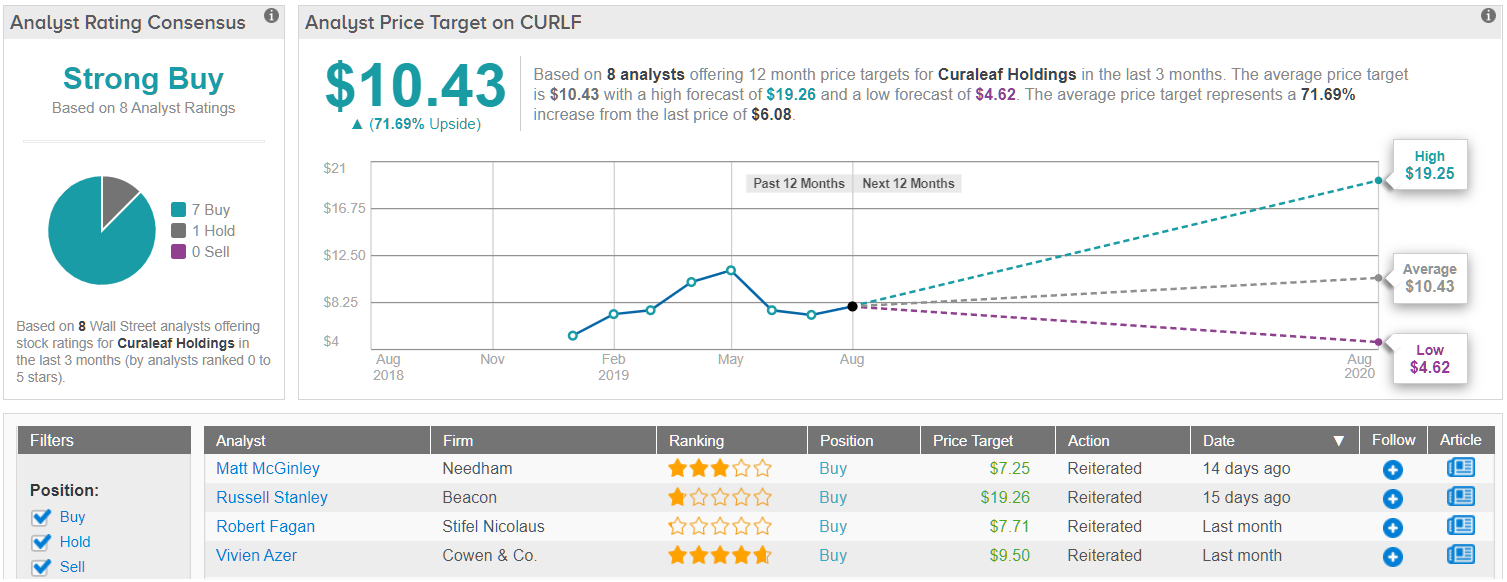

Curaleaf has earned one of the best analyst consensus ratings on the Street. Out of 8 analysts polled by TipRanks in the last 3 months, seven are bullish on Curaleaf’s prospects, with just one on the sidelines, highlighting a strong bullish backing here. With a healthy return potential of 72%, the stock’s consensus target price stands at $10.43. (See Curaleaf’s price targets and analyst ratings on TipRanks)

Cresco Labs (CRLBF)

Cresco Labs has had some of the most dramatic shift in their acquisition plans during 2019. The company originally planned mergers with Origin House and VidaCann, but the later was canceled due to the cash component of the deal. In the process, Cresco Labs has already closed a deal to acquire the Valley Agriceutials, LLC in New York.

Even the Origin House deal was modified to allow Origin House to sell 9.7 million shares at C$4.08 in order to raise gross proceeds of C$39.6 million before the deal closes. The new deal is expected to close in mid-January at an updated ratio of 0.8428 shares of Cresco Labs for each share of Origin House.

In October, the company closed a deal for Valley Agriceuticals providing one of the 10 vertically integrated cannabis business licenses in the State of New York. Cresco Labs can operate one cultivation facility and four dispensaries in the state set to grow to $500 million by 2022.

