Cliff Asness did not make his way to becoming a 51-year-old quant wizard and billionaire without knowing the ins and outs of alternative strategies. When it comes to conventional trading, Asness cares less about beating out the market and more about delivering a strong average return in this alternative arena. Applied Quantitative Research (AQR) Capital Management sprang to life back in 1998 thanks to Asness, along with co-founders David Kabiller, John Liew, and Robert Krail; and this hedge fund is a billionaire-making machine. Asness stands with the tallest fortune at $3 billion- and it seems that he now believes Micron Technology, Inc. (NASDAQ:MU) and Apple Inc. (NASDAQ:AAPL) could bolster his net worth.

The portfolio manager has been in the biz since he was a green 25-year-old, taking a quarter of a century to hone his sharp quantitative investing skills, from cherry-picking stocks with the best value to throwing weight behind Wall Street players that are bringing to the table strong performances. This quant savvy has helped forge a hedge fund with assets soaring at $224 billion, as of December 2017.

Let’s dive in to the fund’s confident moves in two of tech’s biggest giants:

Micron Attracts a 2 Million Plus Hike

Micron has Asness out betting even more of his chips behind this semiconductor player. The quant-made billionaire as of the most recent SEC filing stepped forward to buy another 2,613,634 shares for AQR. Now, Asness owns 19,467,659 shares worth $800,510,000 in MU- a notably 16% boost in this hedge fund manager’s holding in the company.

Yet, Asness is far from the only bull on the Street clamoring for Micron’s success.

Nomura analyst Romit Shah had already stepped away from the sidelines two Junes ago on this chip giant, joining the bullish camp with a vengeance.

Ever since, the analyst has “stair-stepped” his target price expectations 9 times over- and has seen the semiconductor’s share price skyrocket four times over in this period. The last three to four months have proven to this bull one clear insight: it is time to get even more bullish on the chip giant.

“We believe MU shares are in the early stages of another major breakout,” predicts Shah, who asserts: “This time, though, we are raising our target substantially.”

Therefore, looking for multiple expansion ahead, the analyst reiterates a Buy rating on MU stock while massively jumping up the price target from $55 to $100, which implies a close to 67% upside from current levels. (To watch Shah’s track record, click here)

Shah breaks down his confident case for the chip giant into the following standout catalysts set to drive this stock even higher: stronger DRAM pricing coming back on a positive trend in the second quarter; capital return thanks to a first-time dividend coupled with a share buyback reveal in May; sustained margin expansion in NAND; and more M&A discussion making rounds through the Wall Street grapevine.

DRAM spot pricing has Shah positive on MU shares amid the first calendar quarter that is “seasonally weaker.” Throughout the next half of the year, Shah bets on even a higher 10% jump in pricing. Keep in mind, “Year to date, DRAM spot pricing is down a modest 3%, which is much better than normal. In 2014-2016, DRAM spot declined between 10-20% in Q1. Current pricing trends reflect the fact that shortages still exist in the marketplace,” highlights the analyst.

Looking to the MU team’s upcoming analyst and investor day May 21st, Shah expects “a comprehensive capital return program that, among other things, will demonstrate management’s confidence in future cash flows.” By the analyst’s estimation, MU closed its first fiscal quarter with $8 billion in total cash and is on track to generate $5 billion in FCF throughout the next two periods. Considering MU in the past has pointed to a minimum cash balance of $5 billion, Shah spots space here for “substantial” capital return.

Regarding margin expansion in NAND, the analyst notes: “We expect weaker NAND pricing to be offset by a stronger mix and lower cost per bit, driving continued margin expansion in FY18 and FY19. The company is driving meaningful output of 64-layer 3D NAND, which should have 4x bit growth vs. planar NAND. Micron’s 64-layer is on track to deliver good cost benefit and is estimated to have >25% more die per wafer vs. competitors’ 64-layer technology.”

