Paul Tudor Jones found his way onto the Forbes 400 rich list, thanks to a monster net worth of $4.7 billion to his name. Jones’ asset management firm Tudor Investment Corporation has been running since 1980, and not long after followed the Tudor Group- a fund managing around $11 billion as of 2016. How does one of Wall Street’s respected, and most well-to-do gurus assess the memory sector? Jones has opted to welcome his chances with Advanced Micro Devices, Inc. (NASDAQ:AMD). Yet, the same cannot be said for Micron Technology, Inc. (NASDAQ:MU), a chip giant that has seen Jones backtrack in a major way.

Clearly, Jones cares about every move he makes these days in what he deems “the throes of a burgeoning financial bubble” in a word of caution to CNBC. The Street-wise manager has experiencing in investing in everything from equities to derivatives to forex throughout worldwide markets. Jones is one to trust, which might make some investors nervous to hear a narrative is repeating of an “age-old storyline of financial bubbles” that has unraveled in the past. This is a man who sizes up inflation in the U.S. as threatening, preferring to burn his hand with a piece of coal than hold a U.S. Treasury bond.

For a billionaire who obviously hopes to keep his wealthy status that way, let’s explore Jones’ key moves in two of Wall Street’s leading memory chip giants:

AMD Attracts a New Bite from the Billionaire

AMD stock got a fresh vote of confidence from Jones in his latest quarterly play, where the hedge fund manager took on a new stake of 120,192 shares worth $1,236,000.

Bulls were in an enthusiastic uproar this week, with the stock jumping more than 8% two mornings ago. The Wall Street grapevine is buzzing with talk of a takeover- rumors that may only be just that- and nothing more.

After all, it was not so long ago when Wall Street was in a tizzy over talk of AMD and CEO Elon Musk’s Tesla empire teaming up; an artificial intelligent processors-meets-self-driving-vehicles one-two punch. Yet, rumor or market whispers based in reality, the last takeout conversation turned out to be no more than interesting speculation. Regardless, there is more than one iron in the fire that would draw a billionaire to this memory chip giant’s table.

Hearsay has it that the takeover could point to Xilinx, a deal that would enable AMD to guard its x86 license. Either way, Jones is taking his odds on this chip maker’s potential.

Worthy of note, this is a week that saw the rumor mill guzzling another story about AMD- a leak on Asian website Hardware Battle looking to a turbo clock-racing second-gen line of Ryzen CPUs; we’re talking eight cores, 16 threads, powerful Zen+ architecture, and Precision Boost 2 technology. It is the kind of revamped, high-end chip line that could make even an Intel investor afraid.

Meanwhile, Taiwan-based motherboards maker ASRock is raring to walk into the graphics card arena- utilizing AMD’s Radeon-based chips. With this product hitting the market as soon as April, there is plenty of reason to be curious about AMD’s opportunity these days.

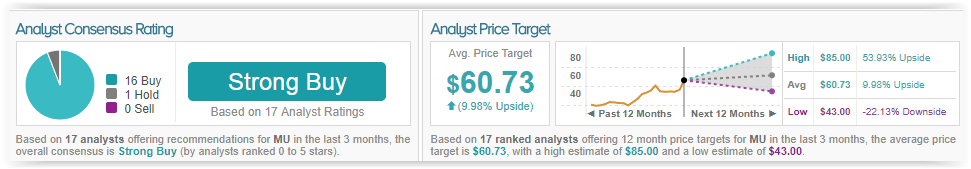

TipRanks underscores analyst sentiment rooted in caution, but with optimism hovering over AMD shares. Out of 13 analysts polled in the last 3 months, Wall Street looks split, but leaning towards the bulls- 6 are bullish on AMD stock, 4 remain sidelined, while 3 are bearish on the stock. With a solid return potential of 28%, the stock’s consensus target price stands tall at $15.35, indicating positivity despite some apprehension at hand.

Micron Gets Close to Halved

Is the billionaire scared off by rumors of memory supply coming up shy of demand? Some have wondered whether the chip demand surge has hit a peak, particularly in terms of NAND chips. Perhaps this led Jones to dump a 44% slice of his stake in Micron, as the hedge fund manager opted to sell off 164,721 shares worth a whopping $6,773,327. Yet, Jones has not abandoned all hope for the chip giant quite yet; the billionaire still clings on to a position of 212,936 shares.

Needham analyst Rajvindra Gill spotlights a data economy evolution as he continues to cheer a bullish case for Micron.

Especially taking note from encouraging insights from the Dell team, the analyst believes it is important to recognize memory strength is far from just near-term. Demand is not only robust, but indicative of a changing memory paradigm here for the long haul in demand.

An upbeat bull on this semiconductor player, the analyst rates a Strong Buy rating on MU stock with a $76 price target, which implies a 37% upside from current levels. (To watch Gill’s track record, click here)

“We believe that positive commentary coming out of Dell reiterates our belief that Micron’s heightened growth is not solely a function of short term supply/demand dynamics but rather due to an increasing demand for memory both via expanding markets but also through increasing densities. This morning on Dell’s quarterly earnings call Jeff Clarke, VP of Products and Operations, stated: ‘On the server side, we are in the longest protracted DRAM price increase that we’ve seen in the last 25 years. Combine that with the fact that we are putting more DRAM in a server today than we were last quarter, than we were a year ago, and you have a compounding effect…. For me it is encouraging that the average amount of DRAM going into our servers and the SSDs, the average SSD size going into our servers is increasing, tells me we are selling higher in the enterprise workload,” highlights Gill.

Bottom line, as the memory backdrop thrives, the analyst anticipates a bright future ahead for bulls raring to take the bet on Micron: “We believe strength isn’t solely short term in nature, rather that a new memory paradigm is emerging, namely memory is expected to experience a heightened, sustained demand in diverse end markets (dampening previous cycles) as we transition to a data economy.”

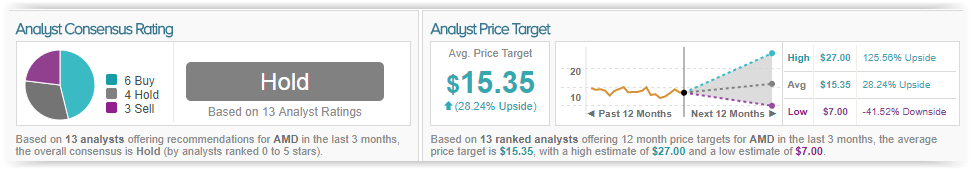

TipRanks points to a big bullish camp betting on this memory chip giant’s opportunity at play. Out of 17 analysts polled in the last 3 months, 16 rate a Buy on MU stock while just 1 maintains a Hold. The 12-month average price target of $60.73 notably boasts encouraging upside potential of nearly 10% from where the stock is currently trading.