In addition, the Tryke Companies deal announced in September has already passed HSR Act waiting period. The company is set to close this deal in early 2020 providing access to the Arizona and Nevada markets with a combined $1.7 billion in annual sales. The deal cost $282.5 million ($55.0 million in cash) and Tryke generated $70.4 million in revenues back in 2018.

Analysts estimates 2020 sales of $554 million with 2021 reaching $866 million.

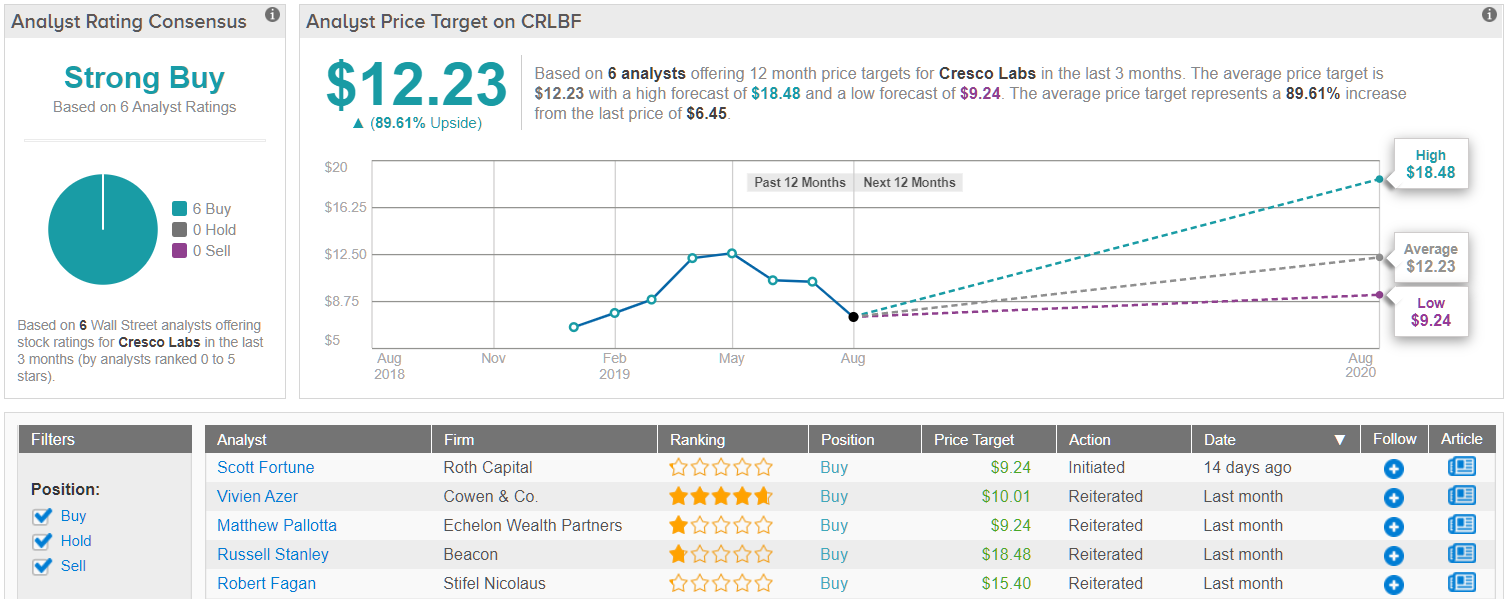

Overall, this cannabis player stands as a ‘Strong Buy’ name among Wall Street analysts. In the last three months, Cresco Labs has won six bullish recommendations. With a return potential of close to 90%, the stock’s consensus price target lands at $12.23. (See Cresco Labs’ stock-price forecast and analyst ratings)

Harvest Health & Recreation (HRVSF)

Harvest Health & Recreation is in a similar position as the other U.S MSOs. The company has several pending deals and recently renegotiated one of the deals to reduce cash payments.

