Apple Set for Strong Fiscal 2018 Despite Initial Shipment Delays

As Apple Inc. (NASDAQ:AAPL) readies to release its third quarter earnings on August 1st after the closing bell, analysts will be looking closely at performance metrics. Despite lowering September quarter estimates, due to limited shipment volumes, top analyst Tim Long of BMO feels that this dip is only a small bump in the road. The analyst believes the company will restore production to optimal levels and come out stronger ahead.

Long notes that because “initial shipment volumes of the premium iPhone Pro will be limited […] we are lowering our September unit and ASP assumptions slightly to reflect our view of limited volume shipments of the premium next-generation iPhone.” However, the analyst does expect “new OLED model is on track to ship with the S versions” and believes “production capacity will continue to ramp throughout the December quarter, with stock-outs continuing into the first half of CY2018.” Long anticipates that shipments of the new premium iPhone will reach 43 million, and as a result, the analyst is raising estimates for ASP and units throughout each quarter of fiscal year 2018. However, for the September quarter, the analyst is in line with consensus looking at 41 million shipments with an ASP of $626 a 0.9% increase over consensus of $620.

The analyst has lowered earnings per share for fiscal 2017 from $9.09 to $8.90, but is more bullish for fiscal 2018, raising estimates from $10.43 to $10.89, holding that long-term revenue growth will be driven by a growing installed base and customers who will switch over from Android.

Long reiterates an Outperform rating on AAPL with an unchanged price target of $170, representing a 13% increase from current levels. (To view Long’s track record, click here.)

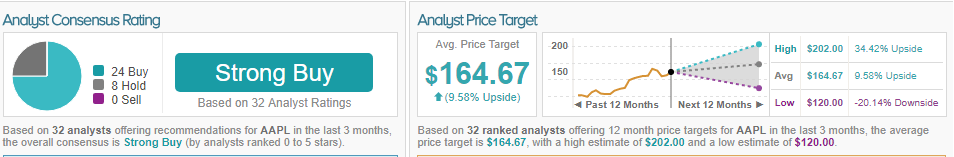

TipRanks analytics indicate AAPL as a Strong Buy. Over the past 3 months, TipRanks polled 32 analysts regarding Apple and has found 24 to be bullish and 8 neutral. The consensus target price stands at $164.67, representing a nearly 10% upside from current market levels.

Facebook Hitting the Button on All Metrics

Facebook Inc (NASDAQ:FB) is about to release its second quarter 2017 results on Wednesday. Considering that the company has just passed the 2 billion user mark and is maintaining ad revenue growth three times the digitial ad industry rate, Facebook is expected to stay ahead of the pack. Analyst Kip Paulson of Cantor Fitzgerald believes that performance will continue to stay strong, considering the company’s unparalleled user engagement and EBITDA margin, calling for continued ad growth with only a small slowdown.

Paulson attributes the expected strong quarter to “robust demand for Facebook’s mobile-first, digital video, and dynamic ad formats; and an overall enviable position in the digital advertising/media landscape given the substantial and ongoing secular shift toward mobile and digital video.” The analyst further notes that the online marketing research group Merkle “supports continued market share gains, with spend up 56% Y/Y and CPMs up 57%” […] Merkle’s DMR showed that mobile ad spend continues to be a key driver, accounting for 82% of advertiser investment on the platform (vs.76% in 1Q17).”

The analyst places 2Q17 revenue estimates at $9,314.3 million and EBITDA at $5,802.9 million, while consensus is looking at slightly lower revenue of $9,191 million with EBITDA $5,655 million. Paulson is keeping Facebook at the top of his list due to “the platform’s unmatched global scale/engagement, industry leading EBITDA margin and additional upside optionality from Instagram, Messenger, WhatsApp and Oculus over time.”

In light of the company hitting the button on all metrics, Paulson reiterates an Overweight rating for FB with a price target of $180, representing a 9% upswing from current levels. (To view Paulson’s track record, click here.)

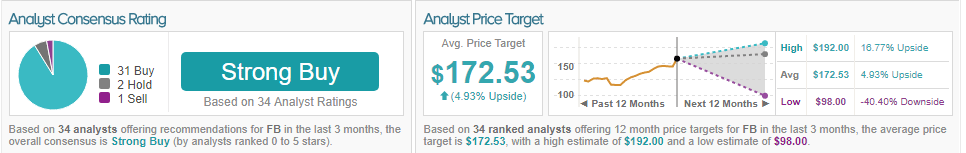

TipRanks analytics indicate FB as a Strong Buy. Over the past 3 months, TipRanks polled 34 analysts regarding Facebook and has found 31 to be bullish 2 neutral and 1 bearish. The consensus target price stands at $172.53, representing a near 5% upside from current market levels.

Google Reigns Strong with Ample Room for Healthy Growth Ahead

It has certainly been a wild ride for Alphabet Inc (NASDAQ:GOOGL), as shares jumped to $1,000 in June, stumbled back to $920 in July, and have since rebounded to around $990. While viewing the company favorably, analyst Kip Paulson did draw attention to a possible fallout for Google in Europe due to the $2.74 billion fine dished out by the European Commission. However, the analyst is confident the company is resilient enough to overcome any adverse effect, believing the Street’s expectations for third quarter outlook “imply healthy growth ahead” for the tech king.

Paulson is confident that Google will continue to capture digital ad market shares and forecasts second quarter net revenue and EBITDA a bit above FactSet expectations. The analyst takes some bullish pointers from encouraging research from Merkle, writing, “Given the positive channel check from Merkle and a continuation of favorable secular tailwinds (as traditional budgets relentlessly shift online), we expect to see in-line or better revenue growth driven by mobile search, YouTube and programmatic.” Additionally, according to the online marketing group, other important metrics like ad spend increased 23% year over year, click growth rose 23%, and notably Phones produced 52% of all Google’s search ad clicks. Paulson sets net revenue at $21,114.8 million and EBITDA at $11,021.8 million, while consensus places net revenue at $20,908.7 million and EBITDA at $10,621.7 million. Moreover, the analyst also estimates EPS at $4.63, above the Street’s value of $4.40.

The analyst reiterates an Overweight rating on GOOGL with a price target of $1,070, representing a near 8% increase over current levels.

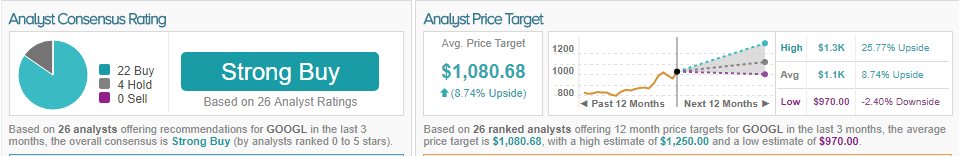

TipRanks analytics indicate FB as a Strong Buy. Over the past 3 months, TipRanks polled 26 analysts regarding Facebook and has found 22 to be bullish and 4 neutral. The consensus target price stands at $1,080.68, representing a near 9% upside from current market levels.