Pandora Media Inc (NYSE:P) announced this morning a $480 million strategic investment from SiriusXM, in the form of new issued Series A convertible preferred stock of Pandora. The Series A preferred stock is convertible into common stock at a price of $10.50 per share and will bear a 6% cumulative dividend, payable in cash, accretion of the preferred stock or a combination thereof. Additionally, Pandora announced it would sell its Ticketfly business for $200 million to Eventbrite, after purchasing Ticketfly for $450 million at the end of 2015.

Top analyst Mark Mahaney of RBC Capital views these announcements as marginally positive for the business, as the sale of Ticketfly should remove some operational distraction and allow P to focus on their core digital music offering, while the SiriusXM investment provides financial flexibility.

However, the analyst is eager to see a visible inflection in Pandora Premium user growth, noting, “There is limited visibility into the success of this new product and so we remain on the sidelines. Though Pandora does start off with an established brand and ~77MM Users. Valuation – at under 2X Sales – remains undemanding.”

As such, Mahaney reiterates a Sector Perform rating on shares of Pandora Media, with a price target of $15, which implies an upside of 76% from current levels.

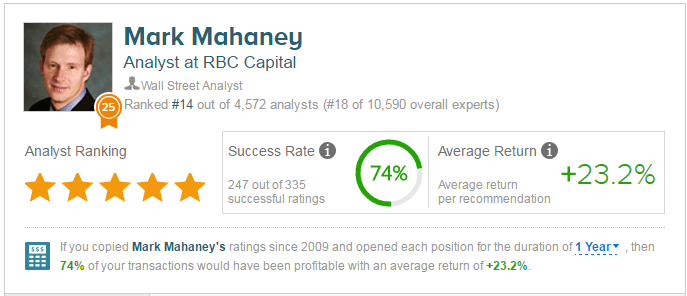

According to TipRanks.com, which measures analysts’ and bloggers’ success rate based on how their calls perform, 5-star analyst Mark Mahaney has a yearly average return of 23.2% and a 74% success rate. Mahaney has a -23.2% average return when recommending P, and is ranked #14 out of 4572 analysts.

Out of the 29 analysts polled by TipRanks (in the past 12 months), 14 rate Pandora Media stock a Buy, 13 rate the stock a Hold and 2 recommend to Sell. With a return potential of 62%, the stock’s consensus target price stands at $13.79.