Dr. David Shaw is a fascinating Wall Street story of success; where success is spelled out in billions on billions of dollars. A former computer-science professor who kickstarted a quant investing strategy that transformed the art of financial trading. Back in 1988, Shaw brought his quant fund D. E. Shaw & Co to life, trusting that he could manipulate technologies to wisely trade securities. Considering the man’s money-making legacy that has stood the test of time, should memory traders get nervous? After all, Shaw just slashed over 3 million shares in both Advanced Micro Devices, Inc. (NASDAQ:AMD) and Micron Technology, Inc. (NASDAQ:MU).

Present-day, Shaw has built a fortune of $5.5 billion to his name, by Forbes’ bet- and manages a roughly $47 billion hedge fund firm that has won over $25 billion for investors by the close of 2016. This is no small feat, a number tying for the third monster gain on hedge fund trading record. For a man who was a quant trader back before it was cool, Shaw had the insight to understand that quant savvy was the key to winning on Wall Street. Now, seven of today’s ten biggest hedge funds stand as quant funds- and Shaw is the quant king to thank for the shake-up.

Is Shaw playing it safe by sharply dialing down his positions in AMD and MU stocks?

Let’s dive in:

A Big Step Back in Advanced Micro Devices

Shaw is all but walking out of Advanced Micro Devices, cutting his holding in the company back by 3,074,989 shares- a 65% overthrow. However, do Wall Street experts agree with the hedge fund tycoon?

Top analyst Vijay Rakesh at Mizuho approaches the tech stock from an opposite perspective.

By day two of his tour through Asia meeting with leading suppliers in the handset supply chain along with graphics processing units (GPU) supply chain companies, Rakesh spotlights “some light at the end of the tunnel.”

Could the company be experiencing improved shipments of its high-performance Ryzen computer processing units (CPUs) and Datacenter EPYC x86 server processor line? This analyst says yes.

Not only is Rakesh not running, he in fact spots “signs of life” for AMD, whose Ryzen and EPYC are both drawing encouraging customer feedback along with “ramping.”

Short-term trends for GPUs point “positive” for the chip giant, cheers the analyst.

Rakesh asserts, “We believe AMD shipments to some of the Graphic card OEMs are improving from zero share in 2017 to 5-8% in 2018. While it will potentially take more time to confirm AMD taking consistent Datacenter market share, the near-term GPU shipments and response on the EPYC and Vega could be a modest positive for AMD.”

Meanwhile, Stifel analyst Kevin Cassidy may be sidelined on the chip giant, but the analyst sees a company that “deserves to be proud of their 2017 accomplishments;” milestones that include “taking 4 points of market share, from 8% in 2016 to 12% in 2017.”

Though the analyst maintains a Hold rating on AMD stock, his $13 price target implies a close to 12% upside from current levels. (To watch Cassidy’s track record, click here)

Following the AMD team’s webcast delving into the kickstart of second year Ryzen chip shipments, Cassidy notes, “AMD will introduce its second generation Ryzen products in 2018. The first products will be premium consumer processors in April, followed by its consumer high-end (Threadripper) and commercial processors in the second half of 2018. The company will announce its timeline for second generation Ryzen mobile processors in the future.”

Mobile computing chips could prove advantageous to bolster AMD’s revenue, as Cassidy concludes: “MD’s Ryzen Pro Mobile which includes integrated Vega graphics, is scheduled to be available in 2Q18. Ryzen Pro Mobile is made for government and enterprise customers which the company sees as providing a reliable and steady revenue source. Available notebooks will include enterprise, ultraportable, and workstation form factors.”

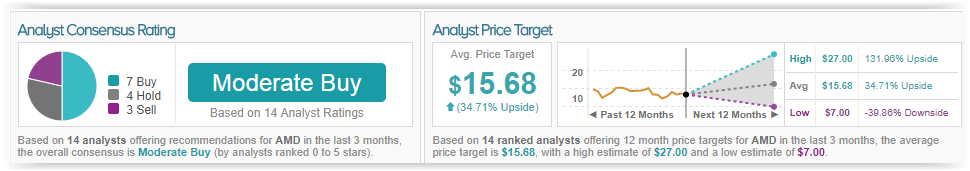

Though Shaw is largely fleeing in his latest bearish quarterly play, TipRanks indicates a mostly optimistic Wall Street consensus surveying the chip giant. Out of 14 analysts polled in the last 3 months, 7 are bullish on AMD stock, 4 remain sidelined, and 3 are bearish on the stock. With encouraged positivity baked into these analysts’ expectations, the 12-month average target notably stands tall at $15.68, marking a nearly 35% return potential from where the stock is currently trading.

