As Foot Locker, Inc. (NYSE:FL) released second quarter results that fell far short of consensus, shareholders fled on Friday causing the stock to plunge by nearly 28%. Analyst Camilo Lyon of Canaccord notes that the retail giant is suffering from stagnation and lead time problems while failing to keep up with current trends. EPS for the quarter only reached $0.62, way below the estimates of both the Street and Lyon, who had predicted EPS to fall out to $0.90 and $0.88 respectively. Furthermore, legacy platforms and accessories fared poorly bringing comps down by -6%, which was worse than the analyst’s estimate of +1%.

As such, the analyst is downgrading FL stock from a Buy to a Hold rating, while slashing the price target by nearly 40% from $64.00 to $39.00. (To watch the analyst’s record, click here)

Lyon commented, “At issue is a soft product cycle, broadening distribution of similar products, and rapidly changing consumer brand preferences. The need for speed by both retailers and vendors has never been more important than it is today. To that end, FL is working with its vendor partners to shorten lead times and deliver product much closer to current demand trends. That said, this strategy takes time to enact and likely does not materially improve until mid-2018 at earliest. Also, while positive commentary by FL about NKE’s innovation pipeline adds a measure of hope, the beneficial mix shift from any new future innovation likely does not turn FL’s overall NKE mix to positive for at least another year, as the drag from legacy platforms (e.g. Roshe, Jordan, signature basketball, Free) will continue to weigh on near term results […] we believe FL comps could be under pressure until mid-2018. As such, we believe it is prudent to step to the sidelines until product trends improve.”

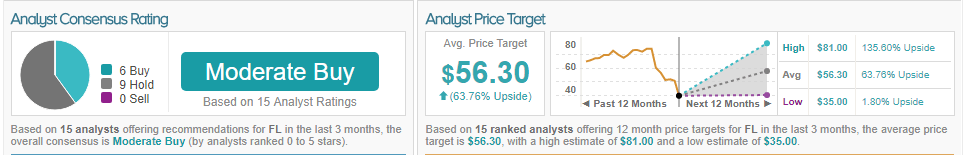

Out of the 15 analysts polled by TipRanks (in the past 3 months), 6 rate Foot Locker stock a Buy, while 9 rate the stock a Hold. With a return potential of near 64%, the stock’s consensus target price stands at $56.30.