A hot topic in the upcoming U.S. Presidential election will likely be federal regulation surrounding marijuana. Right now, cannabis remains illegal at the federal level, but over 30 states have various forms of state-level approval for either medical or recreational cannabis.

New York Governor Andrew Cuomo is pushing aggressively for approval of recreational cannabis, and now, Joe Biden has officially taken a favorable stance on cannabis legislation. Per his 110-page document released back on July 9, his platform outlined three main cannabis-related plans: 1) support federal legislation for medical marijuana, 2) let states decide on recreational cannabis, 3) decriminalize marijuana use and change the drug’s schedule classification via executive action.

All of the plans bode well for U.S. cannabis growth, especially the new regulations allowing states to make their own decisions on recreational cannabis. The plan reads as if the federal government will approve cannabis via passage of a bill such as the STATES act, which would give cannabis companies access to the banking system.

Beyond patchwork state regulations, the biggest issue for cannabis stocks is the lack of access to capital. The companies can’t utilize the banking system and can’t list on the major stock exchanges like the NYSE and Nasdaq, limiting their ability to raise funds for expansion.

Naturally, Biden isn’t guaranteed to win the U.S. presidential election, despite a large lead on Donald Trump right now. In addition, any federal approval has unknown implications for license amounts in certain states where limited licenses are beneficial to multi-state operators (MSOs). Not to mention, an approval to sell beyond state lines would provide major benefits to the large MSOs with access to capital to scale operations.

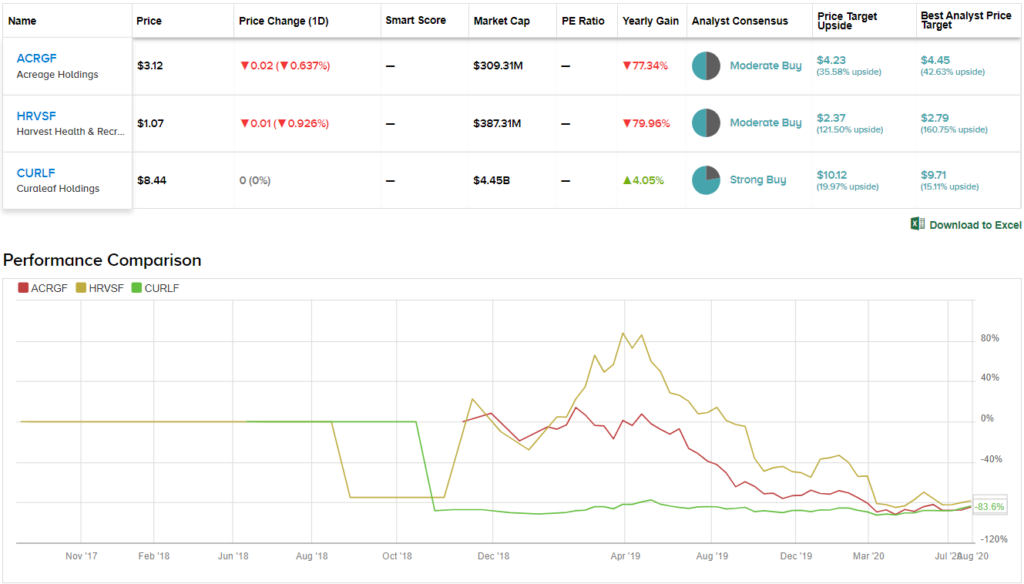

We’ve delved into 3 stocks to consider as a Joe Biden presidential victory promises a push to approve cannabis in the U.S. Using TipRanks’ Stock Comparison tool, we lined up the three alongside each other to get the lowdown on what the near-term holds for these cannabis players.

Acreage Holdings (ACRGF)

Acreage Holdings would be the biggest beneficiary of federal approval of marijuana. The company has an agreement with Canopy Growth for a premium takeover, assuming a triggering event such as the approval of the STATES act.

For shareholders, federal approval of cannabis can’t occur fast enough. Recently, the company had to take on high cost debt to survive until Canopy Growth can take over, which led to a restructuring of the deal.

As per the terms of the deal, Acreage shareholders will receive a complex mixture of fixed and floating shares in Canopy Growth, valuing the stock at nearly $5.50. Canopy Growth is trading at nearly $16.50 now. Acreage only trades for $3.12, but the risk facing shareholders is that the premium price was cut from the original deal.

In the last quarter, Acreage reported Q1 pro-forma revenues of $37.6 million, up 65% from last year. The MSO still posted pro-forma adjusted EBITDA loss of $11.1 million. Acreage has plans to achieve positive EBITDA this year, but the company is in a precarious position.

The stock has 100% upside potential on a triggering event and possibly zero potential without Canopy Growth, making Acreage Holdings the most likely to benefit from Biden becoming President.

Turning now to Wall Street, opinions are split evenly. 2 Buys and 2 Holds add up to a Moderate Buy consensus rating. The $4.23 average price target brings the upside potential to 36%. (See Acreage stock analysis on TipRanks)

Harvest Health & Recreation (HRVSF)

Harvest Health is a struggling MSO with access to numerous medical cannabis markets such as Arizona, Florida and Pennsylvania. The company stands to benefit from any quick approval of recreational cannabis in those states along with the access to cheaper capital.

The company has seen the share price fall to $1 due to failed mergers. The market cap is only $390 million despite 2021 revenue estimates of up to $325 million prior to any approval of recreational cannabis in key markets.

Harvest Health is one of the few MSOs tied almost entirely to medical cannabis markets going recreational. The company has less than five dispensaries open in fully legalized states, with 25 retail stores open in the key states of Arizona, Florida, and Pennsylvania.

Despite expectations that its key medical markets will eventually approve recreational cannabis with or without Biden as president, the stock has lagged. Similar to Acreage, Harvest Health probably doesn’t have the firepower to thrive without better access to capital.

For Q1, the company reported $45 million in sales with a $3.9 million EBITDA loss. Harvest Health plans to become adjusted EBITDA positive this year, but shareholders don’t have time on their side.

Looking at the consensus breakdown, 2 Buys and 2 Holds have been assigned in the last three months, which add up to a Moderate Buy consensus rating. At $2.37, the average price target indicates 143% upside potential. (See Harvest Health’s stock-price forecast on TipRanks)

Curaleaf (CURLF)

Curaleaf is the safest play in this group of stocks. As the largest cannabis company in the world based on revenues, Curaleaf is in the best position to navigate evolving regulations and utilize scale to its advantage.

Just last week, the company finally closed the key Grassroots deal. The transaction expanded Curaleaf’s footprint from 18 states to 23, with 135 dispensary licenses, 88 operational dispensaries, over 30 processing facilities and 22 cultivation sites with 1.6 million square feet of cultivation capacity.

The deal provides important access to the Illinois market and builds on its Pennsylvania market position. The company is a leader in the Florida, New York and Arizona markets that promise to approve recreational cannabis over the next few years with or without Biden as President, but his win would probably accelerate the timeframe in a few of the states.

The company is set to easily top 2021 revenues of $1 billion, with the market valuation around $4 billion. Analysts already have Q3 revenues jumping to $200 million before any boost from additional states approving recreational sales. The stock trades right above $7 where tough resistance has existed for the last year.

To this end, most analysts take a bullish approach. 7 Buys trounce 2 Holds, so the word on the Street is that CURLF is a Strong Buy. The $10.14 average price target puts the upside potential at 18%. (See Curaleaf price targets and analyst ratings on TipRanks)

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclosure: No position.