Shaw Dumps Two-Thirds of Micron Stake

As D. E. Shaw & Co has opted to turn out a monster 3,678,092 shares in Micron to the gutter, it is interesting that the hedge fund’s move goes against bullish ripples seen throughout the Street this week.

As Micron approaches a highly anticipated second fiscal quarter performance tomorrow evening, various analysts have been seen boosting expectations, angling for exciting share gains this year.

Top analyst Vijay Rakesh stands among the upbeat camp rooting for the chip giant’s success- especially after touring Asia. Standout DRAM and NAND memory test packaging OEMs beckon demand to keep trumpeting for both DRAM and NAND. Moreover, pricing is poised for solid momentum to soar through the third fiscal quarter for Micron.

Worthy of note, the analyst has a Buy rating on MU stock and recently hiked his price target from $44 to $66 in enthusiasm for the upcoming quarterly print, expecting a 9% upside from current levels.

“We believe near-term MU estimates appear conservative with potential to guide to ~$3 quarterly EPS (~ $12 annually). We will be meeting many of the memory majors, including Samsung and Hynix, in the coming days. With MU past the seasonally weakest portion of the year (smartphones and PCs), we believe the setup looks good. We believe entering into a stronger build season, MU is well-positioned,” writes Rakesh.

The analyst believes Micron will generate $7.27 billion in revenue in its second fiscal quarter, achieving $2.72 in EPS along with a 57.3% gross margin- leveling with expectations for the company’s just-raised outlook. Micron has guided to $7.27 billion in revenue and between $2.70 and $2.75 in EPS.

Looking down the line to the third fiscal quarter, Rakesh is bullish that Micron can bring $7.14 billion in revenue to the table while hitting $2.49 in EPS and a 55% gross margin. Consensus expectations soar above even Rakesh’s confident estimates, with revenue forecasts towering at $7.17 billion and EPS at $2.59. Even Rakesh is aware, understanding his expectations may end up “very conservative” in the bigger picture.

True, voices in the Street have whispered worries of oversupply to weak demand; but Rakesh is unfazed by these fears thanks to these insights from his Asia tour: “Given potential for continued server, GPU and enterprise DRAM/NAND demand and price momentum MU could guide quarterly EPS closer to ~$3 EPS (~$12 annually). Our checks on our Asia trip today pointed to continued strong demand and price momentum into JunQ. NAND and DRAM pricing has remained strong despite the concerns of oversupply and demand softness (iPhone X, China). As we have noted prior […], server and GPU demand continue to drive DRAM pricing up in MarQ and potentially into the JunQ.”

Strength in capacity requirements for both of these memory OEMs looks enticing considering test capacity is sustaining its leaping momentum, primed for an over 20% vault into this year. NAND also is “ramping well” as 64-L NAND jumps from around 20% present-day to circling 50% by the year’s end for WDC and Toshiba.

Micron could realize $28.4 billion in revenue for fiscal 2018 by Rakesh’s estimation coupled with $10.07 in EPS. By fiscal 2019, Rakesh predicts MU will reach $28.7 billion in revenue and $9.08 in EPS.

Though Shaw sees fit to leap back from the chip giant, Rakesh, one of Wall Street’s best performing analysts is tossing a confident vote into the ring on an “attractive,” well-priced semiconductor opportunity.

Vijay Rakesh has a very good TipRanks score with an impressive 80% success rate and a high ranking of #13 out of 4,787 analysts. Rakesh yields 33.8% in his annual returns. Investors taking heed of Rakesh’s bets on Micron on average would earn 66.9% in profits on the stock.

Is Micron a Wall Street tech darling? By TipRanks’ assessment through analytics, yes, with the chip giant having attracted one of the strongest ratings on the Street. Out of 17 analysts polled in the last 3 months, 16 rate a Buy on MU stock with only 1 maintaining a Hold. With a return potential of nearly 12%, the stock’s consensus target price stands at $66.53.