Gavin Rochussen is a strategic leader who knows how to make the tough cuts. After all, under Rochussen’s guiding hand, special asset management group Polar Capital cut four funds that were underclassing the market. All the same, the hedge fund firm pulled out a good fourth quarter complete with solid net inflows- and by January, Polar was managing £11.7 billion. This marks £2.4 billion more from the end of March this time last year. For a firm that prioritizes diversifying fund strategies to client segments and client geography, how does Polar bet on chip giants Advanced Micro Devices, Inc. (NASDAQ:AMD) and Micron Technology, Inc. (NASDAQ:MU)?

Notably, Rochussen just came on board Polar Capital’s team last July, and already the company’s the former JO Hambro Capital Management (JOHCM) head has proved to be a sharp chief executive for the Polar team. Will Rochussen’s newest moves in these chip players show Polar ‘the money?’

Let’s dive in:

Advanced Micro Devices Gets a 2 Million Plus Lift

Rochussen sees reason to become fiercely confident on this semiconductor player, having fired up Polar’s position to the tune of 2,024,917 more shares. Now, the hedge fund guru’s firm boasts a stake of 6,362,792 shares worth $65,410,000- a nearly 50% lift in the holding.

This could prove to be a valuable year for Rochussen to have jumped up his stake in AMD, with buzz flying around a second gen release of turbo-speed Ryzen computer processing units (CPUs). After a leak on Asian website Hardware Battle, the rumor mill has been in an upbeat uproar for what would be AMD’s fasted desktop CPU play yet in the arena- one boasting an eight-core chip with 16 threads gunning to a max of 4.35 GHz.

Meanwhile, based on the leak making its rounds through the interwebs, AMD looks like it’s geared to keep utilizing the Threadripper 4 and Socket AM4 platform CPU sockets through the next two years.

In a time where PCs are experiencing a real renaissance in the market, consumers will be thrilled to know that with AMD motherboards in tow, forthcoming third-gen CPUs will be all systems go. All rumor, of course- but Street talk is leaning bullish that new AMD CPUs could be supported on these sockets.

Should potential surges in frequency prove true, this chip giant is poised for a killer year- even better than last year. The Ryzen 5 2600 is rumored to showcase a 300 MHz rise in boost frequency against the Ryzen 5 1600, and the second gen of the Ryzen 7 looks to unveil 3.7 GHz- quite a rise from the first gen of the Ryzen 7 1700X’s 3.4 GHz base frequency.

Between better power efficiency and responsiveness, turbo algorithms ramping up the clock, and Precision Boost 2 technology, this next Ryzen CPU line could hit a home run in the gaming market. Rochussen’s new purchase of 2 million + shares could be well worth the investment.

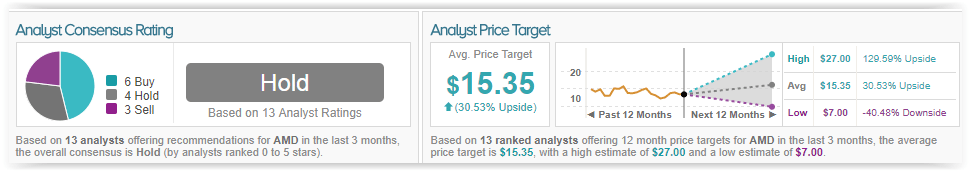

Yet, TipRanks showcases a less bullish Street-wide consensus than Rochussen’s sentiment exhibited in such a confident quarterly play on AMD. Out of 13 analysts polled in the last 3 months, 6 are bullish on AMD stock, 4 remain sidelined, while 3 are bearish on the stock. Yet, considering these analysts’ expectations, some optimism is clearly baked in here- the 12-month average price target notably stands at $15.35, marking a healthy upside potential of 31% from where the stock is currently trading.

Micron Belongs to the Bulls

Micron drew a 129% boost in Polar Capital’s stake, as Rochussen added 397,057 shares more to his holding in the company. This brings Rochussen’s stake to a total of 705,223 shares worth $28,999,000. How does the hedge fund manager’s bullish upturn in Micron compare to sentiment across the Street?

Quite well- most experts in Wall Street are clamoring to buy Micron shares these days.

First, there is “Mad Money” host and former hedge fund manager Jim Cramer, who sees a comeback of a personal computers in full swing. How does a semiconductor company like Micron factor into this narrative?

Consider that MU supplies computer parts, making DRAM to NAND flash memory chips- and by Cramer’s estimation, Micron takes the best slice of the PC rebound wave.

A rush of apprehension followed back in November that NAND flash memory chips were poised for a decline for this quarter. However, this time last week, the company’s shares had reached a 52-week high. Meanwhile, Palo-Alto tech player HP delivered a strong quarterly print on February 22nd leaving breathing room on the Street; in other words, pricing looks good for this year.

As far as Cramer is concerned, the sun is setting on the era of cellphone-led growth in the industry, where PC gains have been “roaring” as phone growth turns sluggish.

If HP can outclass Street-wide expectations, this bodes well for a computer parts supplier like Micron, argues Cramer. “That means Micron will likely meet or even exceed the numbers, and if that’s the case, its stock is way too cheap,” notes the CNBC host, wagering that when it comes to MU stock: “It is a buy on this breakout.”

“I see tremendous pin action off of Micron. The themes are too great to ignore,” anticipates Cramer, making a bullish case for momentum still to come: “The PC suppliers are back and most of them are way too cheap. Even though their stocks have run, I bet they’ll end up looking like bargains down the road when these companies start beating their estimates left and right as their underlying business is finally booming again.”

For those fearing the memory boon was on the brink of falling on a dip after reaching such rocket-fire momentum, another bull likewise sees cause to have high expectations for MU shares.

KeyBanc analyst Weston Twigg calls for a quarterly dip in average selling prices for the company of 2% for the fiscal third quarter as well as the third quarter- an encouraging new expectation.

Keep in mind, Twigg once angled for a 3% waning. The analyst attributes this improved forecast to robust DRAM pricing, which leads to better expectations coupled with multiples.

Predicting “relatively healthy memory markets over the midterm to long term,” the analyst reiterates an Overweight rating on MU stock while bumping up his price target from $53 to $65, which implies a close to 16% upside from current levels. (To watch Twigg’s track record, click here)

For this year, the analyst now projects a 4% rise in EPS to $10.66 and a 3% jump next year to $10.12- both more bullish than the Street’s expectations. Twigg additionally tweaks his revenue forecast up from $28.48 billion up to $29.02 billion for 2018.

“DRAM demand remains very high, and contract pricing has continued to increase this year amid persistent undersupply,” Twigg contends, asserting: “While we expect new supply to come online later this year, we expect bit supply to remain below demand for most of the year, and pricing could continue to increase.”

This flash memory chip giant hovers as one of the most popular-ranked stocks on the Street, according to TipRanks. With a strong bullish backing, 16 out of 17 analysts in the last 3 months rate a Buy on MU stock with just 1 maintaining a Hold. With a return potential of 11%, the stock’s consensus target price stands at $60.73.