If you haven’t heard of Rob Citrone then look out. This is the fund manager behind the $3.2 billion Discovery Capital Management fund with a personal wealth of over $1 billion. Now that the fund’s latest trades have been revealed we can see a very interesting and decidedly bearish attitude on two of the fund’s key chip stocks: Advanced Micro Devices, Inc. (NASDAQ:AMD) and Micron Technology, Inc. (NASDAQ:MU).

If you haven’t heard of Rob Citrone then look out. This is the fund manager behind the $3.2 billion Discovery Capital Management fund with a personal wealth of over $1 billion. Now that the fund’s latest trades have been revealed we can see a very interesting and decidedly bearish attitude on two of the fund’s key chip stocks: Advanced Micro Devices, Inc. (NASDAQ:AMD) and Micron Technology, Inc. (NASDAQ:MU).

The Pittsburgh Steelers owner founded Discovery back in 1999 after working as a portfolio manager at Fidelity Investments and Tiger Management. His time at the famous Tiger Management fund has earned him the Tiger Cub nickname- given to a handful of big-name fund managers who also started their careers under the auspices of hedge fund legend Julian Robertson. Citrone’s hedge funds favor macro bets and emerging markets. And this is a hedge fund manager who knows who to fight: in 2016, after losing money for two straight years, the Discovery Global Macro Fund produced a 9% gain- reportedly in just two months. The fund’s annualized return since 1999 currently stands at about 17%.

Now let’s take a closer look at these two intriguing portfolio moves:

Advanced Micro Devices Inc.

Citrone indicated a bearish attitude to AMD in Q4 with the sale of 26% of the fund’s AMD holding. Following the reduction of 5,587,500 shares, the fund’s remaining holding now stands at 16,293,165 shares worth $167,494,000. Since the last filing date, these shares have recorded an impressive gain of 17%.

And according to top Wells Fargo analyst David Wong, share prices should keep rising. He believes that the company is “positioned to show meaningful market share gains through 2018.” Wong’s optimism stems from an upbeat road trip that he has just enjoyed with the company’s CFO Devinder Kumar and the head of IR, Laura Graves. He joined the pair as they met investors in San Francisco and Los Angeles.

The fact that a third of revenue comes from new products is encouraging says Wong. He notes that 40% of personal computer revenue is already generated by the newer Ryzen chips, and sees this figure hitting 50% this quarter.

As far as AMD’s Epyc chip is concerned, Wong is looking forward to the next manufacturing ‘node’ as a catalyst for share gains. He predicts that AMD is on track for a 5% server processor unit share and a 3% server processor revenue by the December 2018 quarter. And further down the line, if AMD releases the 7nm Zen 2 EPYC server family on schedule, and it’s competitive, then AMD could see these figures jump to 10% unit share and 6% revenue share by end of 2019.

A key reason for his optimism is the dual-socket version Epyc, which could potentially help drive this share gain at the expense of larger rival Intel (INTC). At the same time, he says the scalability of AMD’s superior connection fabric could also prove a critical long-term advantage for the Epyc family. Indeed, AMD’s Infinity fabric) allows the company to make multi-chip solutions that are on par with Intel’s single-chip products.

Finally, Wong cheers the company’s pipeline which is bursting with upcoming product launches. For example, in April, AMD plans to launch its first 2nd generation Ryzen CPUs on 12nm technology. This should be followed in the second half of the year by the first 7nm Zen 2 EPYC server chips and the 7nm Vega chips (Radeon Instinct accelerator chips).

Note that Wong tends to get it right when it comes to making accurate stock recommendations. We can see from TipRanks that this five-star analyst is ranked #228 out of over 4,700 analysts based on his 73% success rate and 17% average return.

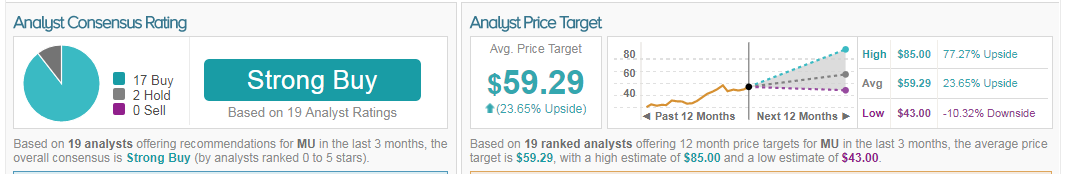

However, the overall take on AMD from the Street is cautious- with a Hold analyst consensus rating. In the last three months the stock has received a mixed bag of ratings with 6 buy ratings, 4 hold ratings and even 3 sell ratings. These analysts have an average price target on AMD of $15.45- 28% upside from the current share price.

Micron Technology, Inc.

In Q4, Citrone exited Micron completely by selling off the fund’s entire position of 3,365,662 shares, worth $138,396,021.

And it seems like Citrone isn’t alone in his MU profit-taking. As a result of memory supply shortages, prices have almost doubled year-to date from $24 to just over $46. Consequently, company insiders are now busy selling shares while prices are still high. We can see that sales by Micron executives and directors have soared to $28.5 million so far this year from just $6.2 million a year ago. Some of these insiders haven’t sold their MU shares for years- but now sentiment has clearly shifted.

For example, Steven Thorsen, world-wide sales senior VP, has sold a whopping $2.6 million MU shares since the start of the year! He also made major share sales in 2017- but interestingly didn’t make a single informative share sale in 2015 or 2016. Interestingly however, as MU prices continue to climb, Thorsen has lost out by selling so soon. We can see from TipRanks that his success rate on MU is just 22% with an average return of -50%. Indeed the only insider really buying right now is director Lawrence Mondry. He picked up shares worth just over $2 million just 9 days ago.

Share prices have exploded as MU keeps delivering with strong earnings reports that beat Street expectations. In the last three quarters the stock has posted massive increases from 90 cents to $1.62, and now $2.02 in the most recent earnings report. And given these appreciations, for some investors the stock now looks cheap.

While Citrone may be heading for the door, big-name hedge fund manager David Einhorn recently reiterated his support for the stock saying, “While DRAM will always be cyclical, we believe investors are underappreciating the dynamics of the current cycle and the long-term structural improvements in the industry.” He sees DRAM support coming from mobile phones and data centers, replacing the sluggish traditional PC market. However, these trends are relatively unpredictable and for other investors the cyclical nature of the memory markets is not so easily forgotten. And Micron also has big competitors like Samsung to contend with. These bigger competitors can easily release supply pressure by upping output. While 2018 may continue to prove strong, projecting any further forward is a challenge best left to the brave.

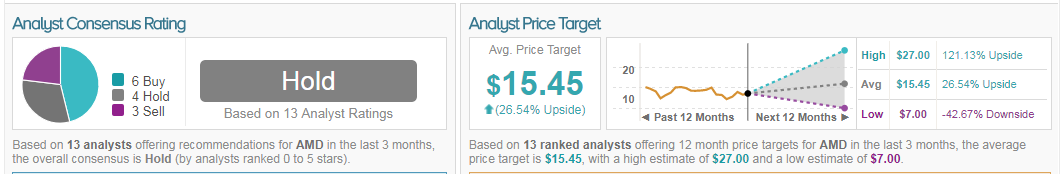

Right now, the Street has a very bullish take on MU stock. TipRanks reveals that this stock boasts a ‘Strong Buy’ analyst consensus rating. In the last three months, this breaks down into 17 buy ratings vs just 2 hold ratings. Meanwhile the average analyst price target of $59.29 indicates big upside potential of over 27%.