On a final bullish note, the analyst likes MU’s odds as a prospective acquisition target as the Street buzzes these days with mega-scale merger & acquisition (M&A) deal discussions. With revenues nearing $20 billion, a NAND presence that keeps spiraling, and “attractive” valuation, this domestic chip giant “stands out” to Shah.

Shah also hikes his fiscal 2019 EPS expectations from $11.78 to $12.22- well ahead of the Street’s $8.90, which models for lesser revenues and EPS in fiscal 2019.

To put it bluntly, “Buy the breakout,” Shah contends.

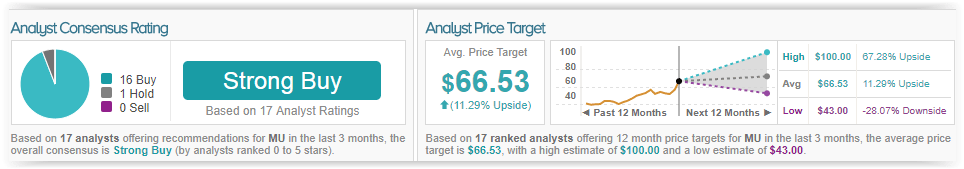

Micron has garnered one of the strongest bullish ratings on the Street, according to TipRanks analytics. Out of 17 analysts polled in the last 3 months, 16 are bullish on MU stock while just 1 hedges his bets on the sidelines. With an encouraging return potential of 11%, the stock’s consensus target price stands $66.53.

A Bigger Bite into Apple

Apple drew an extra slice from the hedge fund billionaire in the latest quarter, with Asness dialing up his stake 9%- a new purchase of 592,700 shares. Now, AQR owns 7,639,827 shares worth $1,292,88 in the tech titan, with Asness seeing fit for a 9% lift in the stake.

Worthy of note, the third best analyst on the Street backs the billionaire’s bullish play here, betting that the company is raring to deliver an attractive, continuous free cash flow (FCF) generation back into shareholders’ pockets.

Top analyst Amit Daryanani at RBC Capital understands that the word on the Street has been “hyper” focused on both the iPhone X cycle as well as its “adoption trends.”

However, a winning note for the tech titan boils down to its ability to generate “resilient and recurring” FCF.

Betting on $59 billion of free cash flow for this year, the analyst rates an Outperform rating on AAPL stock with a $205 price target, which implies a close to 15% upside from current levels.

As far as Daryanani tackles the bigger picture at hand, pinpointing present-day tax reform’s impact of a curbed “appetite to do deals and benefits,” AAPL shareholders are poised to be the victors. To the victor goes the spoils, and for AAPL shareholders, Daryanani anticipates “AAPL to return much of the ongoing FCF generation back to shareholders.”

“In addition, we expect AAPL will provide a roadmap on how it intends to return the $163B of net cash on hand to shareholders when it reports March-qtr results. While there are multiple possibilities, we think the likely scenario is that AAPL maintains a mix between buyback & dividends while keeping some cash for possible deals,” writes the analyst.

Additionally, Daryanani wagers the tech titan targeting rising yearly buybacks to the tune of over $25 billion from balance sheet cash, which would suggest total share reduction throughout the upcoming 5 years to circle 1.6 billion shares.

Bottom line for the top analyst: this is a valuable bet on the Street; one set to keep outclassing the market thanks to robust FCF generation, capacity for monster capital allocation, and a rising iOS install base that keeps yielding ongoing FCF gains.

Daryanani has a very good TipRanks score with an impressive 93% success rate and one of the highest rankings on Wall Street- #3 out of 4,785 analysts. Daryanani earns 31.2% in his annual returns. Notably, investors following Daryanani’s recommendations on AAPL stock will realize an average profit of 30.3%.

TipRanks shows Wall Street leaning towards the bulls, but with a fair number of analysts playing it safe on the big AAPL machine. Out of 28 analysts polled in the last 3 months, 15 are bullish on AAPL stock while 13 remain sidelined. With a return potential of 7%, the stock’s consensus target price stands at $191.52.