Guy Shahar first founded his London-based European long/short equity operation DSAM Partners seven years ago with James Diner, a former coworker from his days at Marble Bar Asset Management. The once equity derivatives trader at Goldman Sachs fuses short-term trading with fundamental investing, where derivatives have a key role in which positions are taken. How does Shahar size up Chinese stocks Baozun Inc (ADR) (NASDAQ:BZUN) and Alibaba Group Holding Ltd (NYSE:BABA)?

The hedge fund guru crafted DSAM’s strategy to thrive even amid volatile times and moments of a shaky macroeconomic backdrop. Usually, these are the very instances in which investors find it challenging to see gains when solely opting for short or long equity positions.

Let’s dive in to see how wise Shahar’s fourth quarter leap into BZUN and retreat from BABA have played out:

Buying Baozun Just in the Nick of Time for Today’s Earnings Buzz

Baozun is looks to be in good standing from Shahar’s eyes, as DSAM’s leader just initiated a fresh stake of 456,969 shares worth $14,422,000 in the company. Shahar must be counting his budding fortune today, as the Chinese retailing consultant/service provider’s shares are shooting up like lightning today.

Notably, giant brands like Nike, Starbucks, Coach, and Fiat Chrysler have sought out BZUN to revamp online sales tactics for the globe’s massive internet playing field in heavily populated China; a market that is often the key to brands’ success. BZUN’s team offers a chance to beef up these Western players’ approach to China e-commerce, offering key insights for web design, hosting, digital marketing, and logistics.

After the company posted an impressive fourth quarter earnings performance this morning that trounced expectations coupled with an encouraging first quarter revenue guide, investors have sent shares on a 22% hike as soon as the bell tolled.

For the fourth quarter, BZUN’s adjusted earnings per U.S. share vaulted to 42 cents on back of $240.6 million in revenue. Total revenue experienced 23% growth with services revenue flying a whopping 56%. By Yahoo Finance’s estimation, the Street had been angling for BZUN to bring 31 cents to the table on back of $245.22 million in revenue. Looking ahead to the first quarter revenue outlook, the BZUN team sets expectations for revenue to grow 50% for this year.

It was an exciting 2017 for the Chinese tech player, whose brand partners hit 152, a nice climb from 133 in 2016. These partners include the likes of Alibaba (a mammoth investor for the company) and JD.com.

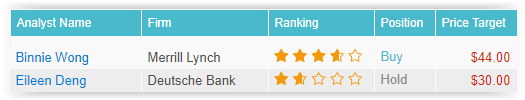

TipRanks points to early analyst sentiment split between confidence and caution on Baozun shares. Out of 2 analysts polled in the last 12 months, 1 rates a Buy on BZUN stock while 1 maintains a Hold. However, taking under the analysts’ expectations, is this stock overvalued or undervalued? Notably, the consensus average price target stands at $37.00, marking a 16% downside potential from current levels.

Alibaba Tossed Aside to the Curb

Shahar was not feeling too confident about Alibaba in the fourth quarter; especially considering the hedge fund guru trashed his entire holding of 188,011 shares worth roughly $32,418,737 in value. Yet, did DSAM’s Chief Investment Officer bow out of Alibaba too soon?

Worthy of note, the Chinese e-commerce king’s fiscal third quarter earnings show last month shone strong, as the company continued to experience standout topline gains. True, the company’s margins were weighed down by new investments in Cainiao Logistics, Globalization, and New Retail. However, one bull makes a case for the compelling value of these initiatives despite the toll they have taken on margins- value that has already delivered new gains.

Oppenheimer analyst Jason Helfstein commends yet “another strong quarter” from BABA, as the Chinese tech player’s third quarter revenue beat out both his expectations as well as the Street’s.

“While margins were weaker on Alibaba’s aggressive expansion in New Retail, globalization, streaming video content and logistics, the value of these investment is already showing growth: triple-digit y/y growth for Ali Cloud revenue & Youku subscribers; Hema revenue +300% y/y. Company agreed to a 33% equity stake in Ant Financial, at the expense of prior 37.5% revenue sharing agreement. We believe this indicates an upcoming Ant Financial IPO,” writes the analyst.

On back of the quarterly print, the analyst reiterates an Outperform rating on BABA stock with a $220 price target, which implies an 18% upside from current levels. (To watch Helfstein’s track record, click here)

For the third fiscal quarter, this king of e-commerce soared past the analyst’s estimate and the Street by a 5% beat. Taking under account logistics company Cainiao Logistics reported a separate line, China Commerce surged 4% beyond the Street and 5% past the analyst’s estimate. Another standout strength of the report highlights Cloud’s performance, which beat out the analyst’s forecast by 5% and the Street by a more substantial lead of 11%. International commerce flashed an 11% outclass over the analyst’s projection and an 18% beat compared to the Street’s estimate. Other review including Digital Media & Entertainment, Innovation Initiatives, and Other Commerce jumped 37% over Helfstein’s forecast. On a less positive note though, this segment came up short of the Street by 4%.

Helfstein notes, “This is supported by the solid performance of almost all business lines, particularly New Retail and AliCloud. Cloud rev growth continues to accelerate, from +96% y/y in F1Q to +99% in F2Q to 104% y/y in F3Q.”

Looking ahead, “We expect to see revenue sharing from Ant Financial (was listed in the Other Income line) to cease, and believe this action paves way for the upcoming Ant Financial IPO,” anticipates the analyst, putting his bet without hesitation behind BABA.

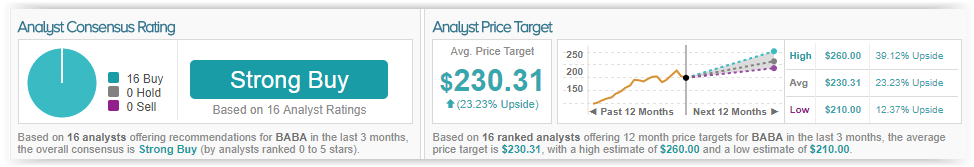

Based on the word of the Street, Shahar seems to be the sole bear running loose here. Alibaba is one of Wall Street’s favorite stocks, considering TipRanks shows a unanimous bullish vote from all 16 analysts polled in the last 3 months. With a solid return potential of 24%, the stock’s consensus target price stands at $230.31.