In a research report released Wednesday, Canaccord analyst Lynne Collier reiterated a Hold rating on shares of Chipotle Mexican Grill, Inc. (NYSE:CMG), while boosting the price target to $440 (from $375), which implies a downside of 9% from current levels. The upward revision in the stock’s price target comes on the heels of solid 1Q17 results, with EPS of $1.60, beating consensus estimates of $1.28.

Collier commented, “In Q1, comp trends turned positive for the first quarter since the food-borne illness incidents, surpassing Street views with a +17.8% increase. While we expect positive SSS to continue over the next few quarters given easy laps, we believe the current valuation reflects a high degree of optimism and leaves little room for error. Accordingly, we remain HOLD rated. We are increasing our 2017 EPS estimate to $8.23 (from $7.41) and our 2018 estimate to $11.30 (from $10.80) as we believe that management’s earnings target of $10.00 will be a 2018 event.”

According to TipRanks.com, which measures analysts’ and bloggers’ success rate based on how their calls perform, analyst Lynne Collier has a yearly average return of 17.3% and a 77.5% success rate. Collier has a 24.8% average return when recommending CMG, and is ranked #216 out of 4571 analysts.

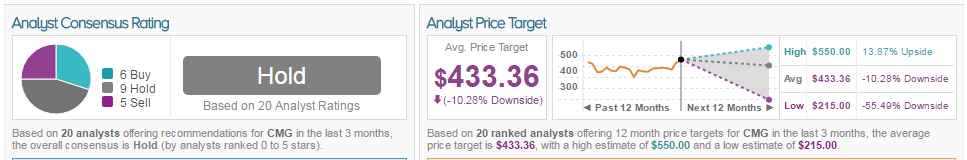

Out of the 20 analysts polled by TipRanks in the past 3 months, 6 rate Chipotle stock a Buy, 9 rate the stock a Hold and 5 recommend to Sell. With a downside potential of 10%, the stock’s consensus target price stands at $433.36.