The biggest deal is for Verano Holdings that passed the HSR Act waiting period on December 4. In addition, the company has pending deals with Falcon, Franklin Labs and Devine Holdings after closing acquisitions with Leaf Life and Urban Greenhouse. The end result was Harvest Health only reporting Q3 revenues of $33.2 million with pro forma revenues of an incredible $95.0 million once including the numbers from all of these deals.

After closing the deals, Harvest Health expects to have over 210 facilities including 130 retail locations with more than 1,700 employees across 18 states and territories. Harvest Health has a fully diluted market valuation of under $1.5 billion once the pending M&A deals are done. The large cannabis company will have ~487 million shares outstanding.

The full picture of the company is probably not represented in the market mindset now. Harvest Health is still forecasting 2020 revenues between $700 million and $1,000 million with at least 20% EBITDA margins.

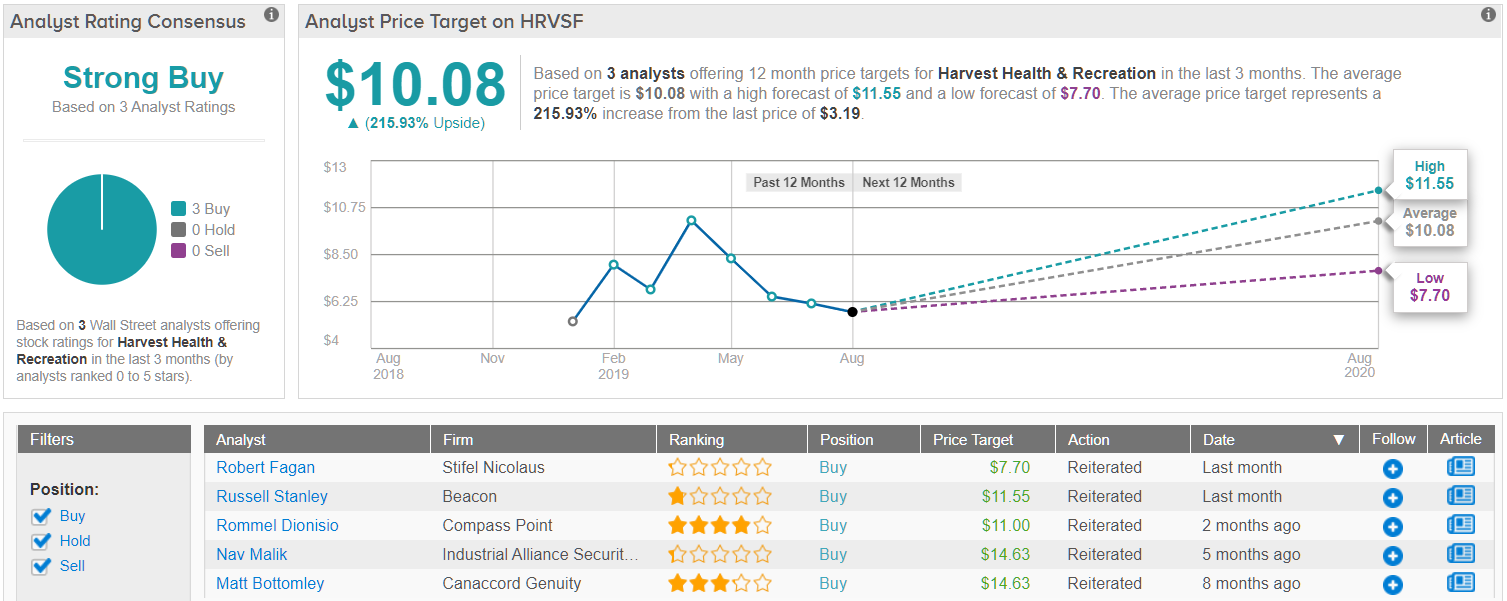

Judging from the consensus breakdown, it has been relatively quiet when it comes to the analyst activity. Over the last three months, only 3 analysts have reviewed the cannabis stock. Three of which, however, were bullish, making the consensus a Strong Buy. On top of this, the $10.08 average price target puts the upside potential at 216%. (See Harvest Health’s price targets and analyst ratings on TipRanks)